The Bullish and Bearish Engulfing patterns are fundamental among the many Candlestick Patterns available.

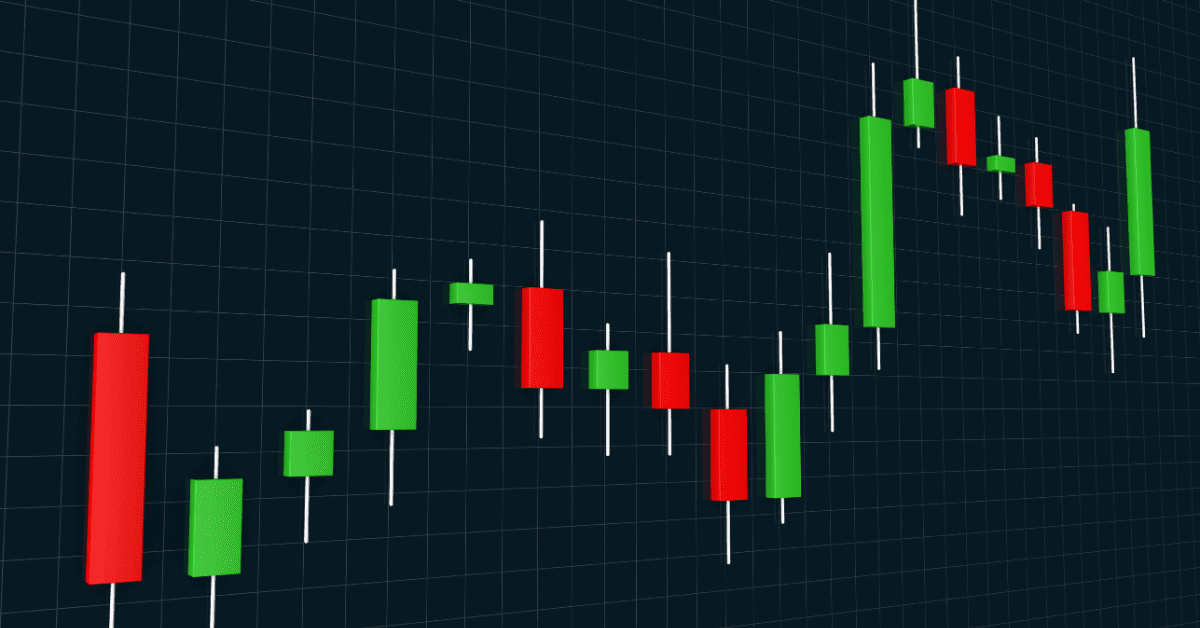

In Forex trading, Japanese Candlestick Patterns are essential for technical analysis. They show how prices move over a certain period.

You can use these patterns to understand the market and predict future price changes.

As a trader, you can utilize these patterns to identify potential reversals in market trends, which can help you make strategic decisions when entering and exiting positions.

In this article, I’ll delve deep into the intricacies of these patterns, exploring their formation, underlying market psychology, practical applications, and limitations.

Understanding the Bullish and Bearish Engulfing patterns can enhance your analytical skills and improve the likelihood of trading success.

What are the Basics of a Japanese Candlestick

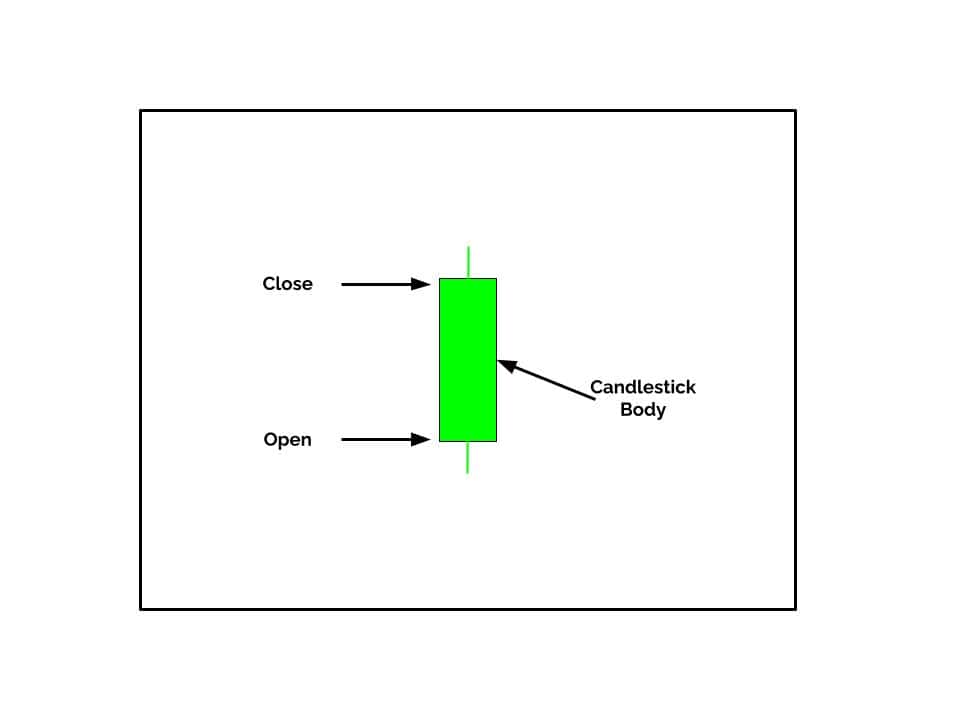

Japanese Candlestick Patterns represent price movements in the market, with each candlestick depicting the open, close, high, and low prices within a specific timeframe.

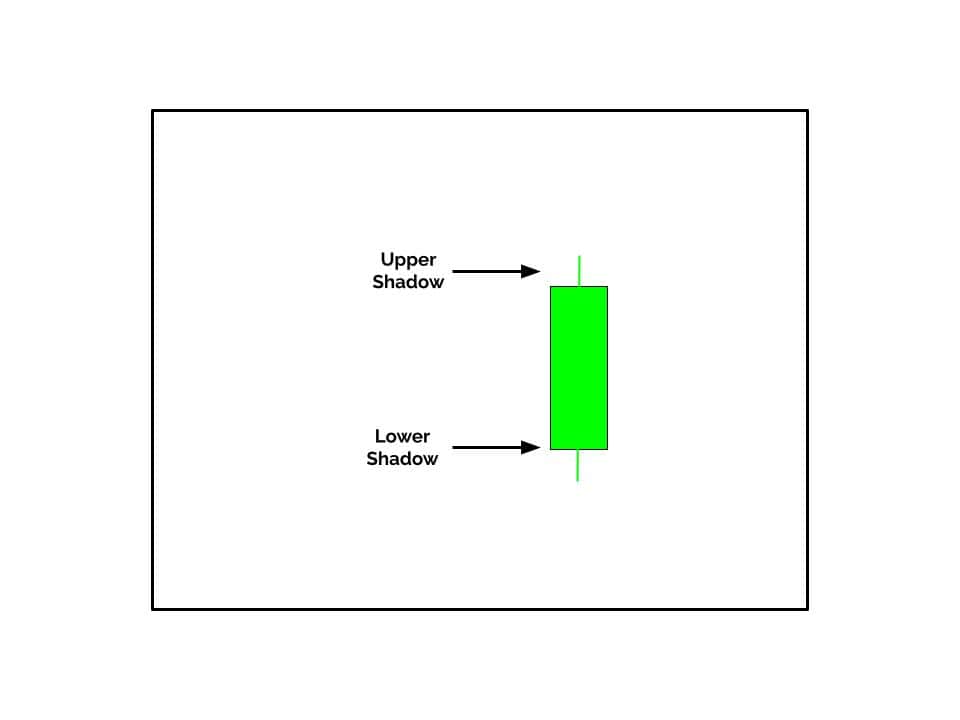

The candlestick’s body represents the range between the opening and closing prices, while the wicks or shadows illustrate the highest and lowest prices.

Understanding the basics of these candles is crucial as it lays the foundation for interpreting more complex formations, such as the Bullish and Bearish Engulfing patterns.

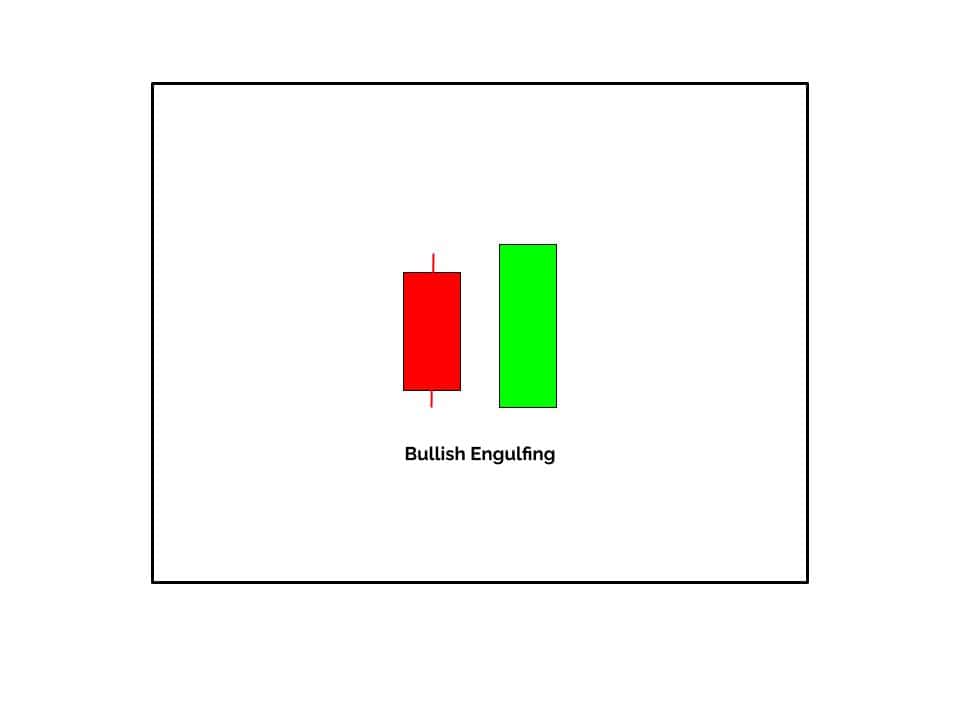

Bullish and Bearish Engulfing patterns are two-candle patterns.

When correctly identified and interpreted, these patterns can offer valuable insights into market sentiment and trader behavior, enabling you to make more informed and strategic trading decisions.

How to Identify a Bullish Engulfing Pattern

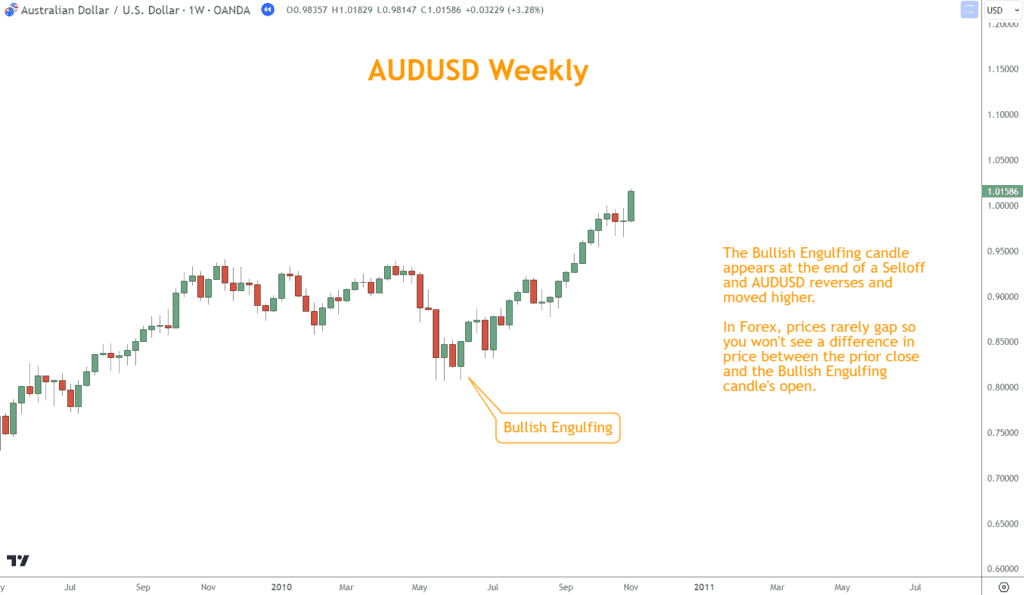

The Bullish Engulfing Pattern is a candlestick formation occurring during a Selloff, signaling a potential reversal to a Rally.

After a smaller Bearish candle, a larger Bullish candle appears, with the body of the Bullish candle completely engulfing the body of the preceding Bearish candle.

This pattern is known as Bullish Engulfing.

Understanding the Bullish Engulfing Pattern’s formation and underlying market psychology is crucial.

It represents a shift in market sentiment, where buyers begin to overpower sellers, indicating rising demand and potential upward price movement.

What Is a Bearish Engulfing Pattern?

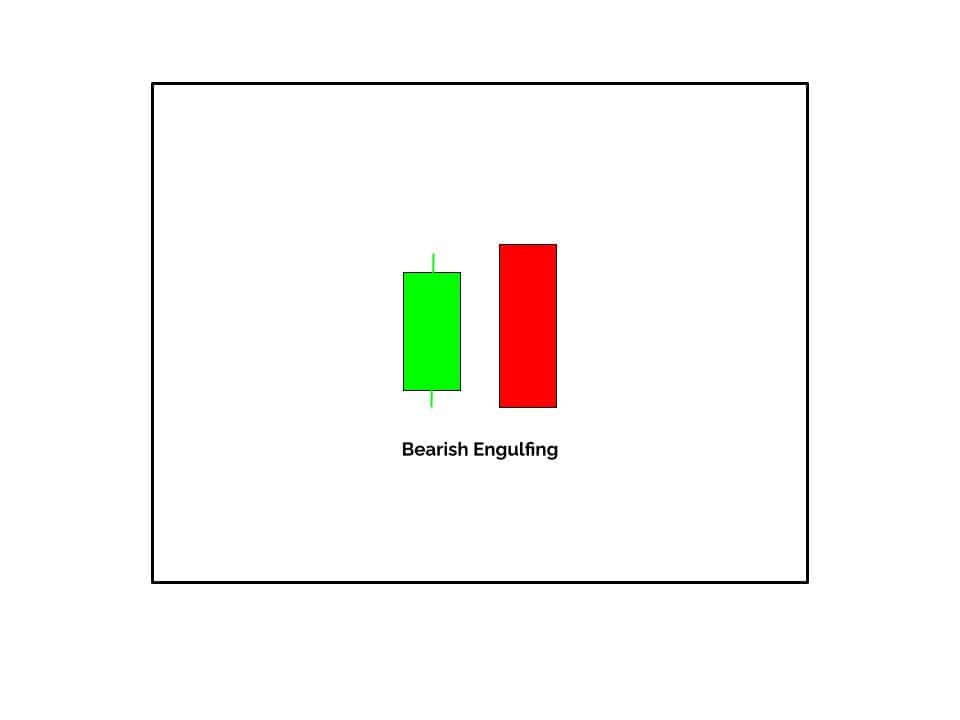

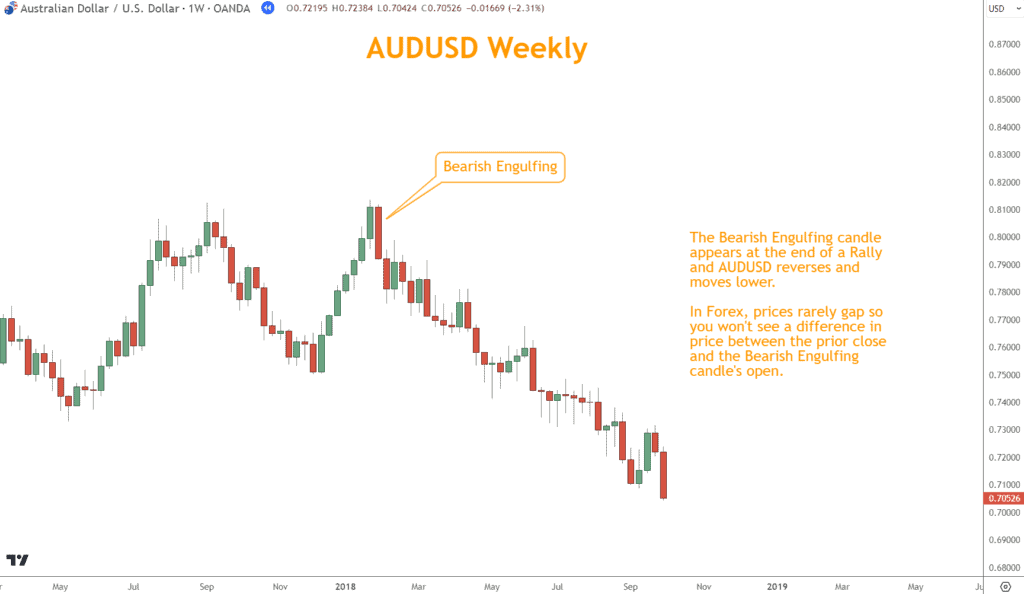

The Bearish Engulfing Pattern is a pivotal candlestick configuration that emerges during a Rally, suggesting a possible shift to a Selloff.

The market sentiment may shift when a larger Bearish candle completely covers a smaller Bullish candle. This change suggests that sellers may begin to take over from buyers, leading to a Selloff.

Understanding the Bearish Engulfing Pattern is important for predicting market reversals. It reveals the formation and market psychology behind these changes.

How to Use Engulfing Patterns with Coincidental Technical Analysis Tools and Indicators

Momentum Indicators: True Strength Index (TSI)

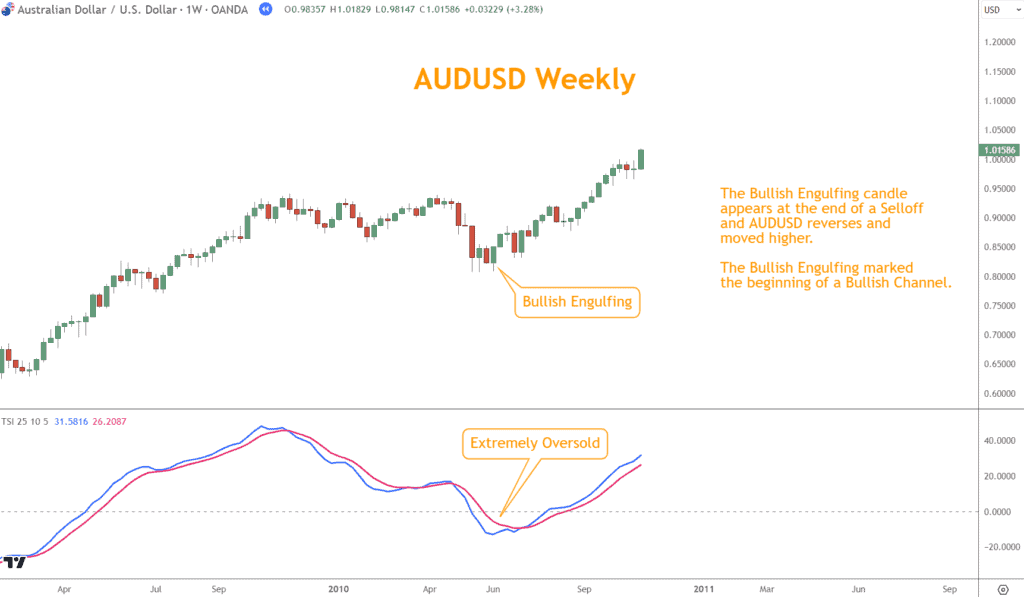

By combining Bullish and Bearish Engulfing Patterns with momentum indicators like the True Strength Index (TSI), you can better understand the current market Momentum and confirm the strength of potential reversals indicated by the Engulfing patterns.

The TSI helps identify the direction of the market Momentum and can be crucial in confirming the entries and exits based on engulfing patterns.

Seeing a Bullish Engulfing Pattern and a TSI Bullish Cross increases the likelihood that prices will rise, providing an excellent reason to open a long position.

Conversely, if you see a Bearish Engulfing Pattern and a TSI Bearish cross, the price will likely fall, and this is an excellent signal to open a short position.

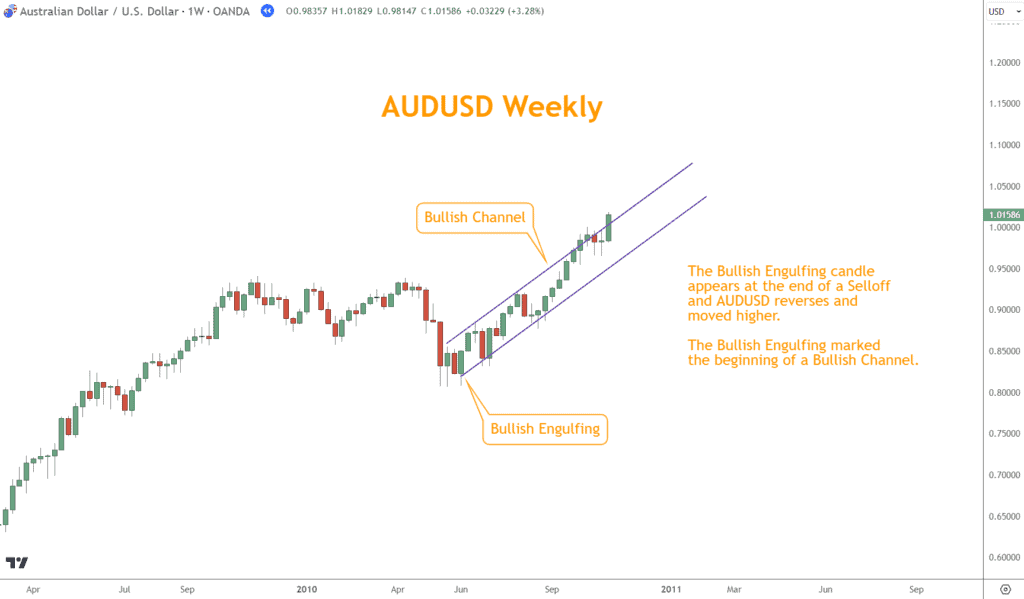

Chart Patterns

You can combine Engulfing Patterns with other Chart Patterns, such as Triangles, Channels, or Head and Shoulders, to improve trade setups.

It could be a perfect time to buy if you see a Bullish Engulfing Pattern at the end of a Descending Channel or the support line of a Descending Triangle.

Opening a long trade makes sense because the pattern shows a reversal signal from the Chart Pattern.

It can be an excellent time to sell when you see a Bearish Engulfing Pattern at the top of an upward channel or the resistance line of an upward triangle.

The coincidence of signals confirms the Chart Pattern predicts a change in direction.

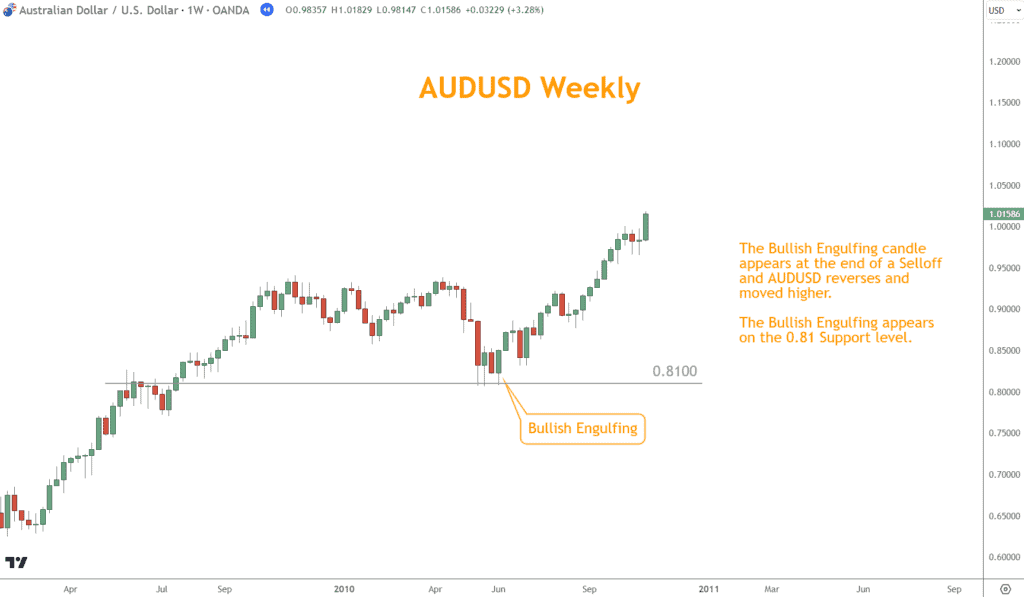

Support and Resistance

Combining Engulfing Patterns with Support and Resistance levels can improve trade accuracy by identifying key areas where price is likely to shift direction.

This pairing can be critical in predicting changes in price movement.

When a Bullish Engulfing Pattern happens near a significant Support level, it can suggest that the price might go up.

The signal is valid because the Support level is where traders have purchased historically.

On the other hand, a Bearish Engulfing Pattern occurring near a crucial Resistance level can signal a probable downward reversal, given that the Resistance level typically represents a point where selling has prevailed in the past.

Support and Resistance levels and Engulfing Patterns can improve your trading.

This coincidence of signals can help you identify trade opportunities with higher chances of success, improving profitability.

Conclusion

In conclusion, Bullish and Bearish Engulfing Patterns are invaluable tools providing insightful visual cues into market sentiment and potential price movements.

The Bullish Engulfing Pattern, indicative of a possible Rally, and the Bearish Engulfing Pattern, signaling a potential Selloff, are crucial for anticipating market reversals.

To effectively use these patterns, one must understand their formation, the psychology driving market movements, and the trading strategies employed.

It is essential to recognize the limitations of these patterns and use them alongside other technical analysis tools and intelligent risk management methods to trade with them successfully.

By continually refining your knowledge and applying these patterns, you can enhance your analytical understanding, make informed trading decisions, and optimize your trading performance.

What’s the Next Step?

Select a favorite chart and look for Bullish and Bearish Engulfing patterns using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these crosses.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the Significance of Japanese Candlestick Patterns in Forex Trading?

Japanese Candlestick Patterns are crucial as they provide visual insights into market price action and trader sentiment, helping you make informed decisions based on the prevailing market conditions.

How Reliable are Bullish and Bearish Engulfing Patterns?

Remember that these patterns should not be the sole basis for identifying reliable reversal indicators.

Their reliability increases with other technical analysis tools and proper risk management.

How Can I Differentiate Between a Valid Reversal Signal and a False One?

To differentiate between true and false reversal signals, consider the overall market context, use additional technical analysis tools, and look for confirmation through subsequent candlesticks or other indicators.

How Important is Risk Management When Trading With These Patterns?

Risk management is paramount in trading, regardless of the strategy or patterns used. Proper position sizing, setting stop-loss and take-profit levels, and managing leverage are crucial to protect your trading capital.

Can Beginners use These Patterns Effectively?

Yes, beginners can benefit from learning and using these patterns, but practicing on demo accounts and learning about market analysis and trading strategies to use them effectively is essential.

Should I Solely Rely on Candlestick Patterns for my Trading Decisions?

While candlestick patterns are valuable, relying solely on them is not advisable. It’s crucial to incorporate other technical and fundamental analysis methods and have a well-rounded trading plan.