One crucial aspect you must understand is the risk-reward ratio of any trade you’re considering opening.

In this article, we will delve deep into the concept of the risk-reward ratio in Forex and explore its significance in managing risk and maximizing profits.

We will discuss the role of risk management and how to calculate the risk-reward ratio effectively. Using a case study, we will illustrate how to apply these concepts to an opportunity.

Additionally, we will highlight the importance of positive expectancy and how negative transactions can impact your overall performance.

Finally, we will reveal three crucial rules for optimizing your risk-reward ratio and share tips for maximizing your potential.

Exploring the Concept of Risk-Reward Ratio in Forex

The risk-reward ratio balances potential risk and reward. You can effectively manage potential losses and maximize profits by understanding and setting realistic risk-reward ratios.

By calculating, you can determine if an opportunity is worth pursuing or if the potential risks outweigh the rewards. It allows you to make informed decisions and manage your transactions effectively.

To calculate the risk-reward ratio, you need to assess the potential reward of a trade compared to the potential risk. In other words, you should identify how much you could make if the price moves in your favor and how much you will lose if it doesn’t.

Adjusting based on market conditions is crucial because different environments may require different risk levels.

The Role of Risk Management in Forex

The risk-reward ratio is determined by dividing potential profit by possible loss.

A favorable scenario is typically considered to be 1:2 or higher, meaning that the potential gain is at least twice the possible loss.

A good risk-reward ratio can minimize damage and maximize gains over time.

Before entering a trade, you must set strict stop-loss and take-profit levels based on your desired risk-reward ratio.

How to Calculate the Risk-Reward Ratio in Forex?

To calculate the risk-reward ratio in Forex, divide the potential reward by the potential risk. For example, if your stop loss level is 50 and your target is 100, your ratio would be 1:2.

A favorable ratio ensures that potential profits outweigh potential losses.

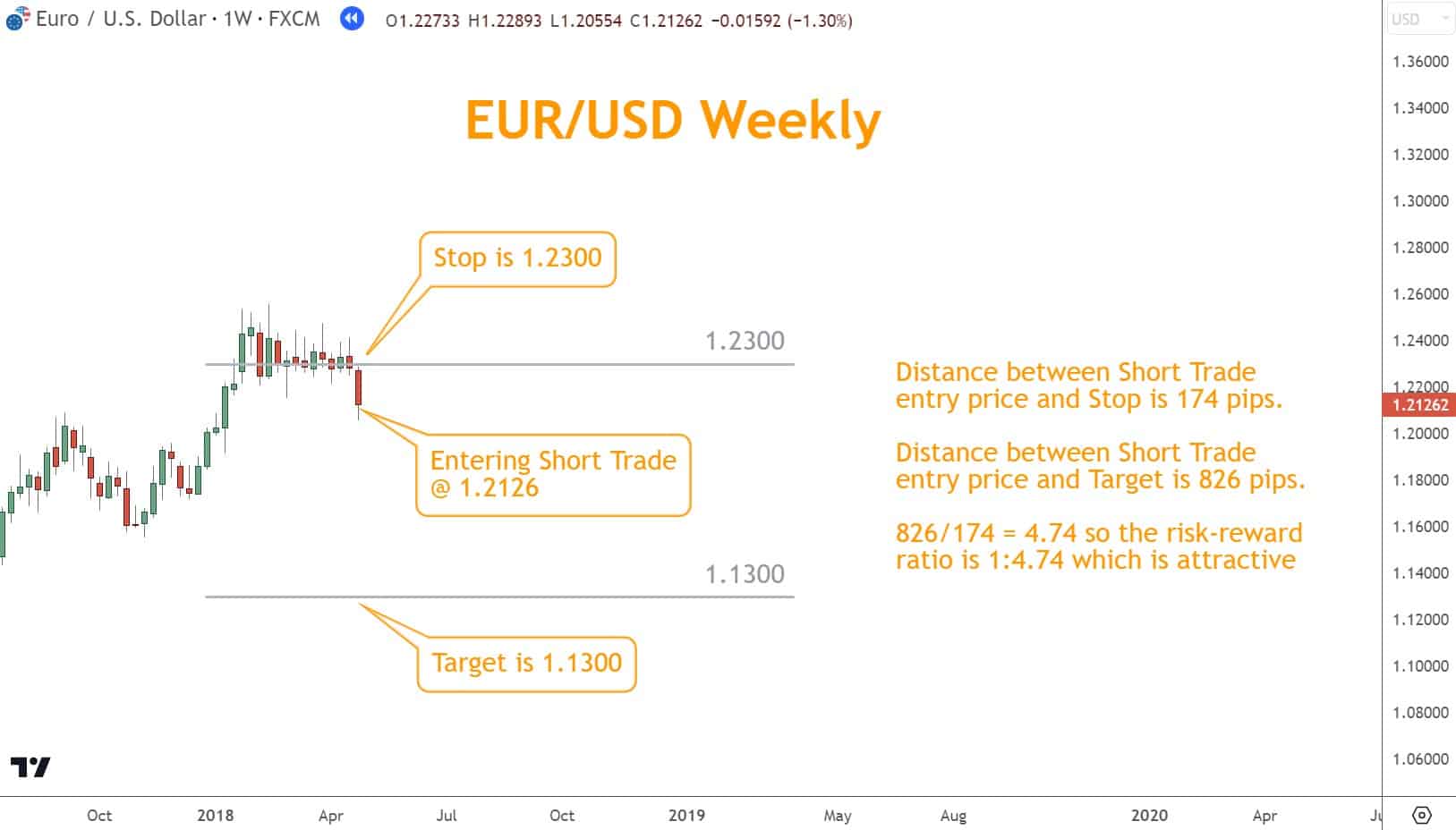

Case Study: Applying Risk-Reward Ratio on EUR/USD Trade

In this case study, we will examine the application of the risk-reward ratio involving the currency pair EUR/USD.

This fundamental concept in Forex allows traders to assess potential profitability and risk. It is calculated by dividing the potential gain by the possible loss.

For instance, if EUR/USD has a potential profit of 826 pips and a potential loss of 174 pips, the risk-reward ratio would be 1:4.74.

A higher risk-reward ratio indicates that the potential gain outweighs the possible loss, making the opportunity more favorable.

The Importance of Positive Expectancy in Forex

Positive expectancy is a crucial concept in the long term. It refers to the expected profitability of a strategy over time.

A positive expectancy means that, on average, your plan should make you money over time.

To calculate expectancy, you need to consider the win rate (the percentage of trades with a positive result) and the average risk-reward ratio.

Multiply the win rate by the average risk-reward ratio and subtract the losing rate multiplied by 1.

For example, if your win rate is 60% and your average risk-reward ratio is 1:3, your expectancy would be 1.4

This means that, on average, you can expect to make a profit of 0.40 for every dollar risked.

Positive expectancy is important because it indicates that your strategy has an edge and is likely to make money in the long run.

You can experiment with an Expectancy Calculator here: Forex Trade Expectancy Calculator.

How Losing Trades Impact Overall Performance

Losing transactions can have a significant impact on overall performance in Forex.

The reason is that making up for losses on a percentage basis requires outsize performance.

For example, if you lose 50% of your account, you must make a 100% return to break even.

Therefore, maintaining a favorable risk-reward ratio is crucial to mitigate the impact of adversity on your overall performance.

The Three Crucial Risk-Reward Rules in Forex

The Three Crucial Rules in Forex are to help you protect yourself and prevent you from ruination.

The story of a Forex trader talented at market analysis but blowing himself up because he couldn’t follow risk management rules is widespread.

If you follow these rules, this will go far in helping you succeed.

Rule 1: Understanding and Managing Stop Loss and Take Profit Orders

Stop loss and take profit orders are crucial in managing risk and potential rewards in Forex trading.

A stop-loss order limits potential damage by automatically closing a trade when it reaches a specific price level. You can use the broker’s software to automate the closure, but I recommend doing this manually.

As we encourage here, you’re opening and closing opportunities shortly after the market opens every week if you’re a position trader.

While open, an automated stop is an open invitation to be hunted down and closed on you for a loss, even though your analysis is correct.

By being responsible for closing a trade that’s violated your reason for opening it, you’re making yourself more responsible, disciplined, and in the long run, profitable by protecting yourself from having your stop “hunted.”

On the other hand, take-profit orders are employed to secure wins by automatically closing a trade when it reaches a predetermined target.

Setting appropriate stop loss and taking profit levels based on your approach is vital to effectively manage risk, with a minimum 1:2 ratio on every opportunity.

Rule 2: Significance of Position Sizing in Forex

Proper position sizing refers to the number of lots or units.

You can effectively manage risk and maximize potential gains by calculating your position size based on your account size, risk tolerance, and specific setup.

Want to learn all about position sizing?

I have a position sizing article here: Position Sizing for Forex – 18 Questions Traders Ask.

You must understand the significance of position sizing and incorporate it into your overall plan.

Rule 3: Finding the Optimal Risk-Reward Ratio for Your Strategy

Finding the optimal strategy is essential to successful Forex trading. The risk-reward ratio refers to the potential gain compared to the possible loss.

Rule 3 emphasizes the importance of striking the right balance. While a higher ratio allows smaller winners to offset larger losers, it’s crucial not to be overly aggressive and increase the likelihood of a significant loss.

To find the optimal risk-reward ratio, analyze your plans, risk tolerance, and current market conditions.

Consider factors such as volatility, price action, and expected returns. By carefully evaluating these elements, you can determine the level of risk you are willing to take on and set realistic targets.

A 1:2 risk-to-reward ratio should work well for you if you’re a position trader. Don’t open a transaction if you can’t reasonably find this in an opportunity.

Tips for Maximizing Your Profit Potential with the Risk-Reward Ratio

By setting realistic targets and stop-loss levels based on the risk-reward ratio, you can effectively manage your risk and increase your chances of growing over time.

Sticking to your plan and avoiding making impulsive adjustments to the risk-reward ratio is essential.

Additionally, using proper position sizing techniques ensures that potential winners outweigh potential losers.

Regularly reviewing and analyzing your performance allows you to identify patterns and improve your risk-reward ratio over time.

By implementing these tips, you can optimize your tactics and increase potential profitability in the forex market.

What’s the Next Step?

Select a favorite candlestick chart, look for opportunities, and, using your knowledge, calculate the risk-reward ratio of a potential opportunity.

Your knowledge of technical analysis should be what you use to find opportunities.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis which you can incorporate with what you’ve learned here about Support and Resistance.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and Advance Strategies? I produce Videos and Guides to help you learn and build a better trading practice.

- Links to New Articles

- I publish new articles on topics you will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

What is the best risk-reward ratio for Forex?

Finding the best risk-reward ratio in Forex depends on your plan and risk tolerance.

Commonly recommended is 1:2 or higher, aiming for double the amount you risk.

Some prefer a more conservative 1:1.5 or even 1:1, prioritizing capital preservation over high returns.

Ultimately, finding a balance that suits your style and leads to consistent profitability is vital.

Is a 2% risk good in Forex?

A 2% risk is a good practice in Forex trading. It helps manage and limit potential damage while also considering individual risk tolerance. Remember, protecting your capital is crucial to your future.