Your trading will improve if you can draw accurate Support and Resistance lines on your candlestick charts.

These lines help identify price levels where buyers and sellers may enter or exit the market, making them a crucial part of any trading strategy.

This article explores why accurate Support and Resistance lines matter and common mistakes traders make when drawing them.

We’ll also provide step-by-step guidance on accurately drawing lines on your candlestick charts to help improve your trading.

Why Accurate Support and Resistance Matters

If you can’t identify where buyers and sellers are considering trading a Forex pair, you will struggle to find good trading opportunities, set proper stops, and identify worthwhile targets.

Learning to draw with precision (horizontal or channel) helps you find opportunities and trade with precise risk management. These lines also help you avoid trading false breakouts.

Drawing accurate lines on a candlestick chart using price action, you can identify critical levels to place stop-losses to limit risk and avoid false breakouts and signals.

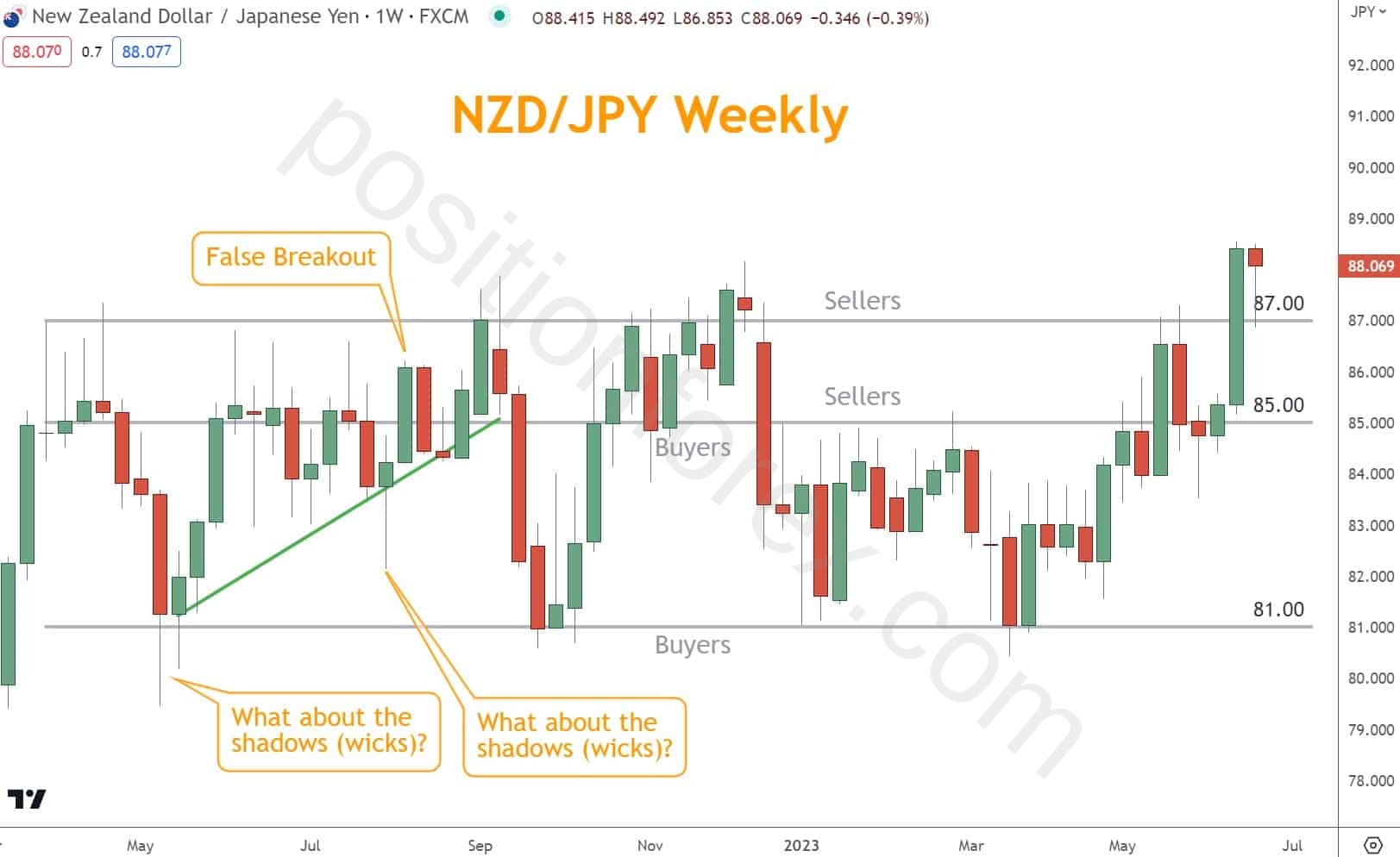

In the example below, NZDJPY finds buyers and sellers at repeated levels over time. Buyers step in at 81.00, sellers at 87.00, and both near 85.00, depending on other factors.

Common Mistakes Forex Traders Make in Drawing Support and Resistance Lines

Drawing too many lines or failing to adjust them as market conditions change can create confusion.

It’s also important not to rely solely on shadows (also known as wicks) or opening or closing prices when drawing—discretion is vital.

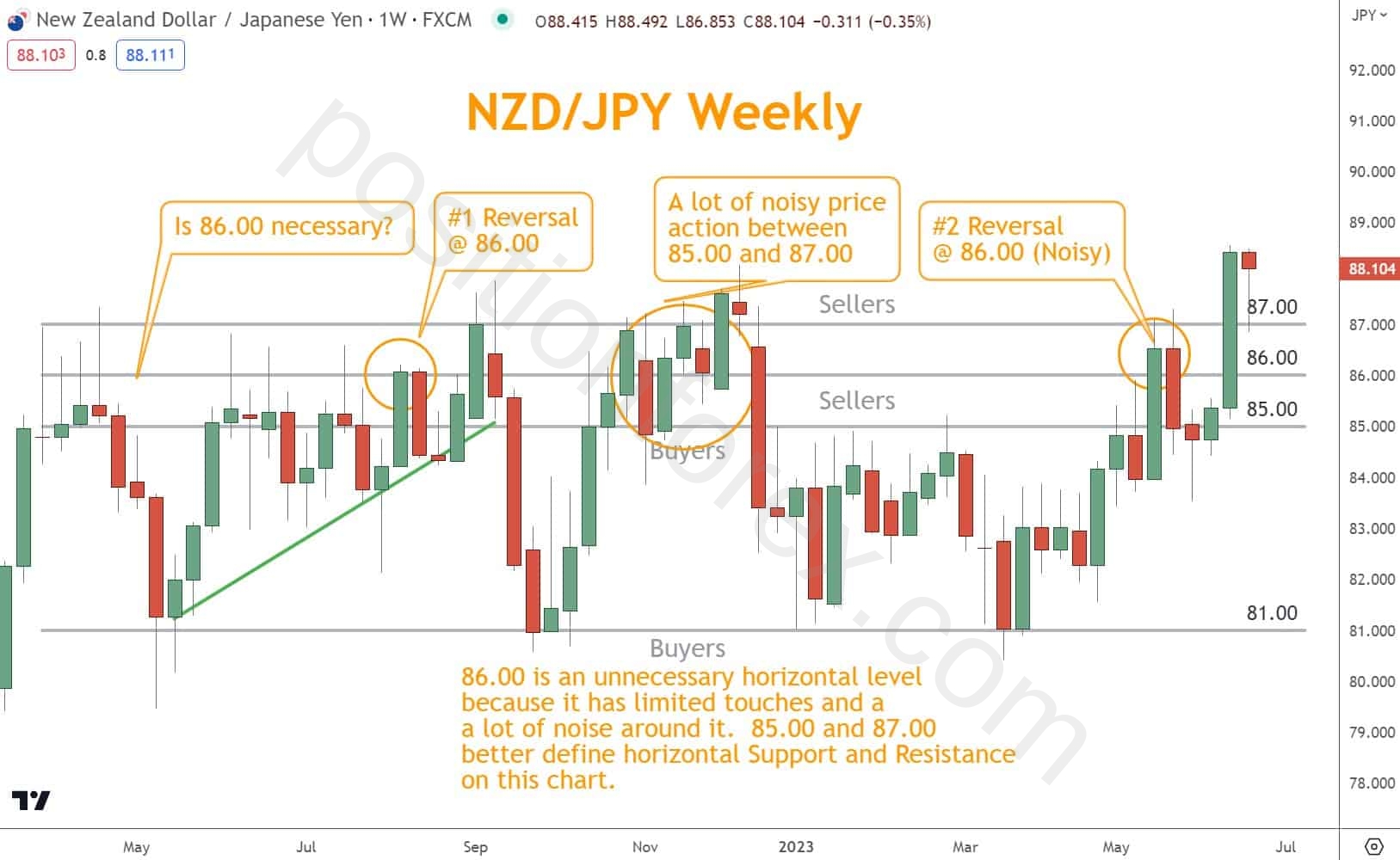

As you can see in the chart below, adding the 86.00 Support and Resistance level adds more confusion than clarity. There is a fair amount of congestion near this price level and only one clean reversal.

If a candle has exceptionally long shadows, perhaps you should ignore them. If you are trying to draw channel lines, look for candles with significant bodies.

Small-body candles such as Dojis and Spinning Tops are often poor places to start a channel or horizontal line because traders demonstrate little conviction.

The result is often a false breakout because few traders are behind that candle’s wick.

In the example below, a Spinning Top failed to confirm a breakout, and instead, prices fell back from an earlier established resistance level.

Another common mistake is ignoring past price action. If prices served as a previous Support level or previous Resistance in the same area multiple times, that key level should be given more credence than a single touch.

Don’t ignore significant levels frequently visited by price, especially historical extremes.

Unfortunately, drawing Support and Resistance isn’t an exact science, but it’s still essential to successful forex trading.

How to Draw Accurate Support and Resistance on Candlestick Charts

How do you select the ideal spots to set your lines?

There are several aspects to consider:

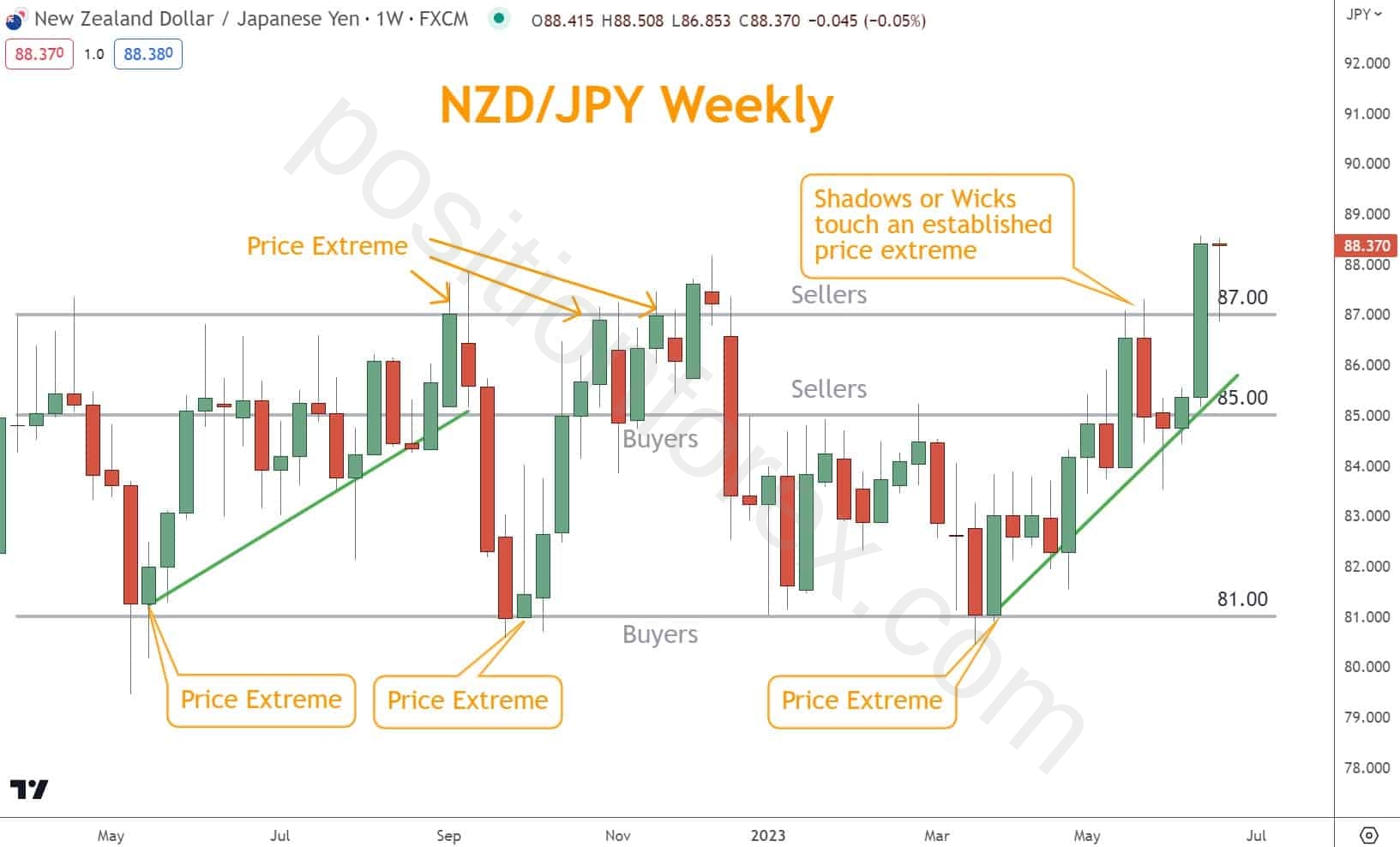

- You should identify significant pause areas where prices have historically stopped and reversed.

- This is especially true for extreme areas.

- In this example, NZDJPY prices reverse at the 87.00 level repeatedly.

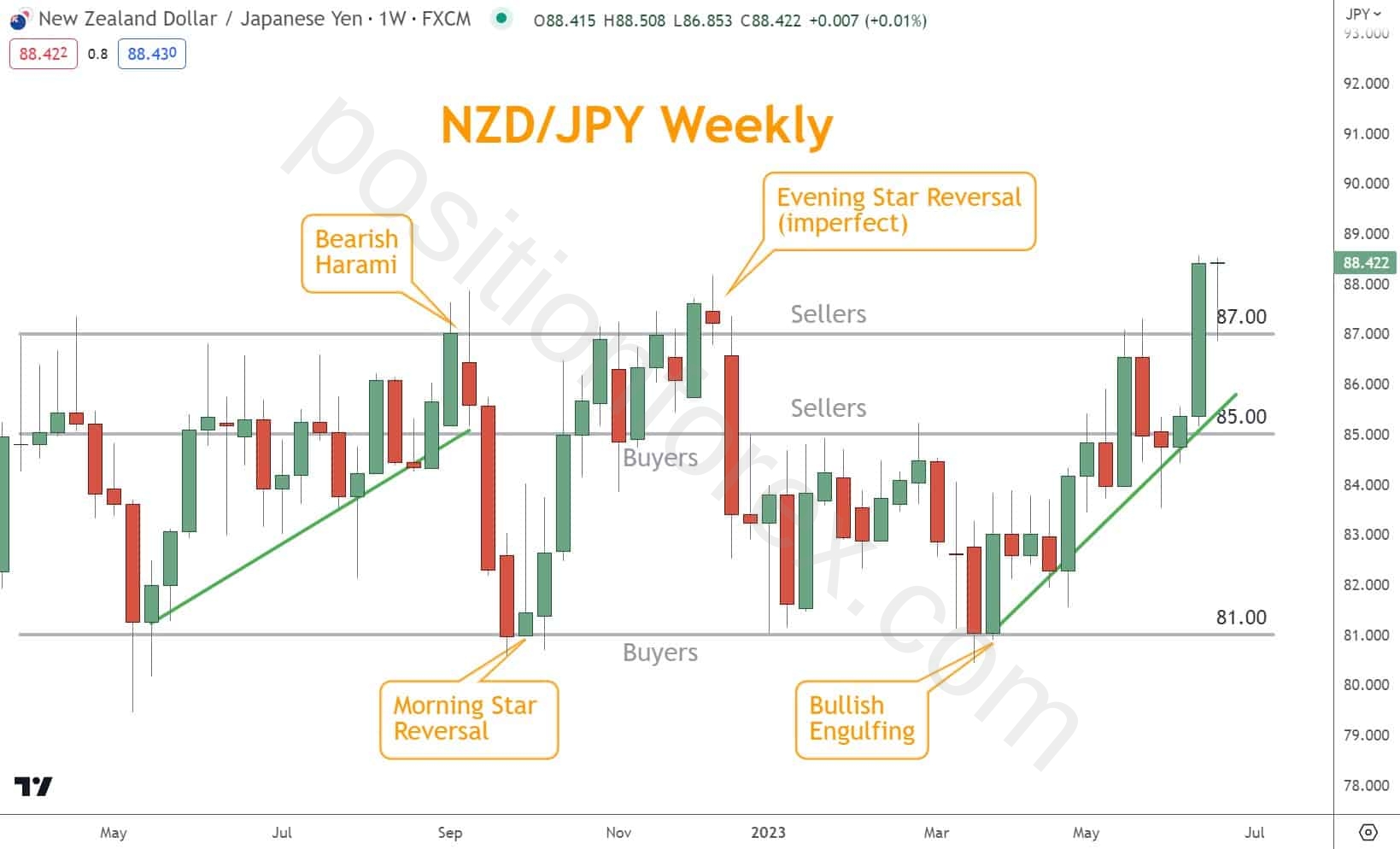

- Candlestick charts provide reversals, signifying essential levels.

- Use these reversals to confirm other techniques.

- The chart below illustrates how Japanese Candlestick reversal patterns coincide with support and resistance levels to provide confirmation.

- Drawing channel or horizontal lines through swing highs or swing lows can also help you map out a potential Support and Resistance level.

- The chart below labels swing highs and lows to help confirm the support or resistance level.

The three support and resistance confirmation methods:

What’s the Next Step?

Select a favorite candlestick chart and look for Support and Resistance zones using what you’ve learned.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining Japanese Candlestick Patterns, Momentum, and Chart Patterns can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate into what you’ve learned about support and resistance.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Why is it Essential to Draw Accurate Support and Resistance Lines?

Drawing precise Support and Resistance lines is crucial in technical analysis, as it can pinpoint potential price levels at which traders may enter or exit the market.

Incorrectly drawn lines can lead to poor trading decisions, but accurate ones can help set appropriate stop loss and take profit levels.

What Timeframe Should You Draw Support and Resistance Lines?

In theory, Support and Resistance lines should work in any time frame. The reality is very different, however.

Short time frames can produce price areas worthy of Support and Resistance. But very few traders are behind that price action, meaning any price pattern is fragile at best and simply trading noise at worst.

Use higher time frames like daily and weekly charts to find a meaningful Support and Resistance level.