The bull and bear trap patterns are essential Forex price actions you should know in technical analysis.

These trap scenarios are costly if you fail to recognize them and avoid their pitfalls.

In this article, we will explore bull and bear traps, unraveling their intricacies and demonstrating how to avoid them.

What are Bull and Bear Traps?

Bull Trap

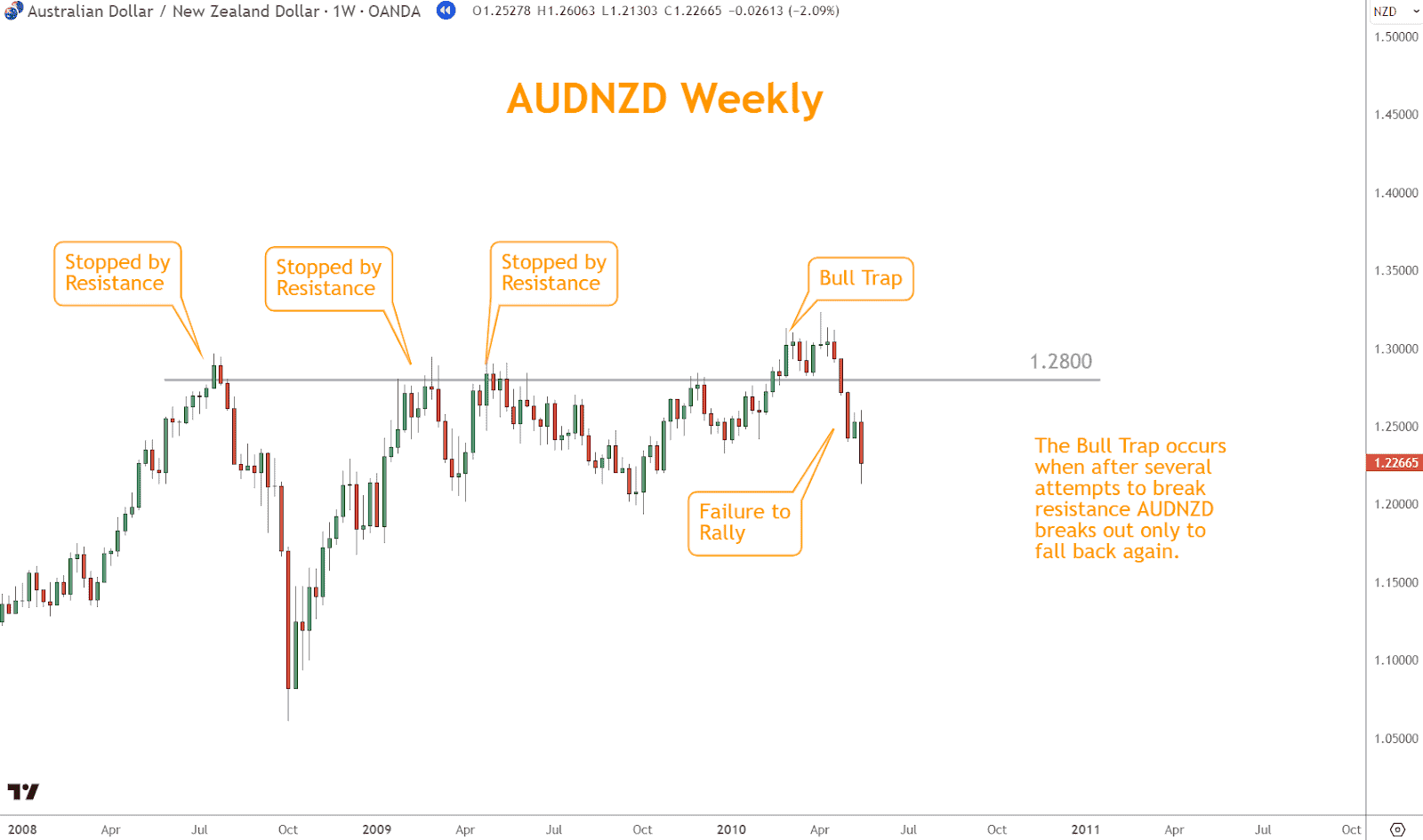

A bull trap typically occurs when a market falsely appears to be reversing its downward trend.

As prices rise, traders are excited to get in early on the reversal.

Traders eager to catch the supposed upswing buy into the market, believing that a substantial bull run is underway.

However, the trap quickly arises when the market unexpectedly changes direction.

Prices dropped rapidly, taking those who believed in the illusion by surprise.

In a very short time, what seemed like a good bull market turned into a situation where people lost money because they got caught in the trap.

Bear Trap

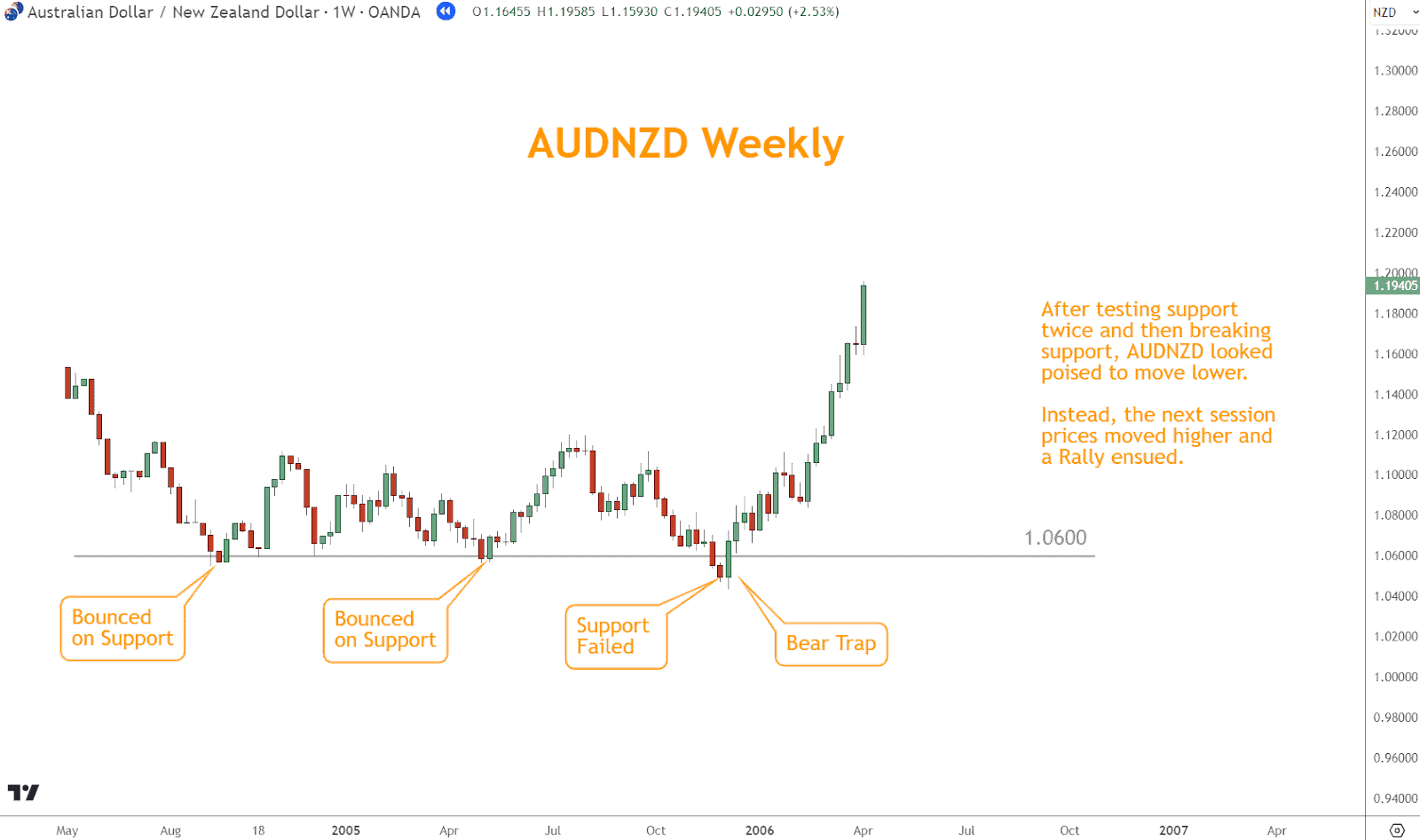

Conversely, a bear trap is the mirror image of a bull trap but plays out in a different context.

It emerged in a bullish market, where traders enjoyed an extended period of rising prices.

During such periods, market participants become increasingly cautious about a potential downturn, fearing that the bull market might be nearing its end.

This apprehension sets the stage for a bear trap. As prices unexpectedly drop, traders interpret this decline as the beginning of a bearish trend.

Some traders, looking to profit from this perceived downturn, initiate short positions, believing prices will continue to fall.

However, the trap springs into action when the market abruptly reverses course, embarking on an upward trajectory.

Like a bull trap, a bear trap capitalizes on the emotions and expectations of traders.

It induces them to make hasty decisions, believing they align with the market’s direction.

However, as the market swiftly changes course, those who shorten the market find themselves trapped in a position that results in losses instead of gains.

Understanding these two patterns involves grasping the psychological aspects of trading.

These traps demonstrate the power of market sentiment and its impact.

You should always approach the market with a healthy dose of skepticism, be patient, and use technical analysis and risk management techniques to confirm your trading decisions.

How to Identify Bull and Bear Traps

There are several tools at your disposal to protect you from getting drawn into these traps:

Candlestick Patterns

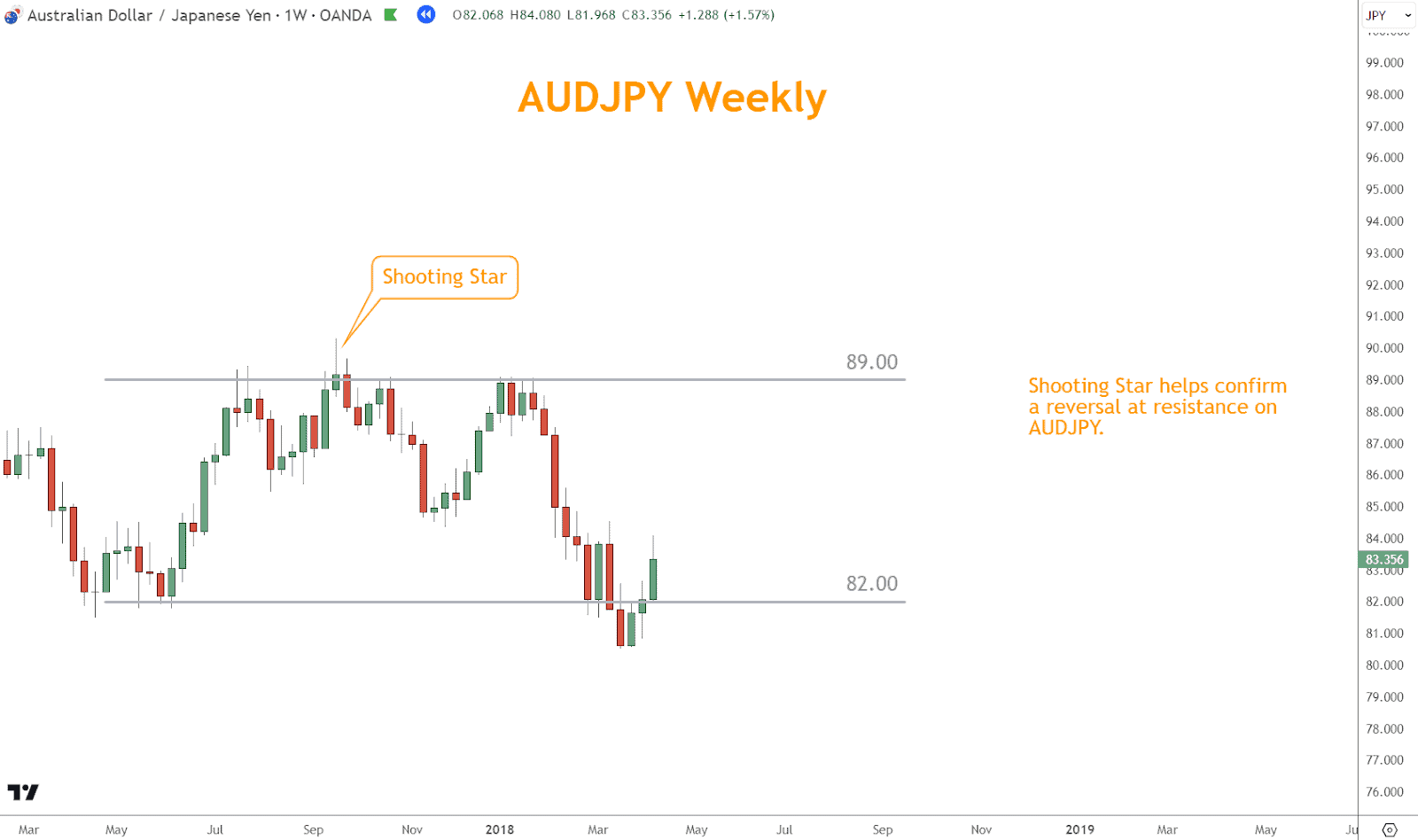

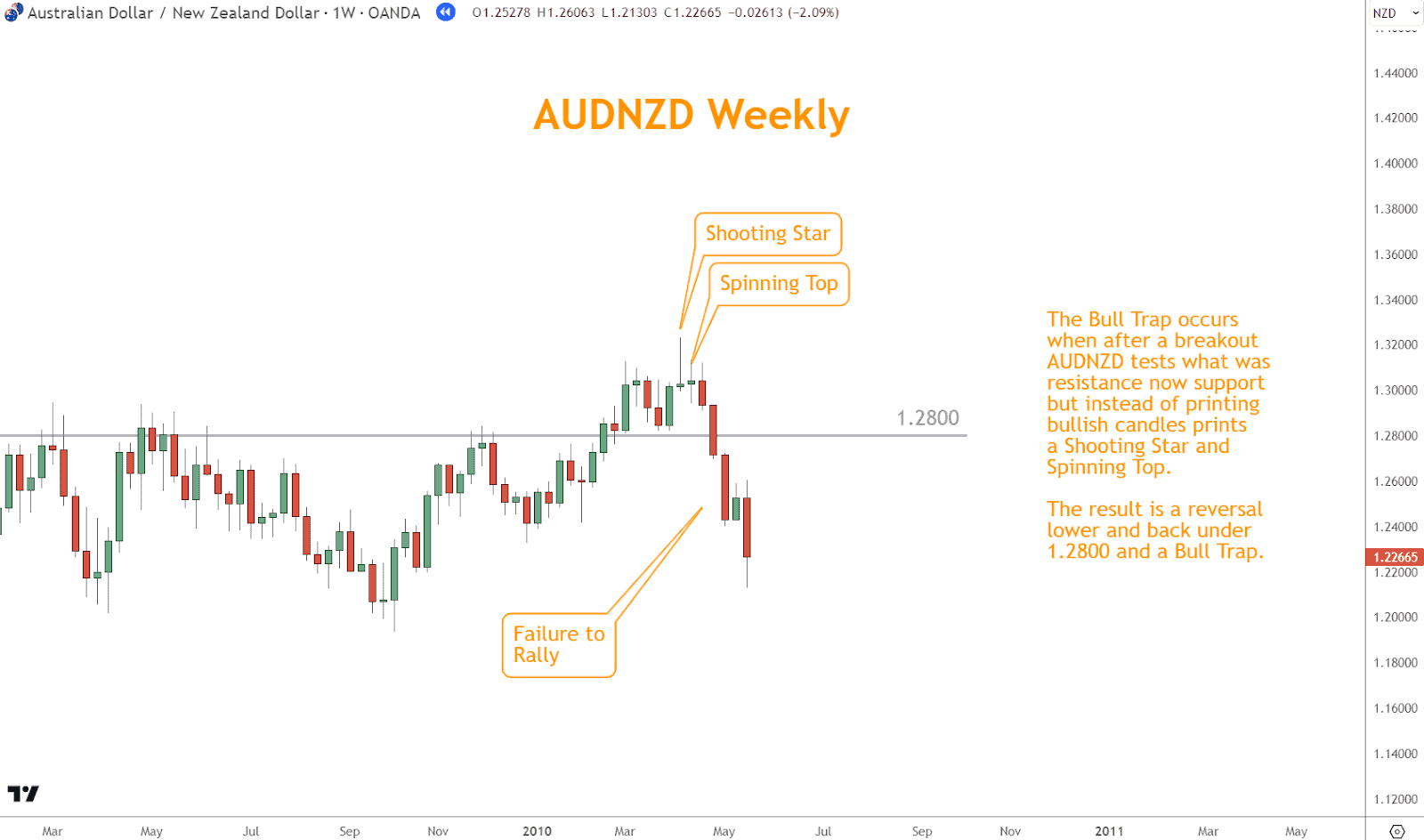

Candlestick patterns offer valuable insights into the potential formation of bull and bear traps.

Watch for patterns like Shooting Stars or Doji candles after a prolonged rally or selloff.

A Shooting Star, for instance, represents a potential bearish reversal after a strong bullish move and can help confirm a reversal.

Conversely, a Doji candle suggests market indecision and can be a precursor to a trap since it doesn’t specifically signal a reversal.

Look for candlestick patterns that can help provide confirmation, not indifference.

Support and Resistance Levels

A bull trap often occurs when prices breach a crucial resistance level but quickly reverse, trapping traders who bought into the breakout.

On the other hand, a bear trap is set when prices break below a crucial support level, only to bounce back upwards, causing losses for those who shorted the market.

Recognizing these levels and the potential for traps near them is vital.

Divergence

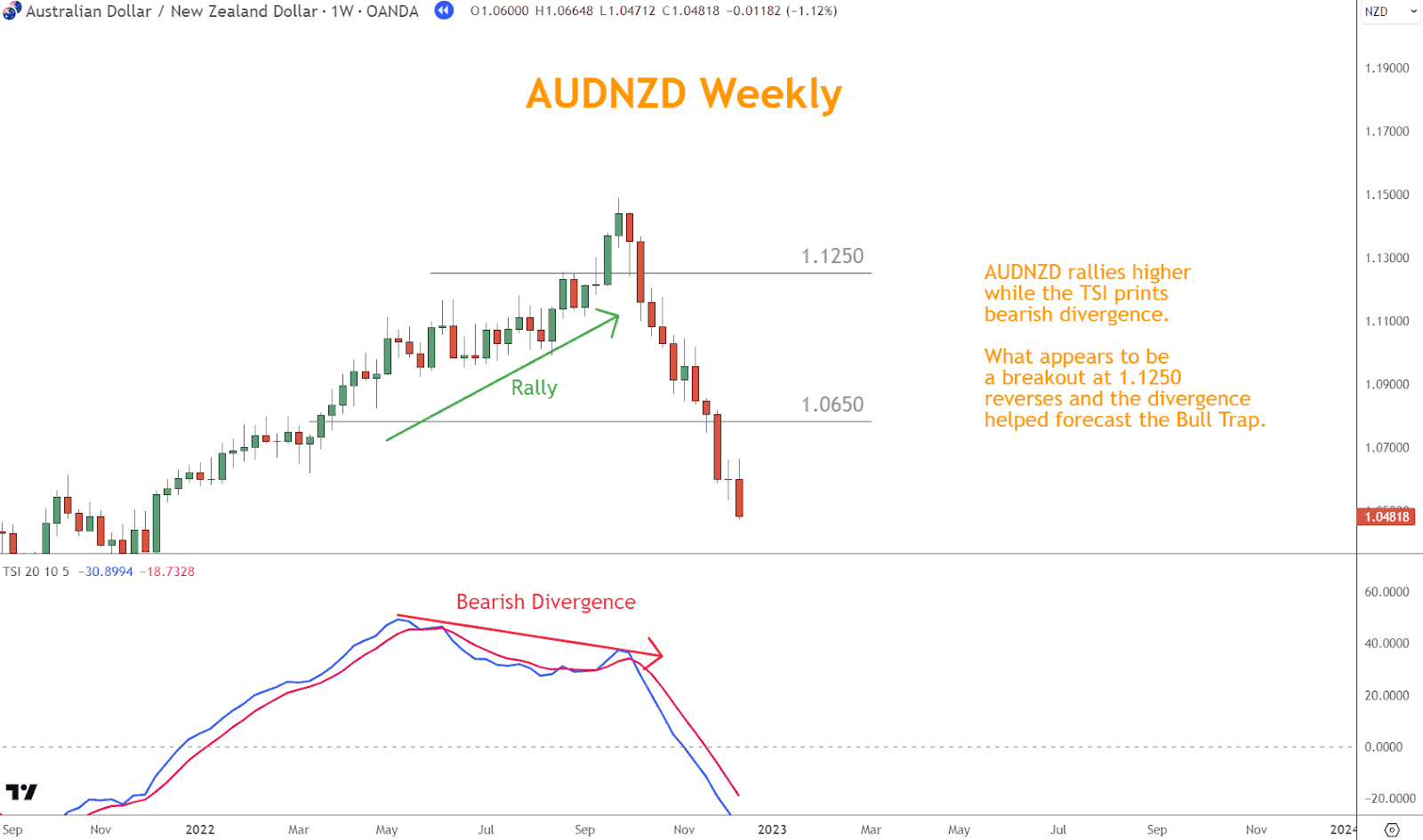

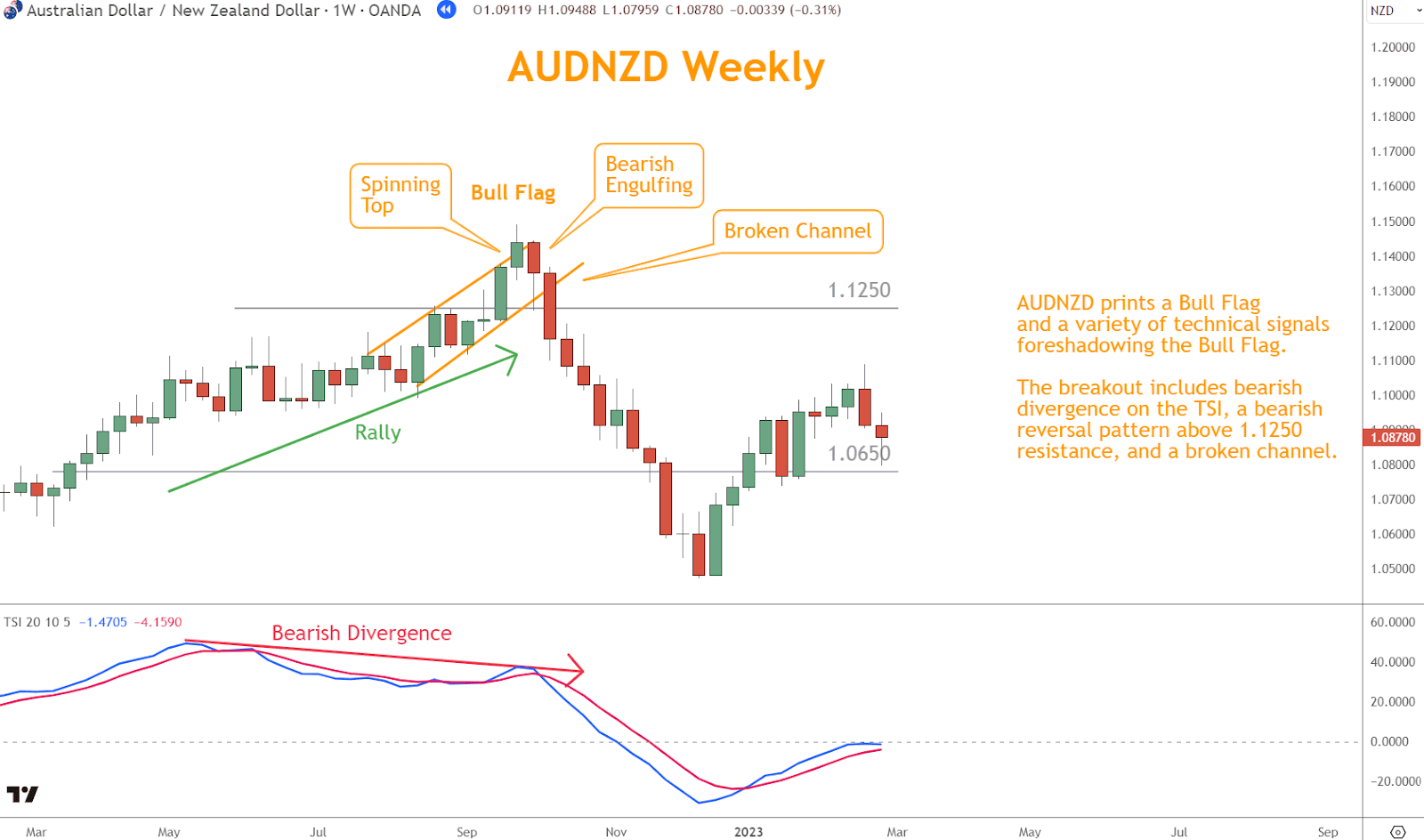

Technical indicators like the Relative Strength Index (RSI) and True Strength Indicator (TSI) can help identify divergence, a powerful signal of potential traps.

Divergence occurs when price and these indicators move in opposite directions.

For example, if prices are making higher highs while the TSI is making lower highs, it could indicate a weakening bullish trend that might culminate in a bull trap, as seen in the chart below.

Divergence is a helpful tool but fallible, so use it with caution.

News and Events

Market-moving news and events can trigger traps. Sudden, unexpected news can lead to volatile price movements that mimic trap characteristics.

You should be cautious when trading around major economic announcements, central bank decisions, or geopolitical events, as they can create deceptive market movements.

Multiple Indicators

Analyzing a combination of technical indicators can provide a more comprehensive view of potential traps.

As the example above shows, combining indicators such as momentum, chart patterns, and support and resistance can offer a more robust assessment of whether a breakout is likely to occur or become a “trap.”

Confirmation

The cardinal rule when identifying traps is to seek confirmation before taking action.

Avoid impulsive decisions based solely on the initial breakout.

Wait for additional signals, such as price confirmation in subsequent candles or the alignment of various technical indicators, to validate the market’s direction.

You can significantly improve your decision-making processes by honing the ability to identify bull and bear trap patterns using these techniques and indicators.

What Trading Strategies Do I Need for Bull and Bear Traps?

Mastering these traps, often set by market dynamics and traders’ psychology, can be a stumbling block or a stepping stone on your trading journey.

This section will explore effective trading strategies for handling both trap patterns.

Confirmation is Key

Successfully navigating trap patterns means exercising extreme caution and waiting for confirmation.

You should resist jumping into a trade immediately after identifying a potential trap.

Instead, patiently observe how the market unfolds.

Confirmation can come in various forms, such as additional candlestick patterns or the alignment of multiple technical indicators.

Identify Stop Loss Levels

Stop losses are your best defense against significant losses when dealing with traps.

After entering a trade, identify a stop loss level beyond where the trap trigger might be.

This tactic limits potential losses and allows you to exit the trade swiftly if the market unexpectedly turns against you.

Risk Management

Adhering to a sound risk management strategy is crucial when dealing with traps.

Never risk more than a small percentage of your trading capital on a single trade.

Limiting your exposure, even if a trap is sprung, will make the losses manageable and won’t jeopardize your overall trading account.

Psychological Discipline

Emotions are a trader’s worst enemy when it comes to navigating traps.

Fear and greed can lead to impulsive decisions that play right into the hands of the traps.

Maintain emotional discipline by adhering to your trading plan, setting realistic profit targets, and sticking to your risk management rules.

Continuous Learning and Adaptation

Finally, you should continuously educate yourself about market dynamics and stay updated with the latest developments in the Forex market.

Markets evolve, and strategies that were effective in the past may become less so over time.

Being adaptable and willing to learn from successes and failures is essential for long-term success in trading.

Navigating trap patterns requires a blend of technical analysis, risk management, and psychological discipline.

Traders who approach these situations cautiously, employ confirmation signals, and adhere strictly to their trading plans stand a better chance of turning traps into opportunities for profit.

Success in Forex trading is a journey that involves learning from experiences and mastering the art of handling traps, which is a significant step towards becoming a skilled and resilient trader.

Conclusion

Bull and bear trap patterns are part of Forex trading; you must prepare to encounter them.

Understanding how these traps work and having a set of strategies to navigate them is essential for success in Forex trading.

Remember that success in trading is a long-term endeavor, and mastering the art of navigating traps is a significant step toward becoming a proficient Forex trader.

What’s the Next Step?

Use this article to look at favorite charts and determine where bull and bear trap price action occurred.

In addition, look for opportunities to use what you’ve learned in your process.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about bull and bear trap patterns in Forex.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will use the Six Basics of Chart Analysis and Advanced Strategies to show you the trade opportunities I’m watching.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What Are Bull and Bear Traps in Forex Trading?

A bull trap occurs when a rising market lures traders into believing a bullish trend is emerging, only to reverse and head downward.

Conversely, a bear trap unfolds in a declining market when it deceives traders into thinking a bearish trend is taking hold, causing losses for short traders.

Traps are deceptive market movements that can catch traders off guard if not identified and managed effectively.

How Can I Identify a Bull or Bear Trap?

Identifying traps requires a combination of technical analysis and market awareness.

You should watch for telltale signs such as candlestick patterns, support and resistance levels, divergence in technical indicators, and the impact of unexpected news events.

You can become proficient at recognizing potential traps by carefully examining these indicators and employing thorough analysis.

What Strategies Can I Use to Navigate Bull and Bear Traps Successfully?

Practical strategies for dealing with traps include seeking confirmation before trading, implementing stop losses, aligning with the prevailing market trend, practicing risk management, maintaining psychological discipline, and using technical indicators.

When applied diligently, these strategies can help you avoid falling into traps and even turn them into profitable opportunities.

Why Are Bull and Bear Traps Significant in Forex Trading?

Bull and bear traps are essential concepts because they reveal the psychological dynamics of the market.

They showcase how emotions and expectations can lead to deceptive price movements, emphasizing the importance of patience, discipline, and careful analysis in trading.

Understanding and navigating traps is vital for traders looking to thrive in the Forex market, as they can significantly impact trading outcomes.