As time passes, the price movements in Broadening Patterns gradually expand, forming a shape similar to a megaphone when viewed on a chart.

Price movements can diverge when the market becomes more volatile and uncertain, causing distinct patterns to emerge in the highs and lows.

The psychology behind these patterns can be explained by the back-and-forth struggle between buyers and sellers, with neither side holding a definite advantage.

The price range expands as the market oscillates between optimism and pessimism, creating these patterns.

Recognizing and interpreting them can offer you a glimpse into the prevailing market sentiment and potential shifts in the future direction of a currency pair.

In the subsequent sections, we’ll explore the two primary types of Broadening Patterns, Ascending and Descending, and how they can be pivotal in shaping trading decisions.

What is an Ascending Broadening Pattern?

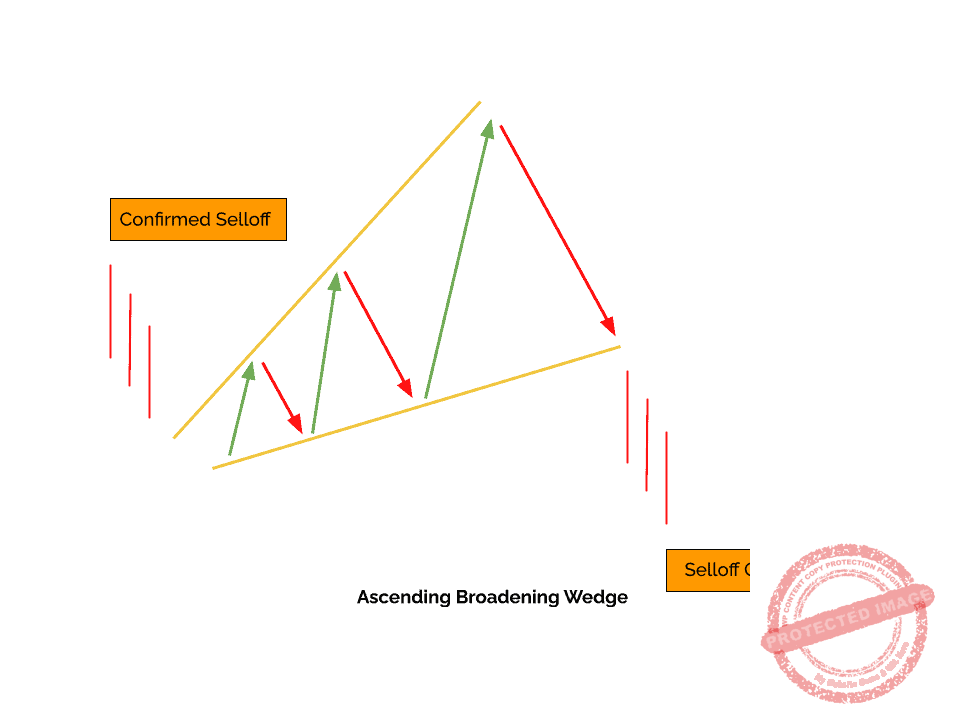

The Ascending Broadening pattern is a unique chart formation that showcases an upward slant while simultaneously revealing an expanding range between the successive highs and lows.

Visually, it appears as two diverging lines, where the lower line ascends at a steeper angle than the upper one.

This pattern often emerges after a significant Rally and is typically considered Bearish, signaling potential exhaustion in the Bullish momentum.

The underlying market psychology suggests that while buyers push the price to new highs, the increasing lows indicate growing uncertainty and a more substantial presence of sellers.

You can anticipate a potential reversal or a significant pullback when this pattern is confirmed.

However, as with all Chart Patterns, waiting for confirmation, such as a decisive break below the lower line, is crucial before making trading decisions based on the Ascending Broadening pattern.

What is a Descending Broadening Pattern?

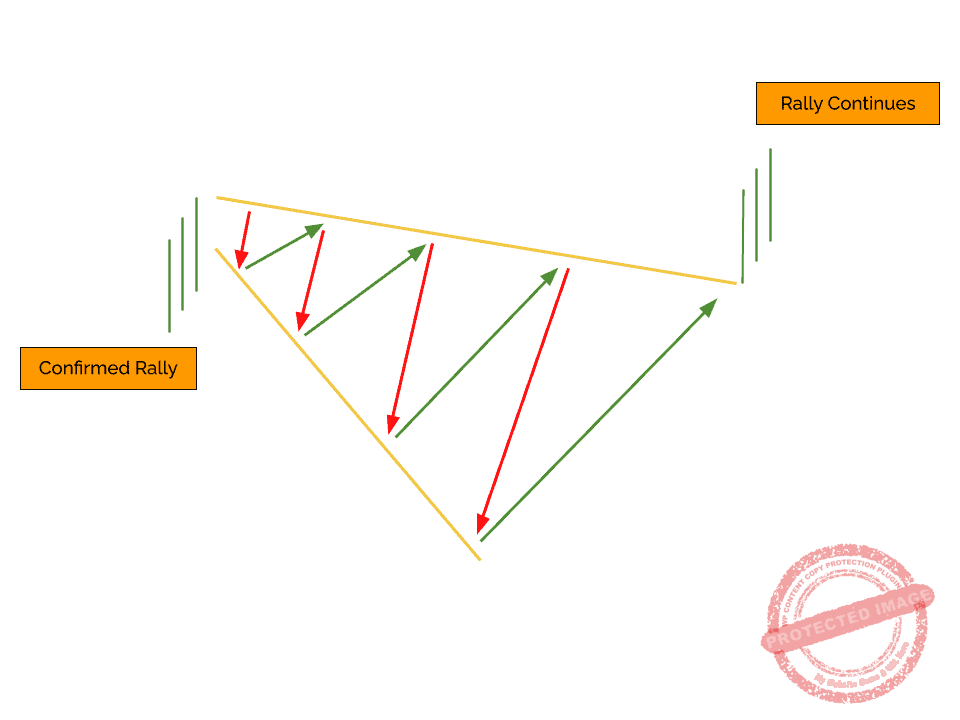

The Descending Broadening pattern shows a downward direction while increasing the distance between each low and high point.

When plotted on a chart, it manifests as two diverging lines, with the upper line descending more gently than the steeper, lower one.

This pattern frequently occurs after a pronounced selloff and is generally interpreted as a Bullish signal.

The market psychology behind this formation suggests that while sellers continue to drive prices to new lows, the rising highs indicate a growing hesitation and a mounting influence of buyers.

The Descending Broadening pattern hints at a potential weakening of the Bearish Momentum, and you should view it as a precursor to a reversal or a substantial Rally.

Before making any trading commitments based on this pattern, confirming it with a decisive break above the upper line is essential.

Harnessing their Power in Trading

Successfully navigating the Forex market using Broadening Patterns requires a strategic approach beyond pattern recognition.

For you, the key lies in identifying optimal entry and exit points that align with the pattern’s implications.

If you come across an Ascending Broadening pattern, it might be a good idea to open a short position once you confirm a break below the lower line. Consider setting a stop-loss just above the most recent high to manage your risk.

Conversely, a Descending Broadening pattern might initiate a long position after a confirmed break above the upper line, with a stop-loss set just below the latest low.

Setting take-profit levels can be based on previous Support or Resistance zones or by measuring the widest part of the pattern.

As always, be mindful of the inherent risks and ensure your strategies align with risk tolerance and overall trading objectives.

Enhancing Confirmation Strength with Other Technical Indicators

While insightful, these patterns gain enhanced predictive power when combined with other technical indicators.

For instance, the interaction of price with Momentum during a Broadening Pattern can offer clues about the strength and potential longevity of the Rally.

The True Strength Indicator (TSI) can identify Overbought or Oversold conditions, providing context to the broadening formation.

A divergence between the TSI and the price, especially during the pattern formation, can signal weakening Momentum and potential reversals.

Utilizing Japanese Candlestick Patterns can help to pinpoint reversals and improve the accuracy of entry and exit points.

Lastly, Support and Resistance can shed light on frequent reversal areas that precede significant price movements.

Integrating these indicators with Broadening Patterns enables you to craft a more holistic and nuanced trading strategy, reducing false signals and enhancing profitability.

Broadening Wedge Patterns are not Standalone Indicators

While they offer valuable insights into potential market movements, you must recognize their limitations.

Broadening or otherwise, no Chart Pattern can guarantee a specific market outcome.

Relying solely on these patterns with consideration of the broader market context can lead to misguided trading decisions.

External factors, such as sudden geopolitical events, central bank announcements, or significant economic data releases, can swiftly disrupt and override pattern formations.

Moreover, even without such external influences, patterns can sometimes fail due to the unpredictable nature of market dynamics.

Hence, you should always combine analysis with technical and fundamental analysis tools.

Implementing risk management strategies, like setting stop-loss orders and diversifying trading approaches, can help mitigate potential losses from unexpected pattern failures.

What’s the Next Step?

Select a favorite chart and look for Broadening Patterns using what you learned in this article.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Momentum, Japanese Candlesticks, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate with what you’ve learned about these crosses.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions (FAQs)

What are Broadening Patterns in Forex Trading?

- They are chart formations characterized by price movements that progressively widen over time.

- They can be ascending (upward slant) or descending (downward slant) and are used to predict potential market reversals.

How Reliable are Ascending and Descending Broadening Patterns?

- While these patterns can provide valuable insights, no single pattern guarantees a specific market outcome. It’s essential to use them in conjunction with other technical indicators and to be aware of external market influences.

Can I Trade Solely Based on Broadening Patterns?

- It’s advisable to rely on multiple indicators rather than any chart pattern.

- Combining them with other technical and fundamental analysis tools can offer a more holistic trading strategy.

How do I set Stop-Loss and Take-Profit Levels?

- Stop-loss can be set just above the most recent high (ascending patterns) or below the most recent low (descending patterns).

- Take-profit levels can be based on previous Support or Resistance zones or by measuring the widest part of the pattern.

How do Other Technical Indicators like TSI or Japanese Candlestick Patterns Interact with Broadening Patterns?

- Indicators like TSI can identify Overbought or Oversold conditions, providing context to the broadening formation. Japanese Candlestick Patterns can signal potential reversals.