Candlestick patterns are an essential tool for you as a trader. They provide an excellent way to understand market sentiment, identify trend reversals, and exploit profitable trading opportunities.

This article will dive into two-candle patterns that have proven valuable in trading.

We will explore the anatomy of these patterns, how to recognize them, and what they indicate about the market’s direction.

We will cover eight Bullish and Bearish two-candle patterns and three complementary signals to help you make more informed trades.

Bullish candles are green and Bearish candles are red by default on most chart platforms. Sometimes Bullish candles are white and Bearish black, but we’ll use green and red here.

Lastly, we’ll discuss some common mistakes made when using these patterns and how to avoid them.

What are Two Candle Japanese Candlestick Patterns?

Two Candle Japanese Candlestick Patterns are a reversal technique in trading.

By analyzing the relationship between two candlesticks, you can predict price movement. Examples include Bullish Engulfing, Bearish Harami, and Piercing Pattern, but there are many more.

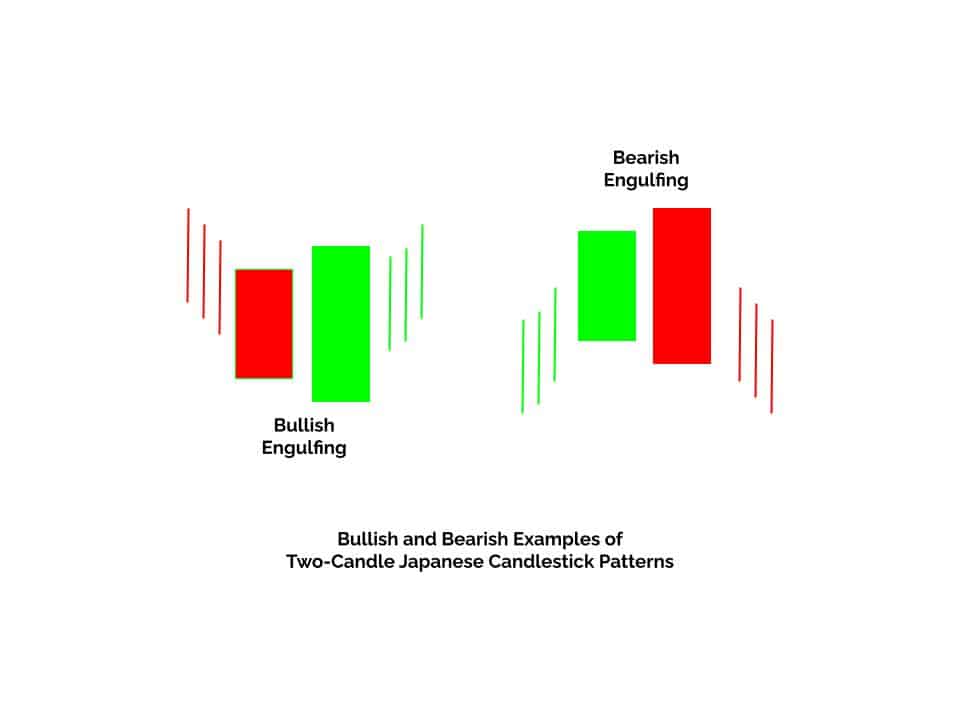

Identifying these can aid in better-informed decision-making. Here is an example of two-candle reversals: one Bullish and one Bearish.

Anatomy of a Two-Candle Pattern in Forex

In an earlier article, single candlestick patterns were examined. A single candlestick pattern uses only one candle to forecast a reversal possibility, whereas Two Candle Patterns involve analyzing two consecutive candles for price movement prediction.

These candlestick patterns can signal a Bullish or Bearish reversal pattern, and you should look for additional complementary signals.

The combination of candlesticks and complementary patterns is available at any time frame.

Complementary signals include Support and Resistance levels, Chart Patterns like Double Bottoms or Rising Wedges, and technical indicators such as RSI (Relative Strength Indicator) and TSI (True Strength Indicator).

Which Bullish Candlestick Patterns Should You Focus On?

Candlestick reversal patterns are essential for you to interpret market sentiment accurately.

Bullish candlestick patterns represent a potential reversal of a Selloff, signaling buying pressure and optimism around a forex pair.

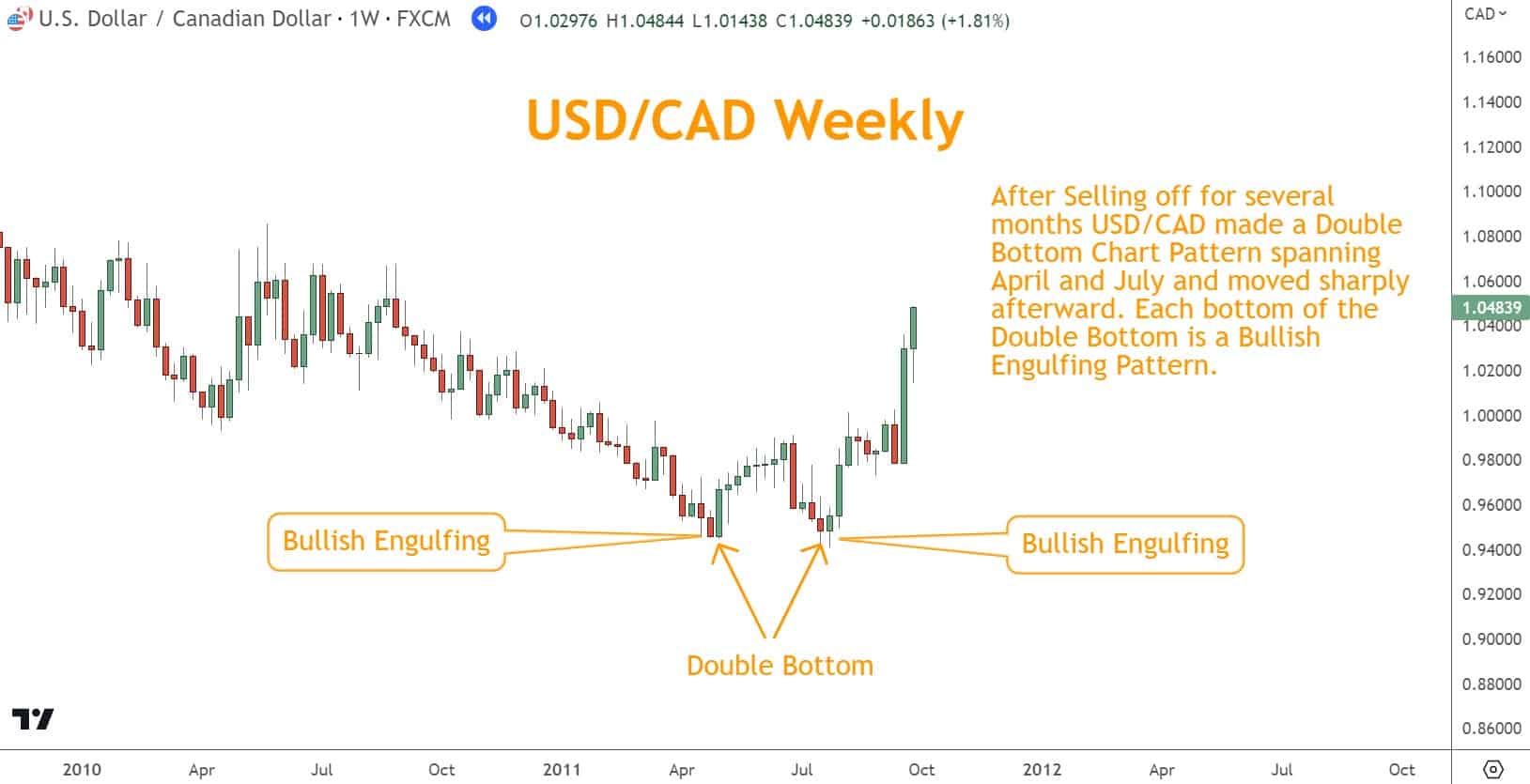

There are many Bullish Candlestick Patterns, including Bullish Engulfing and Bullish Harami.

Bullish Engulfing

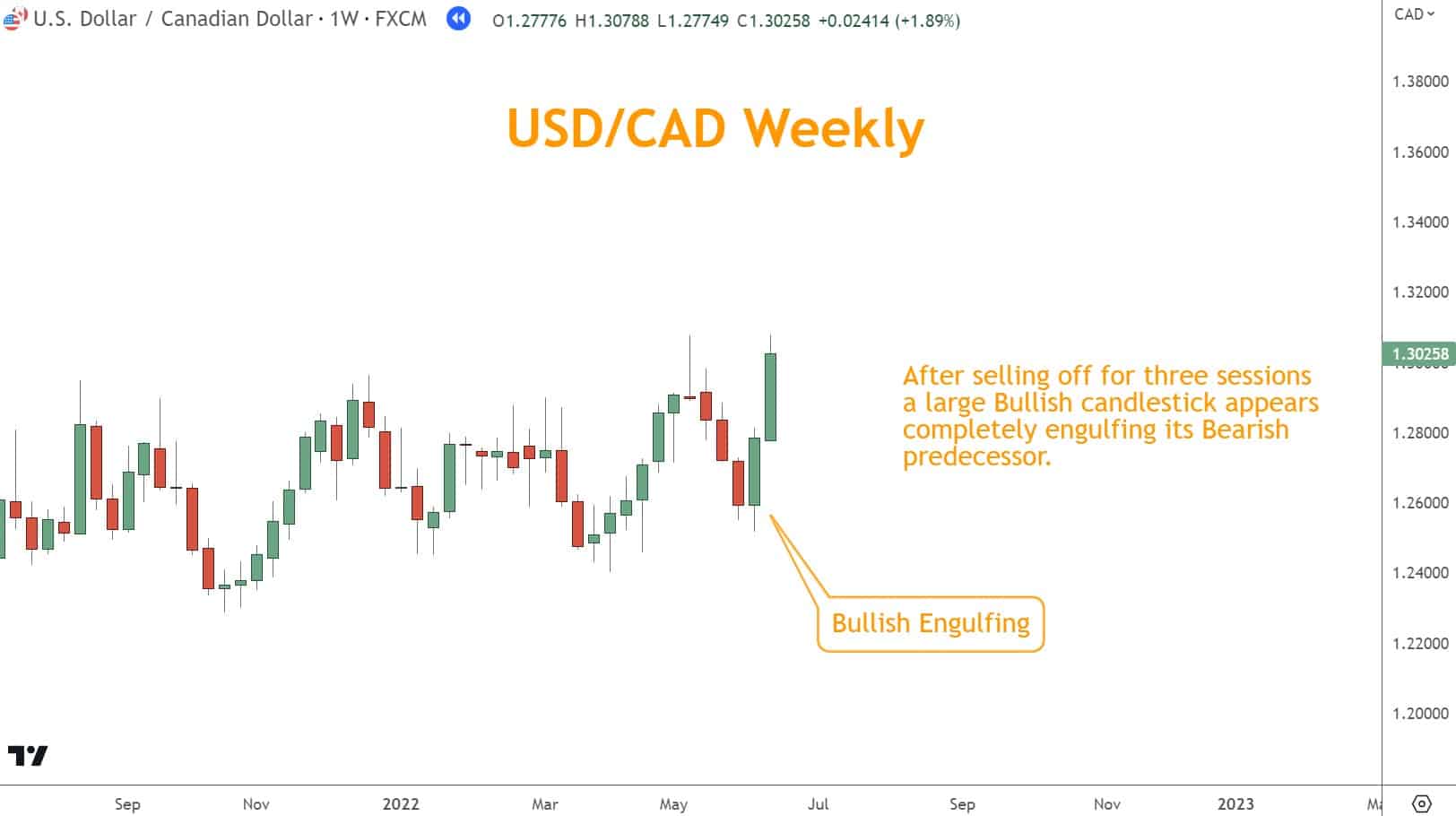

You can identify potential reversals with the Bullish Engulfing pattern. This signal forms when a small red candlestick is followed by a more sizeable green candlestick that engulfs the previous one.

Engulfing means opening lower and closing higher than the previous candle.

Buyers take control of the market and push prices higher after this setup. This pattern is found at Selloff bottoms since it indicates a Bullish reversal.

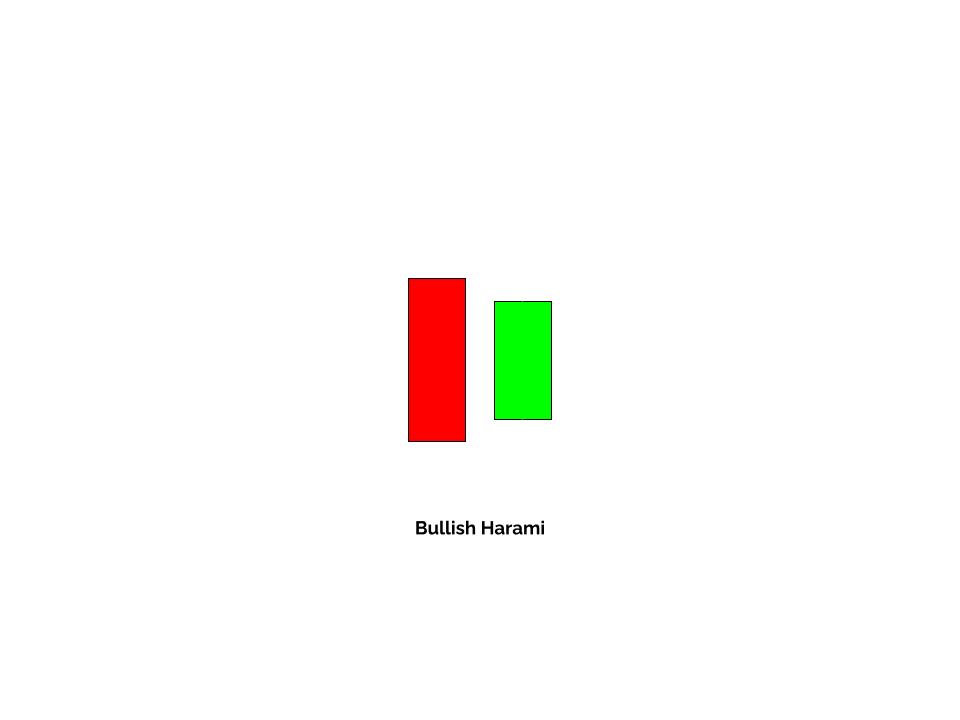

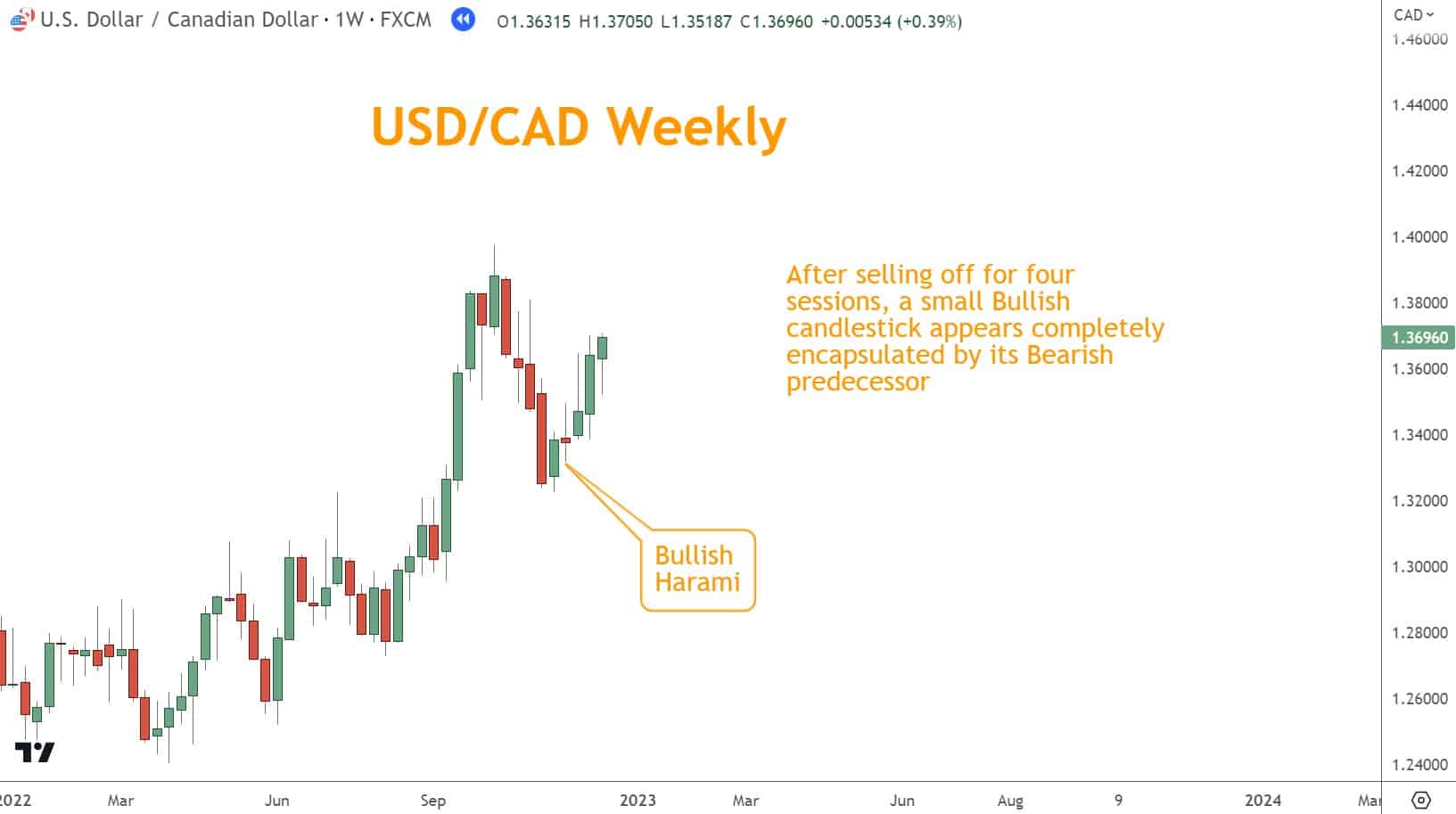

Bullish Harami

A Bullish Harami indicates a potential reversal in a downtrend. The first candlestick of this pattern is usually Bearish and can have a considerable body.

On the other hand, the second candlestick of this pattern is smaller and opens higher and closes lower than the first candle.

This pattern suggests that selling pressure may decrease while buying pressure may increase, leading to a potential price reversal at the bottom of a downtrend.

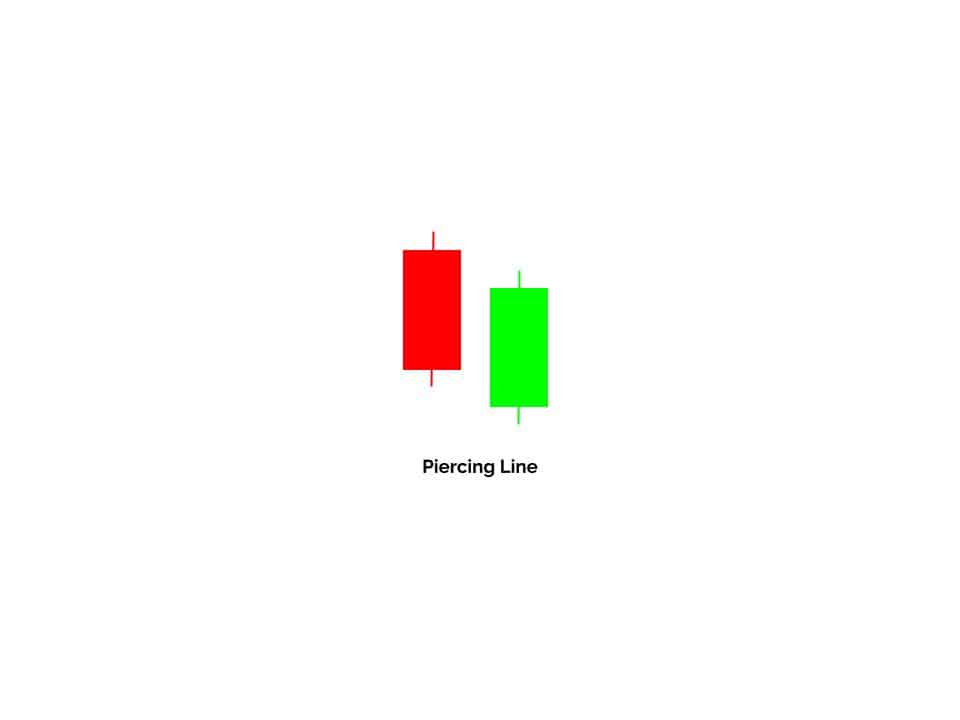

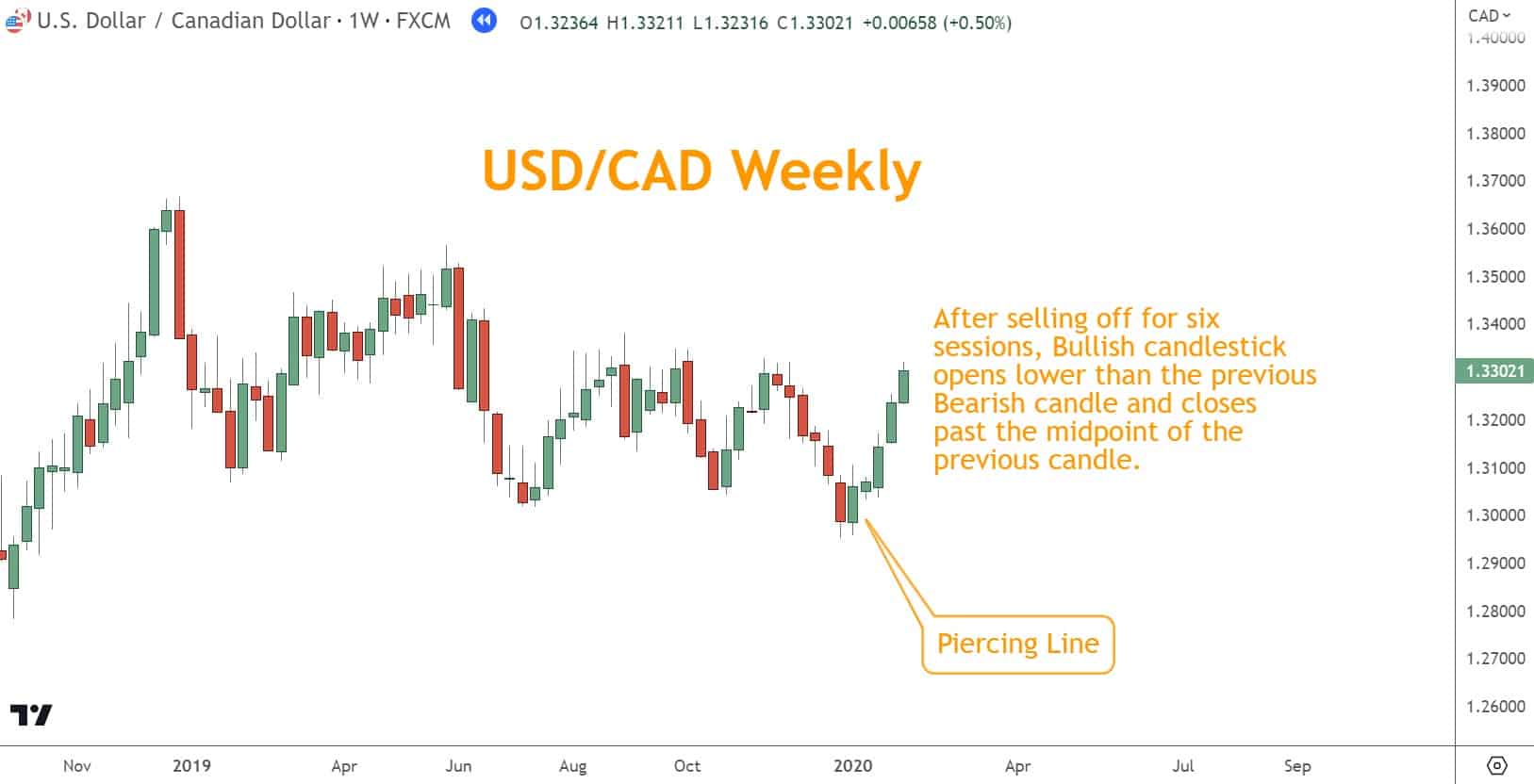

Piercing Line

A Piercing Line is a Bullish Candlestick Pattern comprising two candles – a Bearish candle followed by a Bullish one opens lower. Still, it closes above the midpoint of the Bearish candle.

It signals a reversal as buying pressure overcomes selling pressure, which dominated initially.

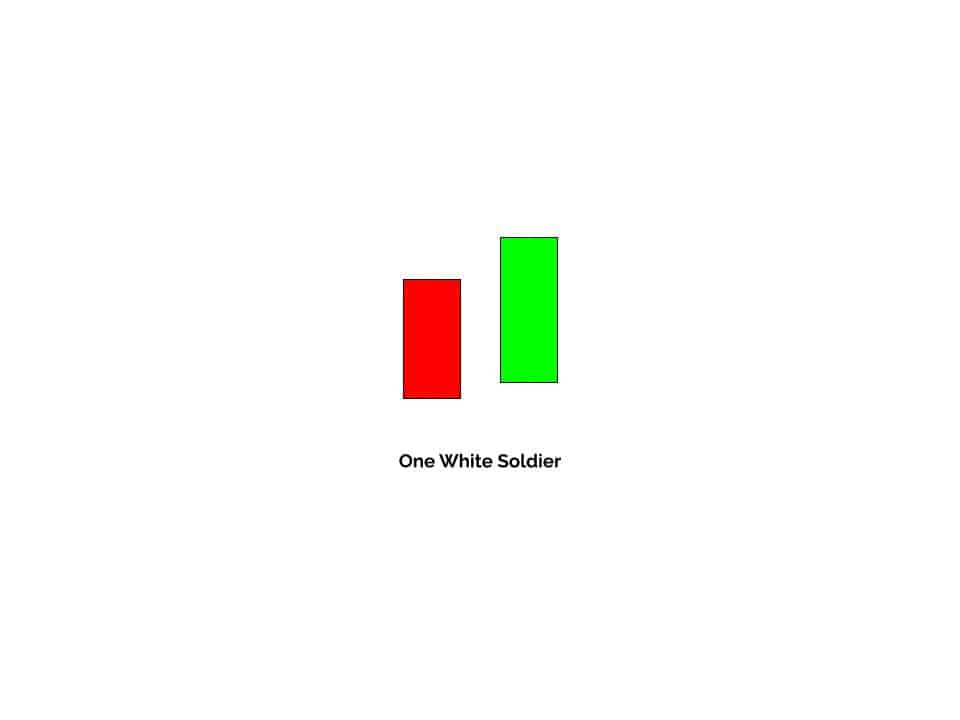

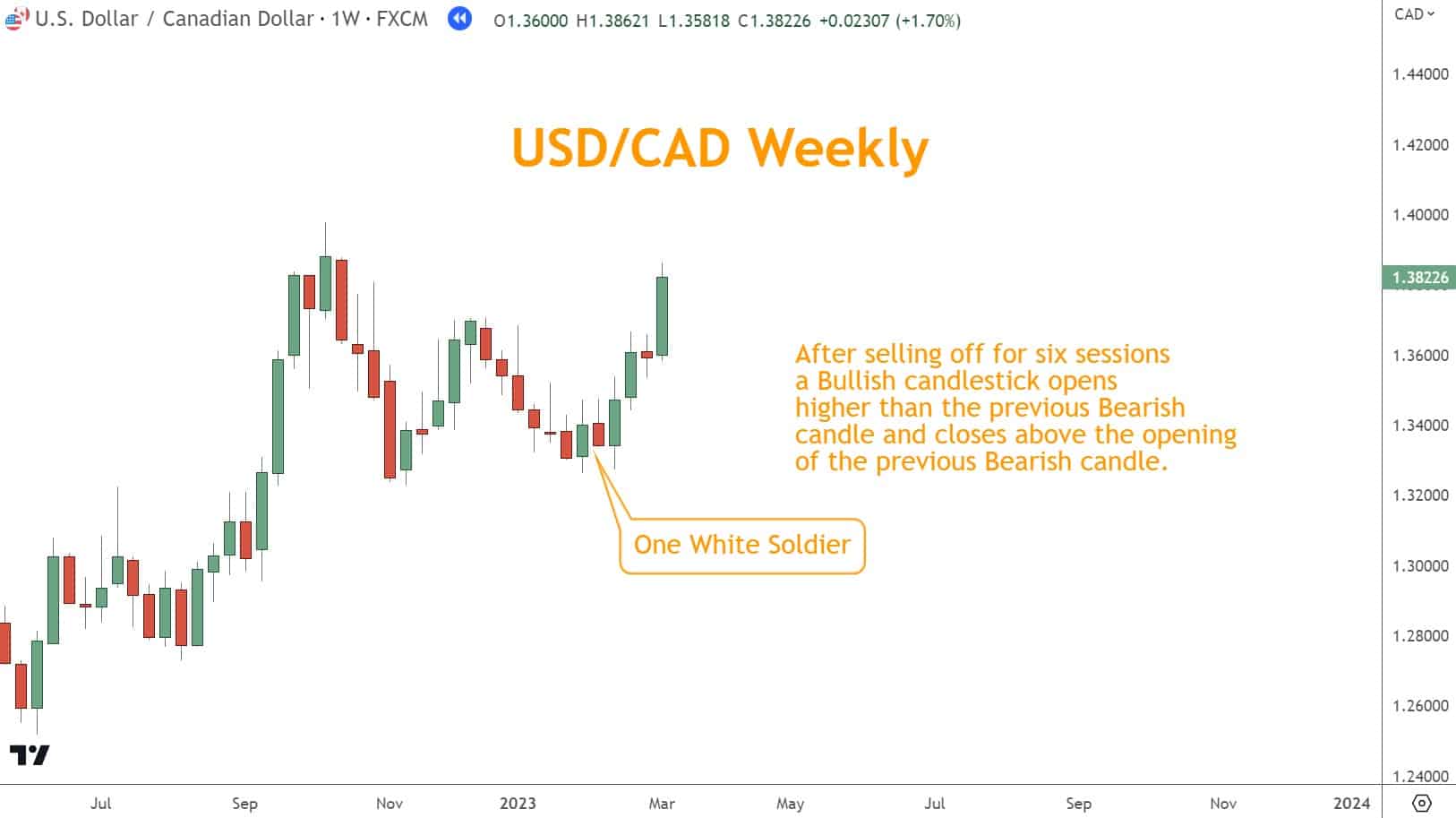

One White Soldier

One White Soldier is a powerful Bullish reversal pattern consisting of two candles that appear at the bottom of a downtrend.

The first candle has a long body and represents selling pressure. The second candle opens higher than the previous day’s closing price and Rallies to close above the last day’s closing price.

Which Bearish Candlestick Patterns Should You Focus On?

Bearish Candlestick Patterns are potent tools in used to identify potential reversals at the end of a Rally.

These patterns reflect the trader’s psychology in their formation. A few bearish reversal patterns include Bearish Engulfing, Bearish Harami, Dark Cloud Cover, and One Black Crow.

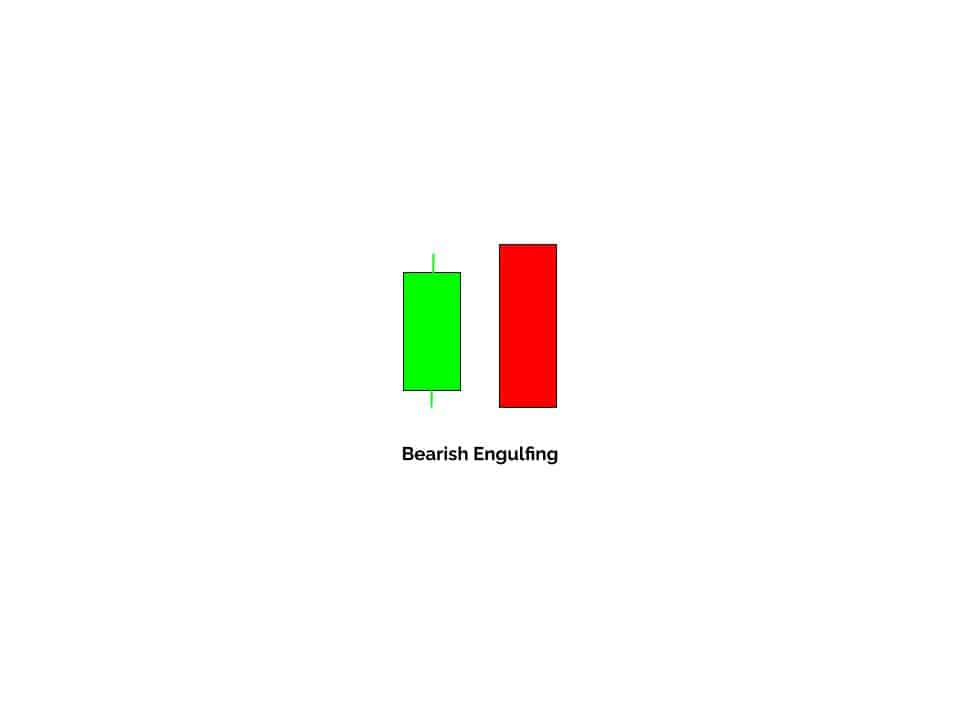

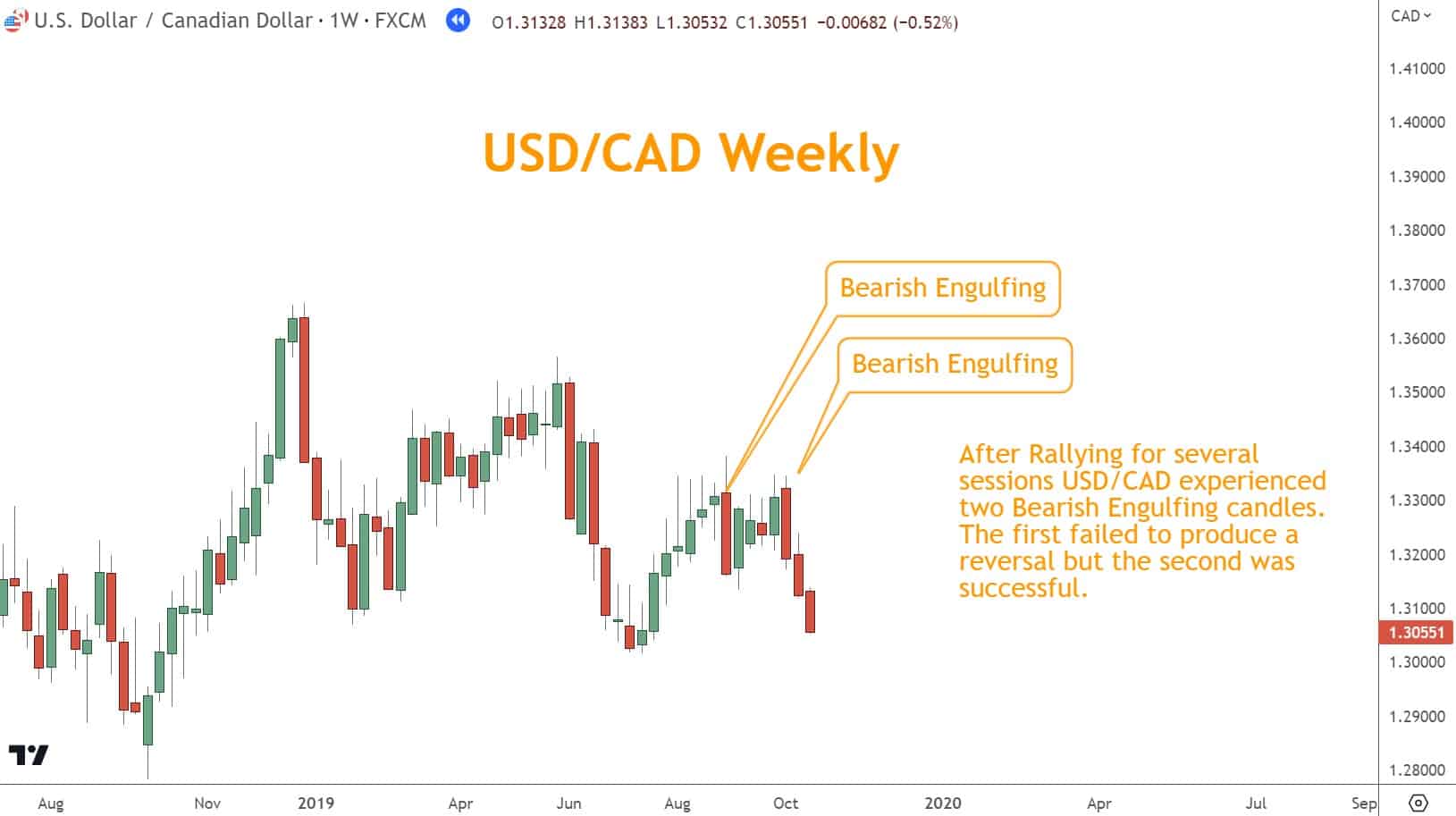

Bearish Engulfing

The Bearish Engulfing pattern is a two-candlestick reversal pattern you can use to signal the end of an uptrend.

A small Bullish candle is at the end of a Rally, followed by a sizeable Bearish candlestick engulfing the last green candle.

This price action implies selling pressure has taken over, and prices could fall.

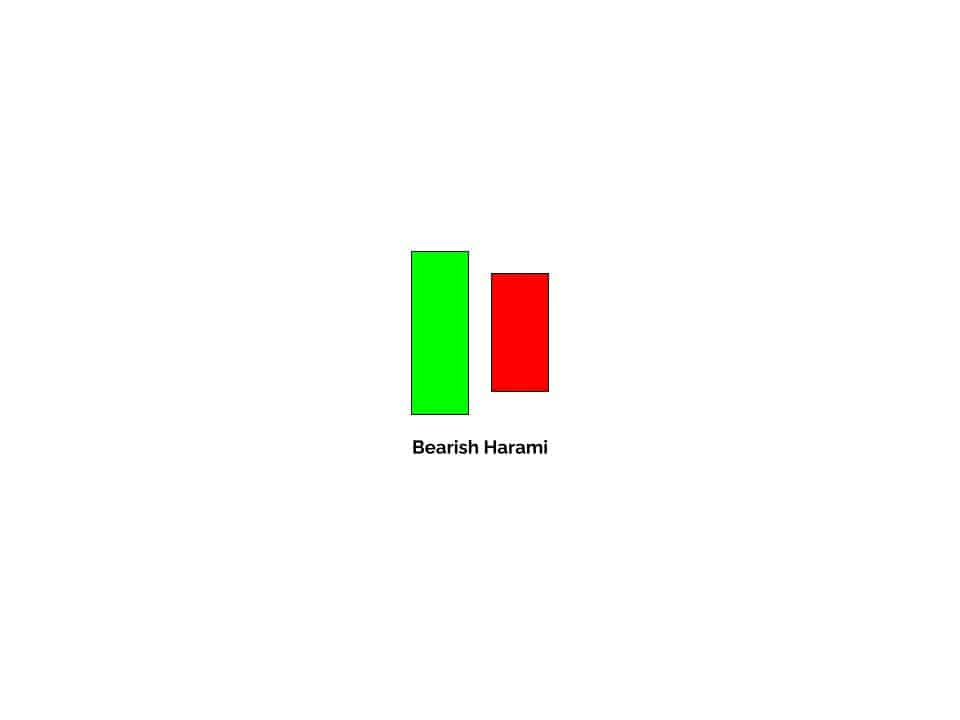

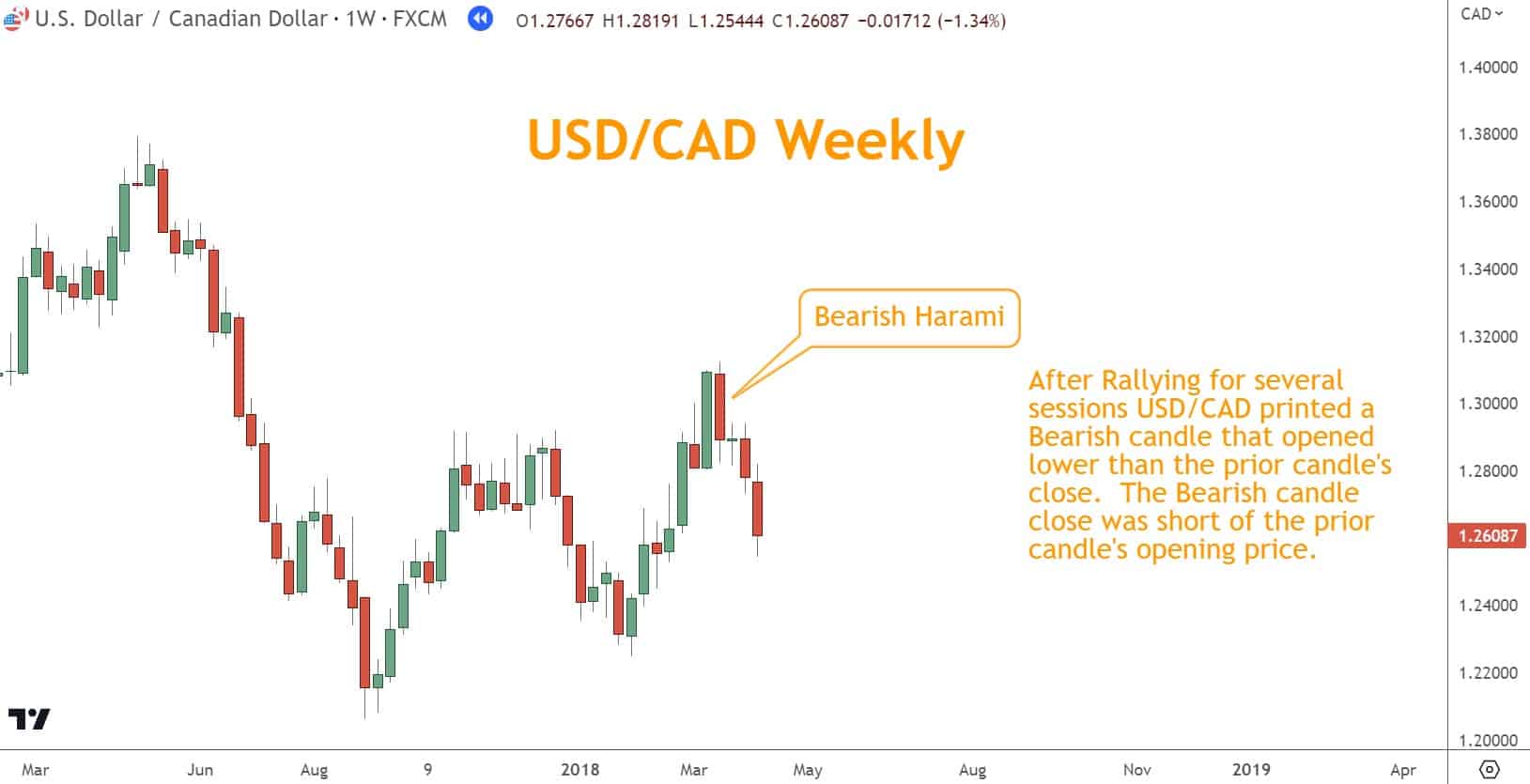

Bearish Harami

The Bearish Harami is a useful two-candlestick pattern to help you identify potential reversals.

This candlestick pattern occurs when the first candlestick is larger and Bullish versus the second smaller Bearish counterpart.

A Bearish Harami indicates buying has slowed down, and prices may start to decline.

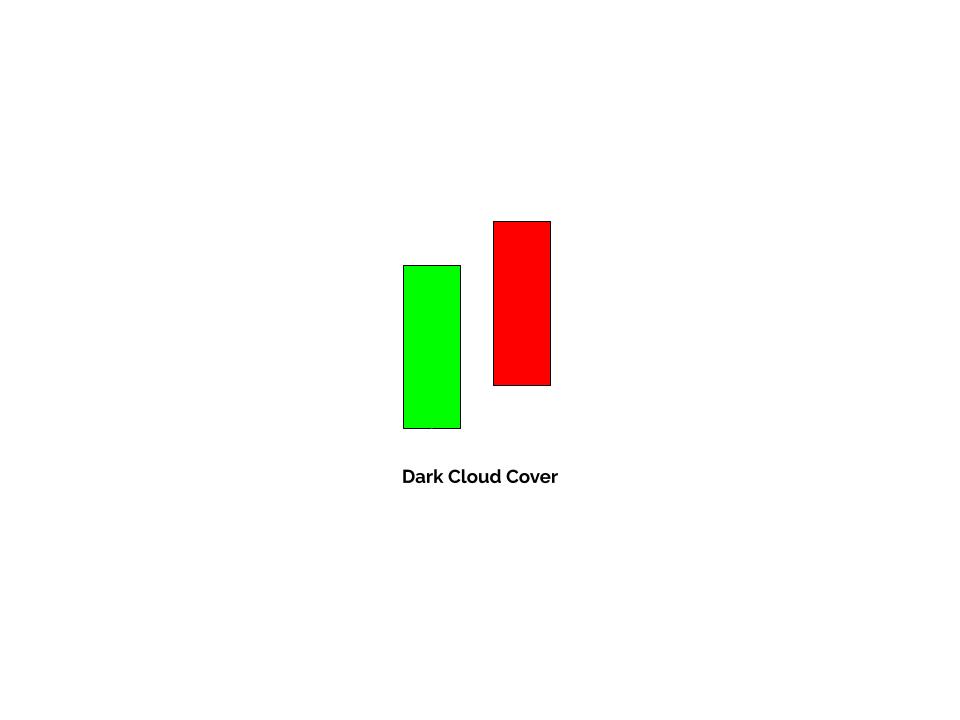

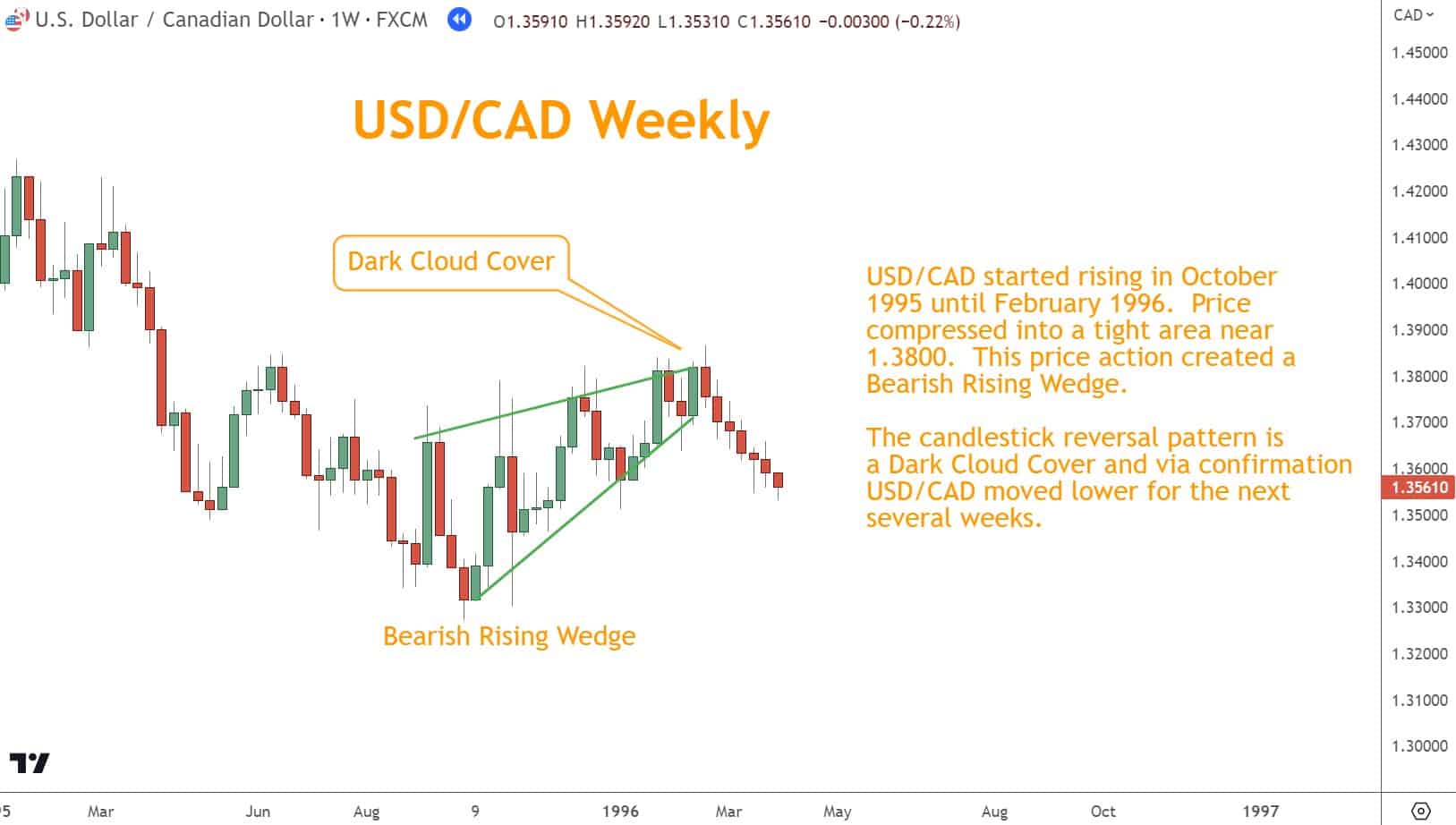

Dark Cloud Cover

The Dark Cloud Cover pattern is a Bearish reversal pattern found in Japanese candlestick patterns.

The pattern forms with two candles, where the first is bullish and the second is bearish.

The opening price of the second candlestick must be above the high of the previous day’s bullish candle while closing below its midpoint.

This indicates a sentiment change in the market, with buyers losing control over sellers who might dominate trading activities soon.

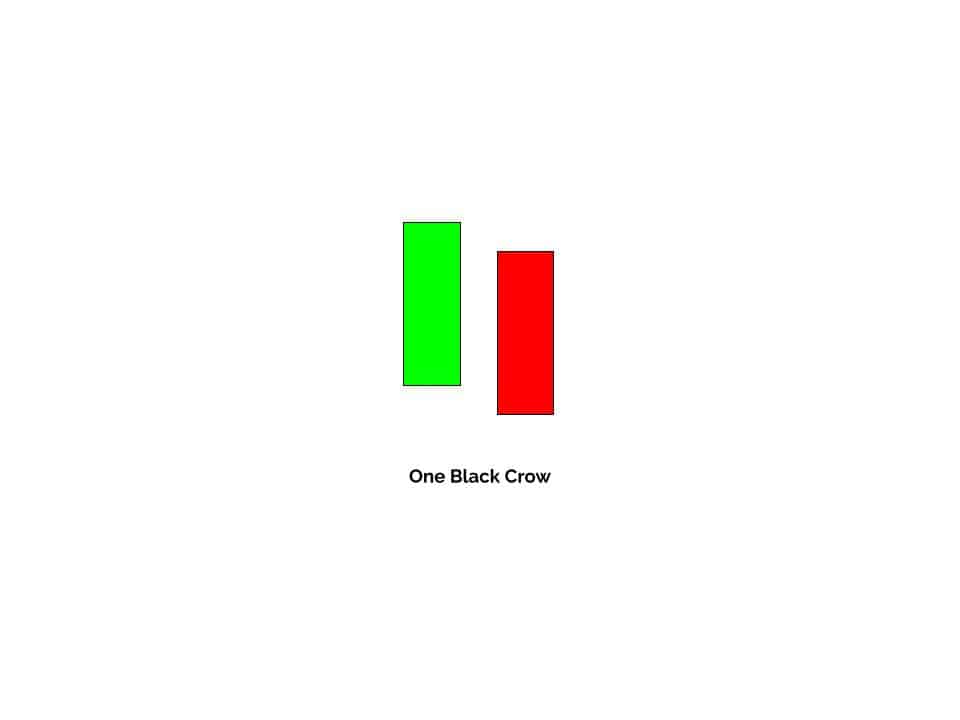

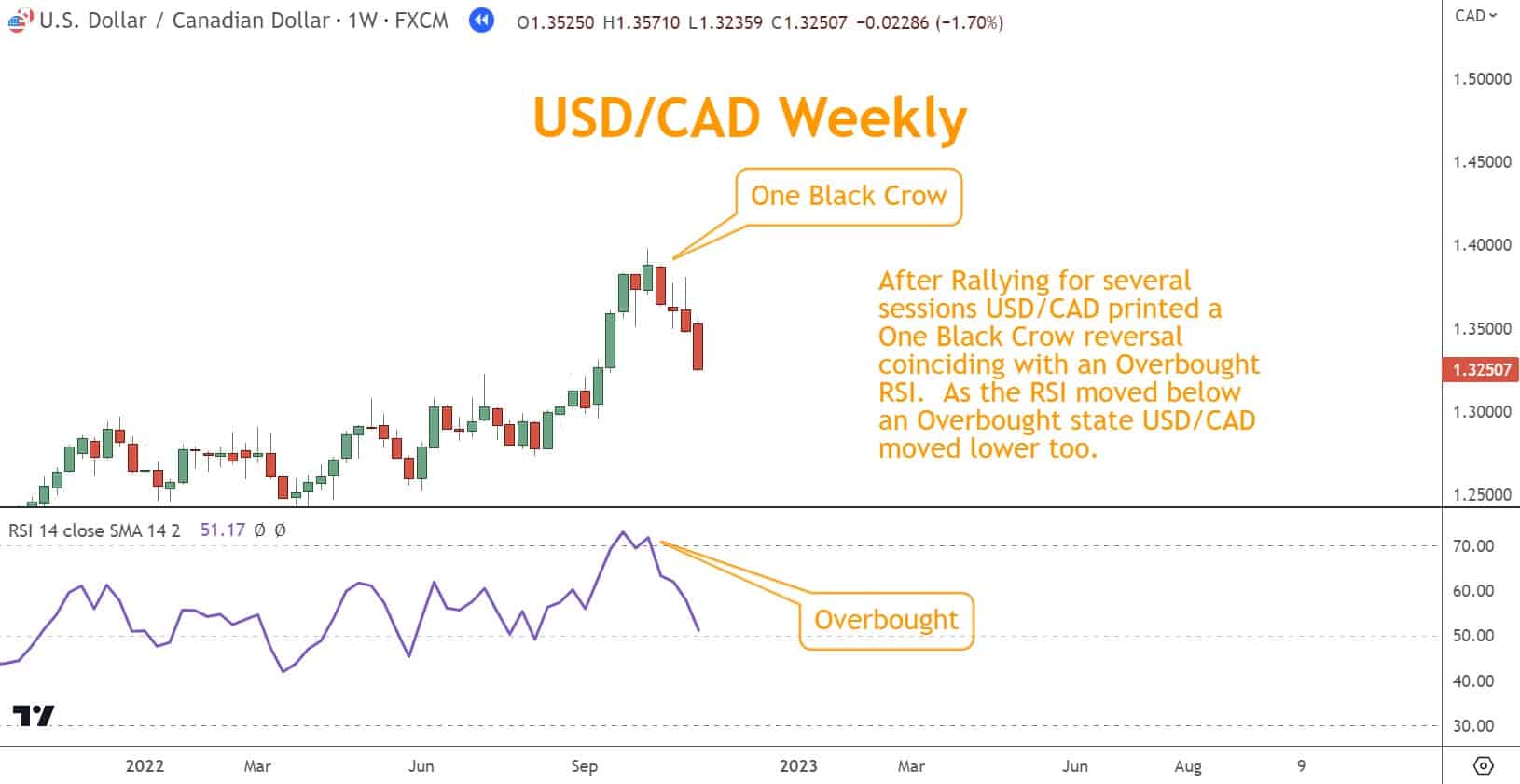

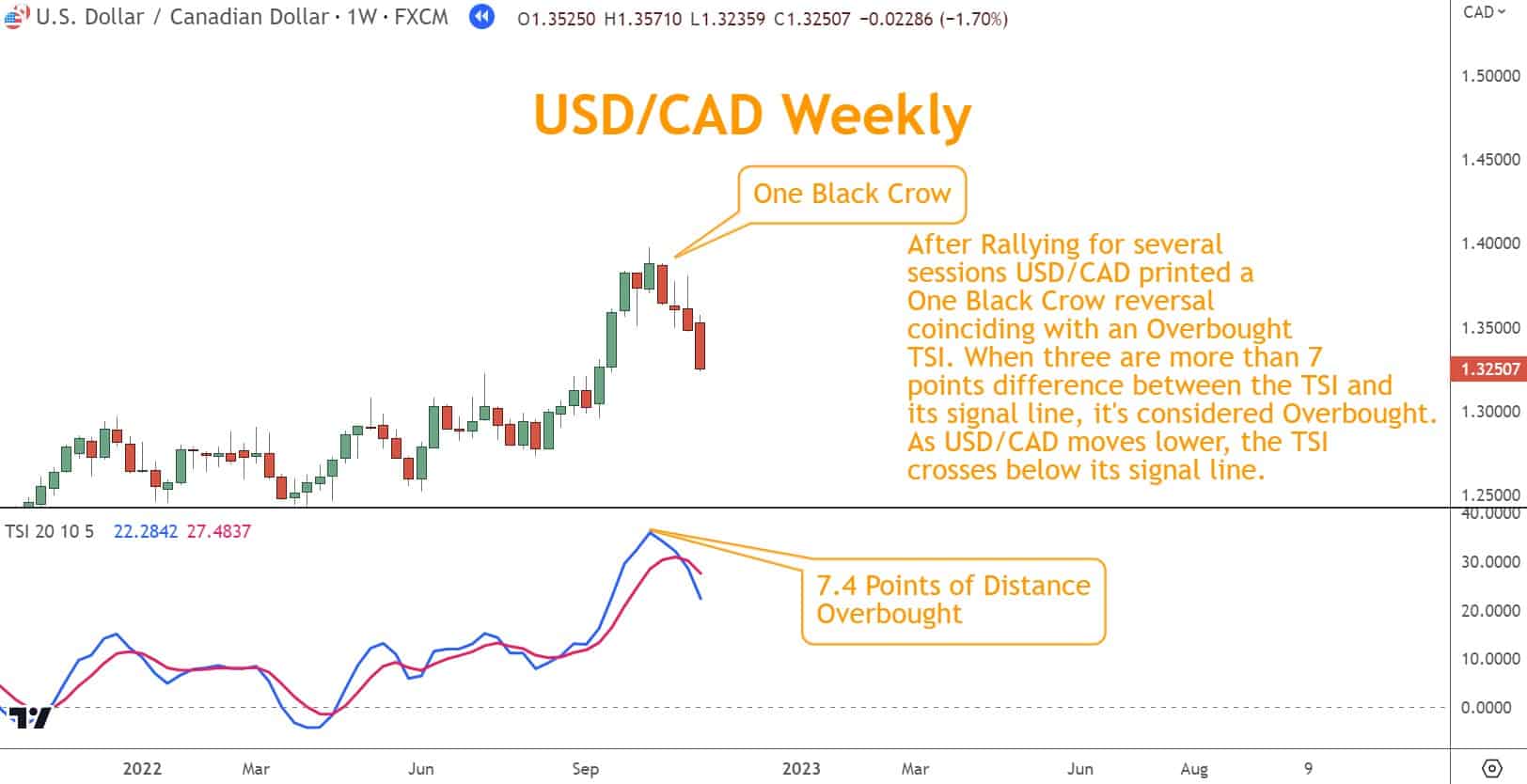

One Black Crow

The One Black Crow is a two-candlestick pattern that shows a potential reversal in an uptrend.

The first candlestick is a Bullish Candle, followed by a long Bearish Candle with a lower open and close.

This pattern suggests that the buyers are losing their control as selling pressure increases, indicating the possibility of a price decline.

How Does Candlestick Pattern Trading Strategy Work?

Two-candle Japanese candlestick patterns can reveal valuable information about potential reversals in the market.

Explore how applying these candlestick patterns supports smarter trading decisions.

Look for confirmation signals from other tools and techniques to improve the likelihood that your candlestick analysis is correct.

What Complementary Signals are Helpful?

Complementary signals like Momentum, Chart Patterns, and horizontal Support and Resistance can help confirm your strategy with candlestick patterns.

Avoid relying solely on one indicator, and learn to integrate multiple signals to improve your trading.

Leverage Momentum Indicators such as RSI and TSI

To confirm the reversals in two candle Japanese Candlestick patterns, we can utilize Momentum indicators such as RSI and TSI.

These indicators work well with Candlestick Patterns to provide a more detailed market insight.

The RSI, or Relative Strength Index, is a commonly used Momentum indicator that can identify changes in Momentum and Overbought Oversold conditions.

Meanwhile, the TSI or True Strength Index is another momentum indicator identifying the energy in an instrument’s price action.

When used with two-candle Japanese Candlestick patterns, these indicators can give you a more accurate reading of market trends and potential reversals.

Chart Patterns like Rising Wedge and Double Bottom Work Superbly

Using complementary signals like Chart Patterns in conjunction with Candlestick Patterns can improve the accuracy of your Forex trading.

The Rising Wedge portrays a Bearish market sentiment forming during a Rally, while a Double Bottom suggests a Bullish reversal at the bottom of a Selloff.

You can Depend on Horizontal Support and Resistance

Additional confirmation of the accuracy of a candlestick pattern can be obtained by analyzing horizontal Support and Resistance levels.

If a candlestick pattern forms at or near such levels, it may suggest a potential solid reversal and confirm its validity.

Using this methodology provides valuable insights into market trends for traders who want to stay ahead.

Common Mistakes Made by Traders in Using Candlestick Patterns

Many traders using two-candle Japanese candlestick patterns make common errors that can be avoided.

A significant mistake is focusing solely on the patterns without considering other indicators or market activity. It is also critical not to misinterpret the pattern by using it outside of its intended context.

Lastly, implementing proper risk management techniques using these patterns. Taking these precautions can help improve forex trading results.

What’s the Next Step?

Using what you’ve learned, select a favorite candlestick chart, and look for two candle Japanese Candle Patterns.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining with Momentum, Chart Patterns, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about two candle Japanese Chart Patterns.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies?

- I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics you will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

How Can Complementary Signals Enhance the Accuracy of Candlestick Patterns?

Incorporating complementary signals can boost the reliability of candlestick pattern analysis by confirming potential reversals and offering insight into trade entry and exit points.

Examples of helpful complementary signals include Momentum indicators, Chart Patterns, and horizontal Support and Resistance levels.

Are There Any Risks to Relying Solely on Candlestick Patterns in Trading?

While Candlestick Patterns can be helpful in trading, relying solely on it may be risky as it may not consider all market factors.

It’s best to use Candlestick Patterns with other methods to confirm reversals and make informed decisions. Risk management planning is also crucial for successful trading.