Bullish and Bearish Harami patterns help forecast Forex market reversals and are a popular Japanese Candlestick strategy.

In this article, I will review chart patterns, discuss how to identify them, incorporate them with other technical analysis tools, and cover confirmation and trading.

What are Bullish and Bearish Harami Patterns?

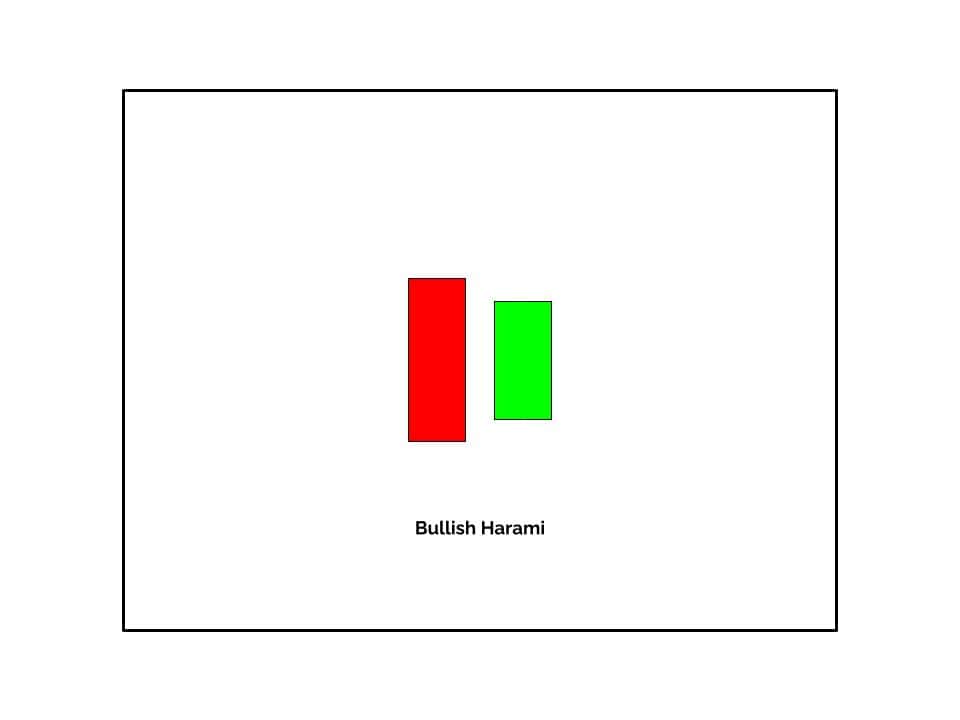

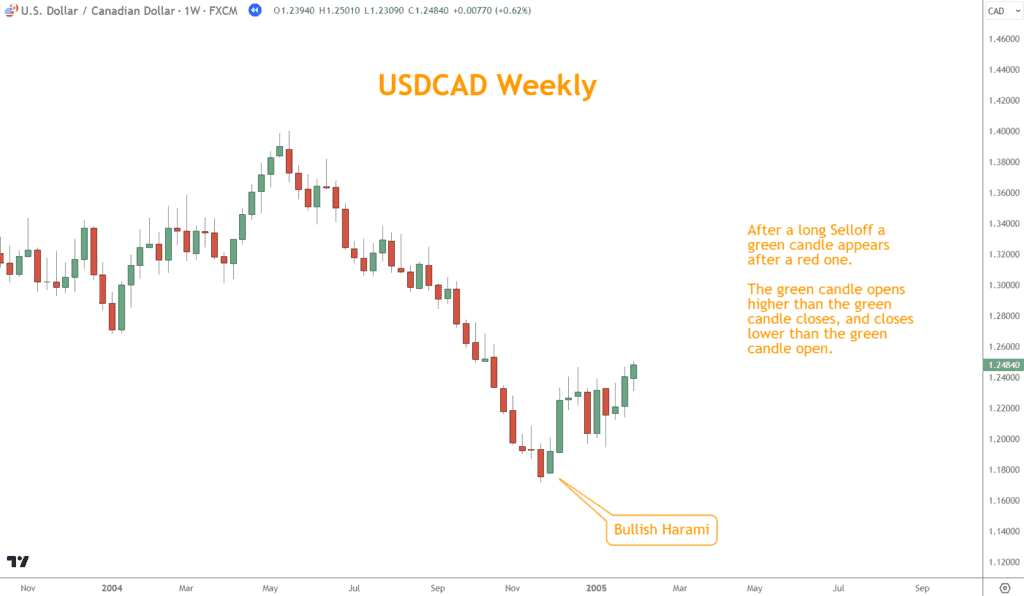

A Bullish Harami pattern occurs during a Selloff and may signal a possible upward reversal. It consists of a small green candle following a large red candle.

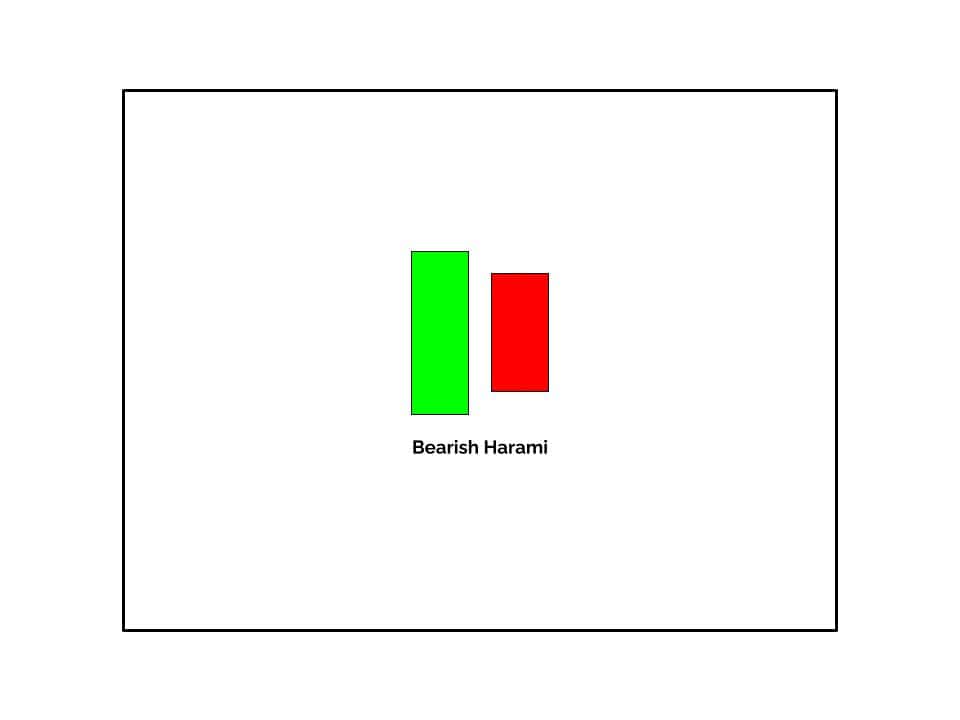

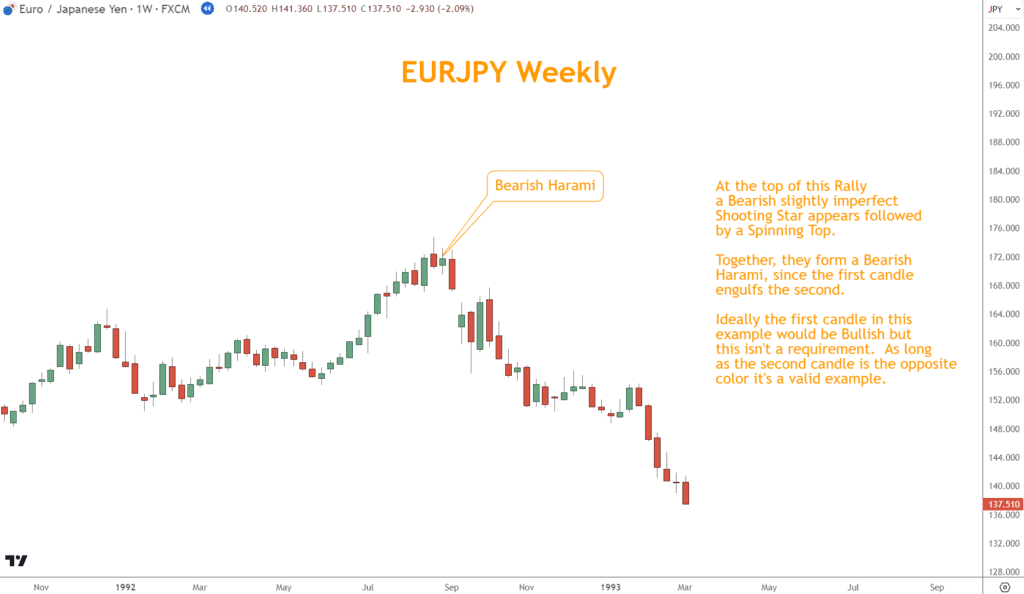

Conversely, a Bearish Harami pattern appears during a Rally and may indicate a potential downward reversal. A small red candle represents it, following a large green candle.

Recognizing the Bullish and Bearish Harami is crucial as they reflect shifts in market sentiment and can help you anticipate changes in price direction.

How to Use Momentum With Bullish and Bearish Harami Patterns

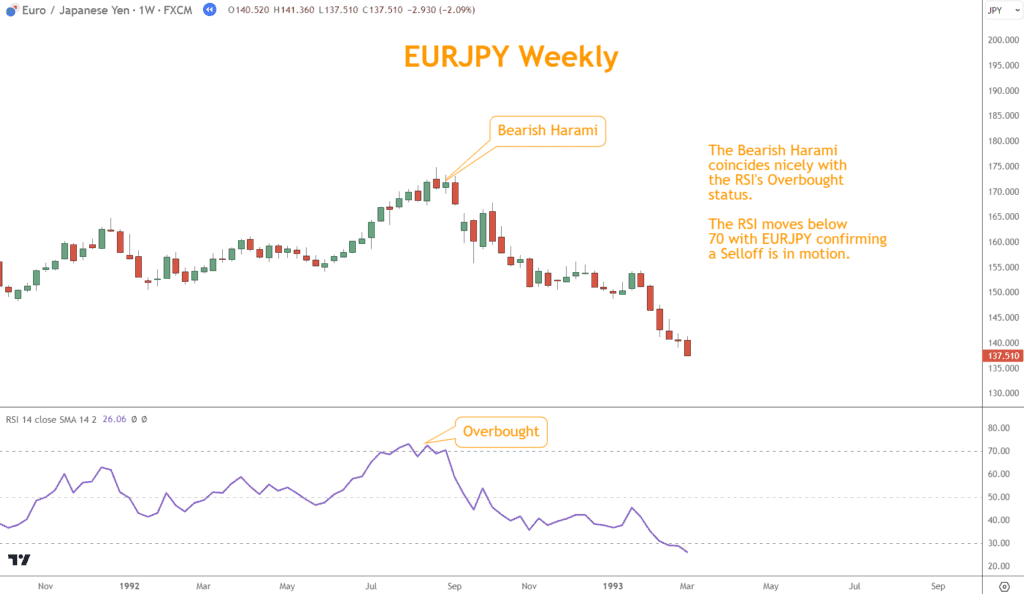

Momentum is a crucial concept in Forex trading, helping you confirm the signals generated by Harami patterns.

It measures the speed and strength of price movement, acting as a gauge of market energy.

Traders use momentum indicators like the Relative Strength Index (RSI) to confirm the validity of Harami patterns.

These indicators help traders understand whether the market is overbought or oversold, providing additional confirmation for the Harami patterns and aiding traders in making informed decisions.

Chart Patterns Can Validate Bullish and Bearish Harami Patterns

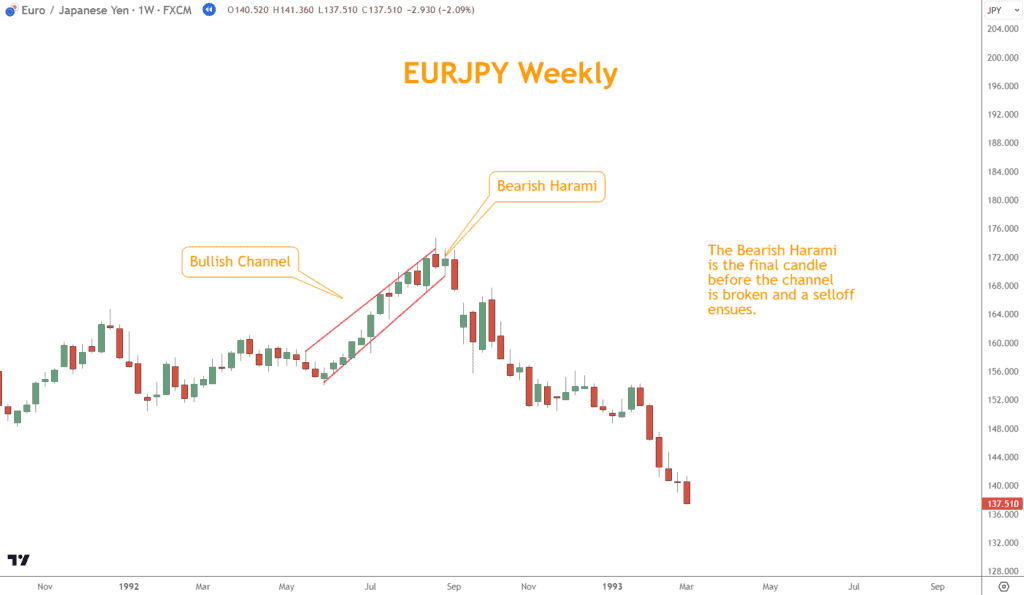

Graphical symbols that display market sentiment are called Chart Patterns. These are useful in confirming the signals given by Harami patterns.

Continuation patterns show that the current direction will continue, while reversal patterns suggest that the direction might change.

Combining Chart Patterns with Harami patterns lets you better understand a trading signal and look for confirmation.

For example, a recognized reversal Chart Pattern alongside a Harami pattern can strengthen your belief in a potential market turnaround.

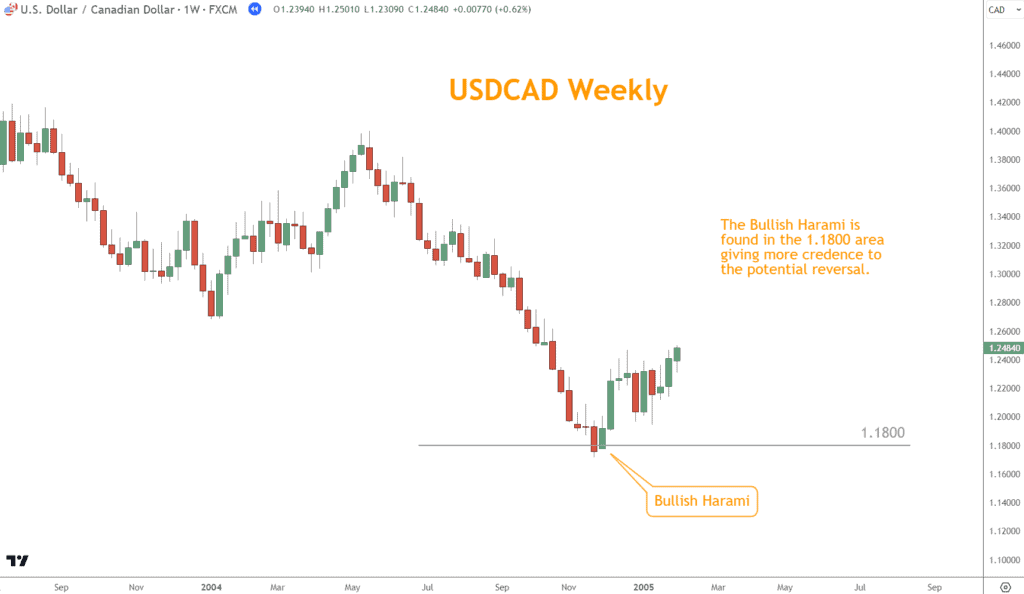

Support and Resistance are Sources of Confirmation

Support and Resistance are price levels at which a direction will likely reverse due to a concentration of supply or demand. They are crucial for identifying optimal entry and exit points.

When combined with Harami patterns, these tools help you evaluate a reversal opportunity.

A Bullish Harami pattern occurring at a significant Support level can strongly indicate a potential Rally. In contrast, a Bearish Harami pattern at a Resistance level may signal a possible Selloff.

By analyzing the convergence of Harami patterns with Support and Resistance levels, you can enhance the accuracy of your market predictions and optimize your trading strategies.

Conclusion

Understanding and applying Bullish and Bearish Harami patterns and other technical analysis tools like Momentum, Chart Patterns, and Support and Resistance levels can significantly enhance trading strategies in the Forex market.

When identified and applied correctly, these patterns can provide valuable insights into market reversals and help you make more informed decisions, manage risks effectively, and navigate Forex trades with increased confidence and understanding.

What’s the Next Step?

Select a favorite chart and look for Bullish and Bearish Harami patterns using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these patterns.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the Significance of a Harami Pattern in Forex Trading?

It signals a potential reversal in price direction, helping you make informed decisions on entry and exit points.

How Reliable are Bullish and Bearish Harami Patterns?

Traders can use Momentum as a reliable indicator of a potential reversal. However, it’s essential to use other technical analysis tools for confirmation.

Can Harami Patterns be Used for Long-Term Trading Strategies?

Yes, but they are typically more effective in shorter time frames.

How can a Trader Differentiate Between a Genuine and False Harami Pattern Signal?

Traders can use Momentum, Support and Resistance levels, and other Chart Patterns to confirm valid and false signals.

Can Harami Patterns be Used in Conjunction with Other Technical Analysis Tools?

Using Harami patterns with other technical analysis tools can increase the reliability of the trading signals.