Head and Shoulders patterns will help you discover reversal opportunities you can use for profitable trades.

This article will cover the Head and Shoulders Pattern, how to identify it, and how to use it for Bearish reversals.

We’ll cover the three confirmation tactics you should use to improve your likelihood of a winning trade.

We will also review the Inverse Head and Shoulders Pattern, its identification process, and how it can be used for Bullish reversal pattern opportunities at a market top.

We will also discuss complementary indicators that can confirm your trading decisions for both patterns.

By the end of this post, you will have a solid understanding of these two key Chart Patterns that can help you trade reversals more confidently.

What is a Head and Shoulders Pattern?

The Head and Shoulders Pattern is a technical analysis chart pattern suggesting a possible trend reversal.

The pattern is found at the end of a Rally. It includes three peaks, with the center peak being higher and the other being lower.

The first peak is considered the “first shoulder,” followed by a spike labeled the “head,” and a second shoulder” completes the pattern.

The pattern “neckline” connects the lowest points of the shoulders. A break below or above the broken neckline after its formation confirms a Bearish or Bullish trend reversal, respectively.

How Can You Identify a Head and Shoulders Pattern in Forex

To spot an impending reversal with a Head and Shoulders Pattern, consider price action consisting of three distinct peaks.

The middle peak (i.e., the “head”) is higher than the other two (i.e., the “shoulders”) and a neckline connects the lows between both shoulders.

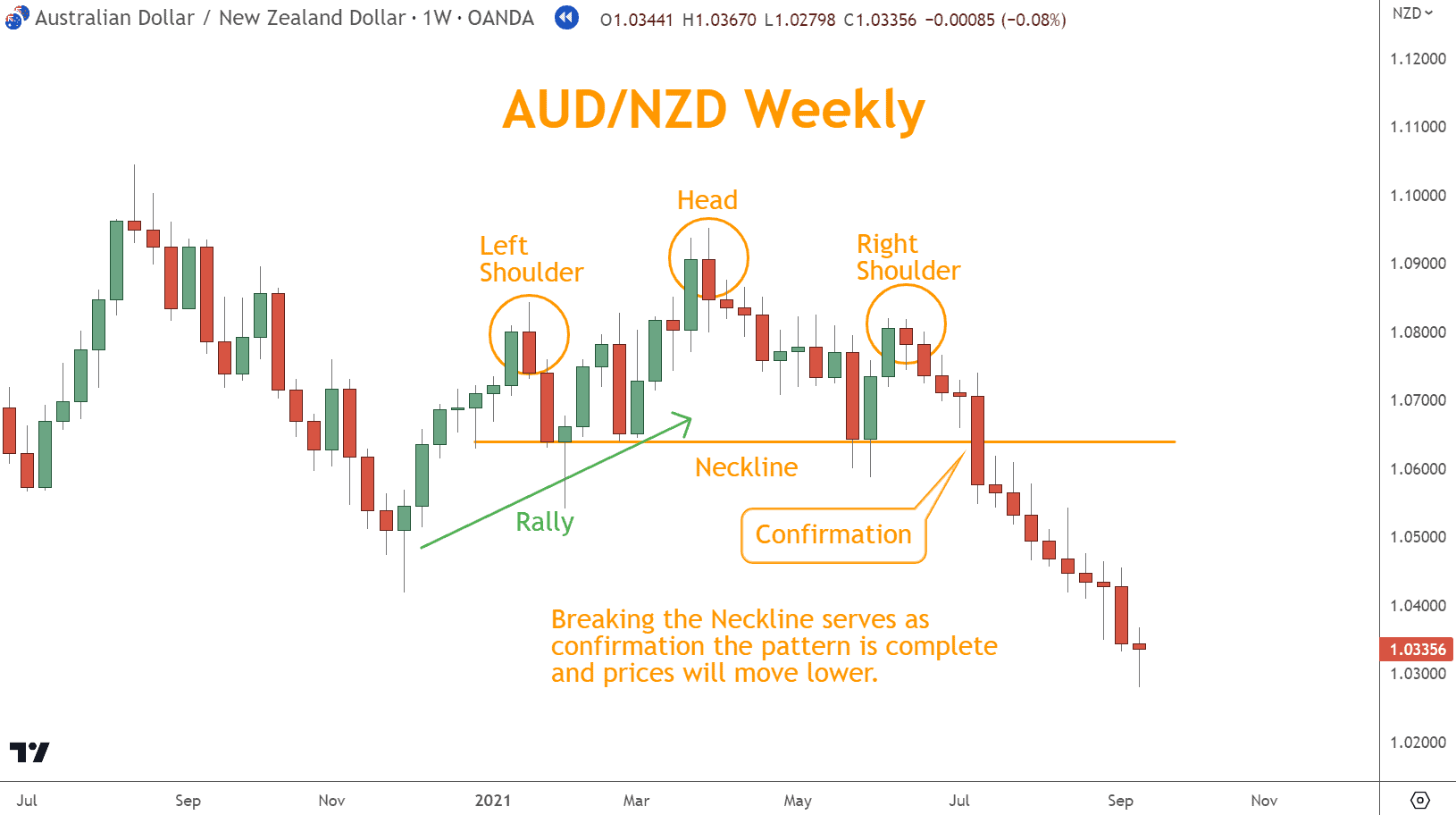

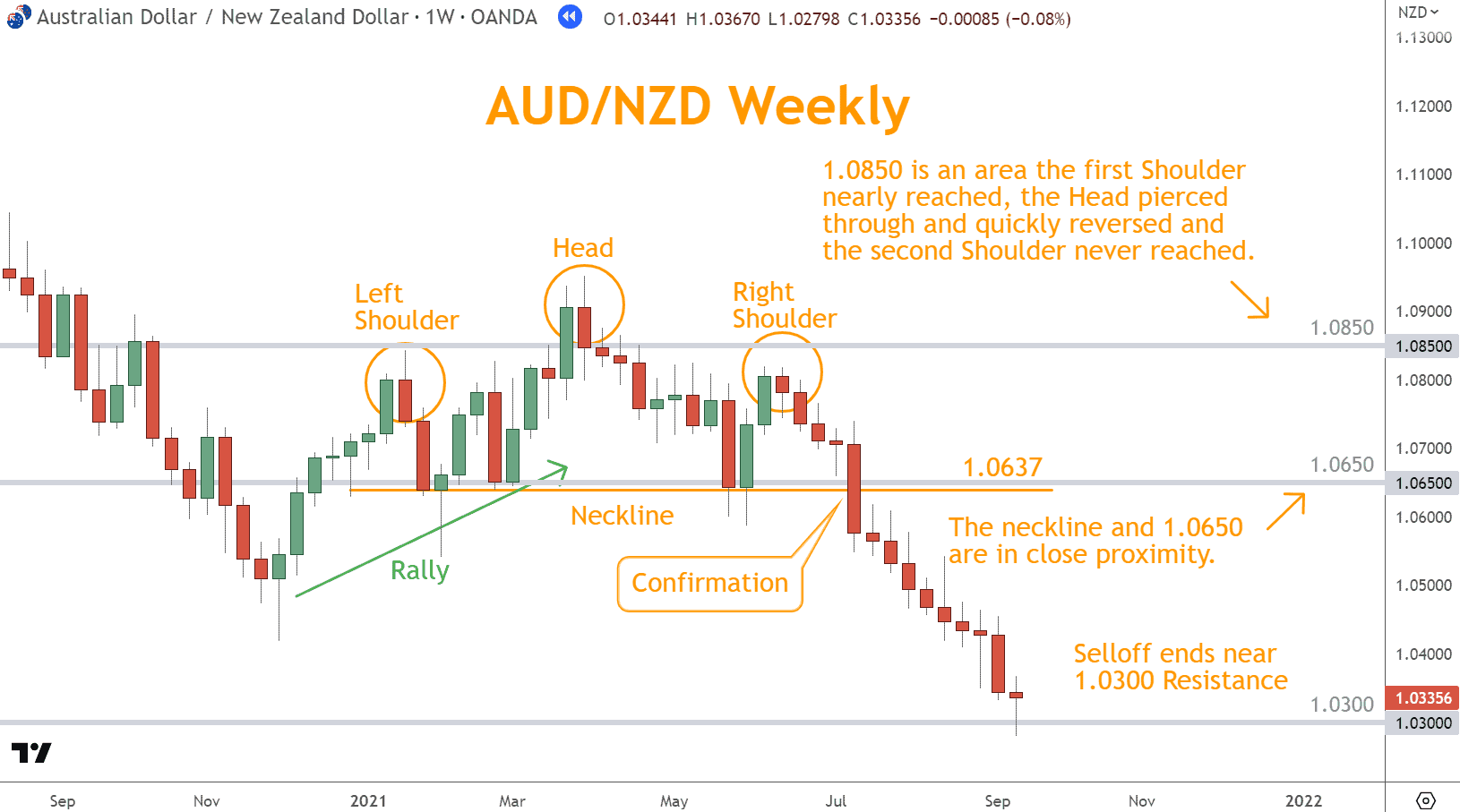

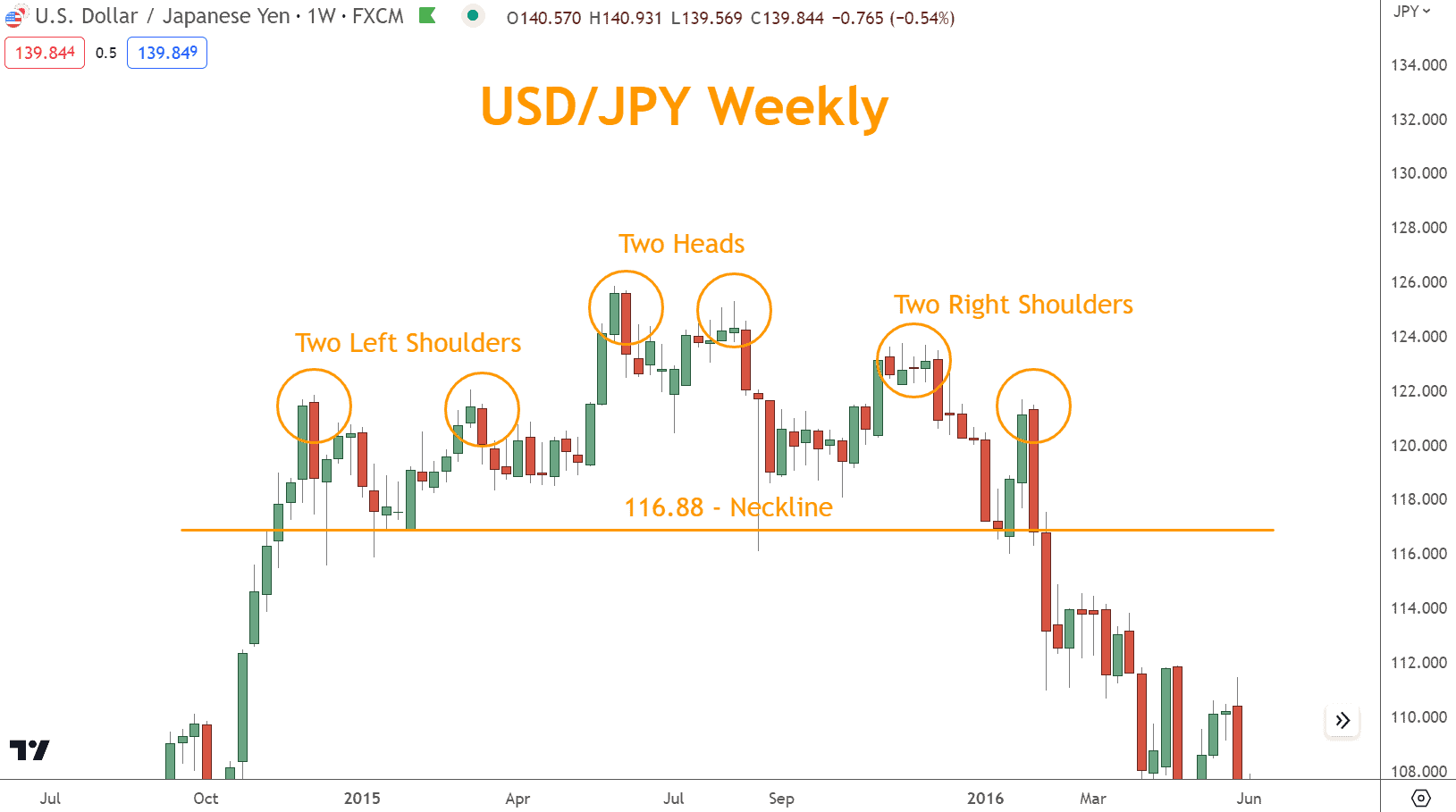

Look at the chart below for an example.

It’s All About Reversals (and Confirmation)

How do you confirm this pattern is complete, and a reversal lower is in motion?

After forming this pattern, a close below the neckline break confirms a Bearish reversal.

Waiting for a confirmed close below the neckline break before entering any trade is essential.

This is because false breakouts can occur, and you must ensure the validity of the pattern before making trading decisions.

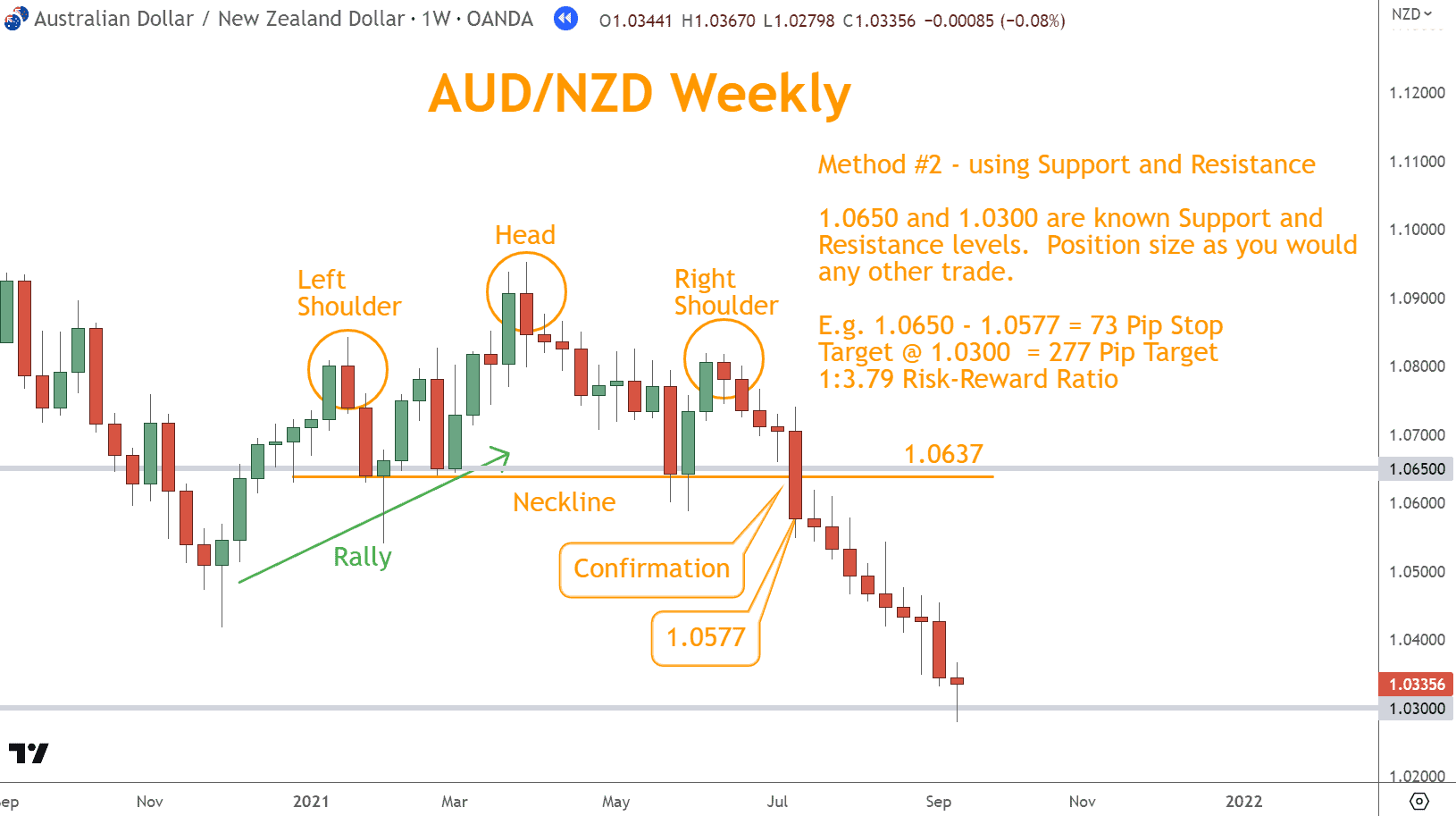

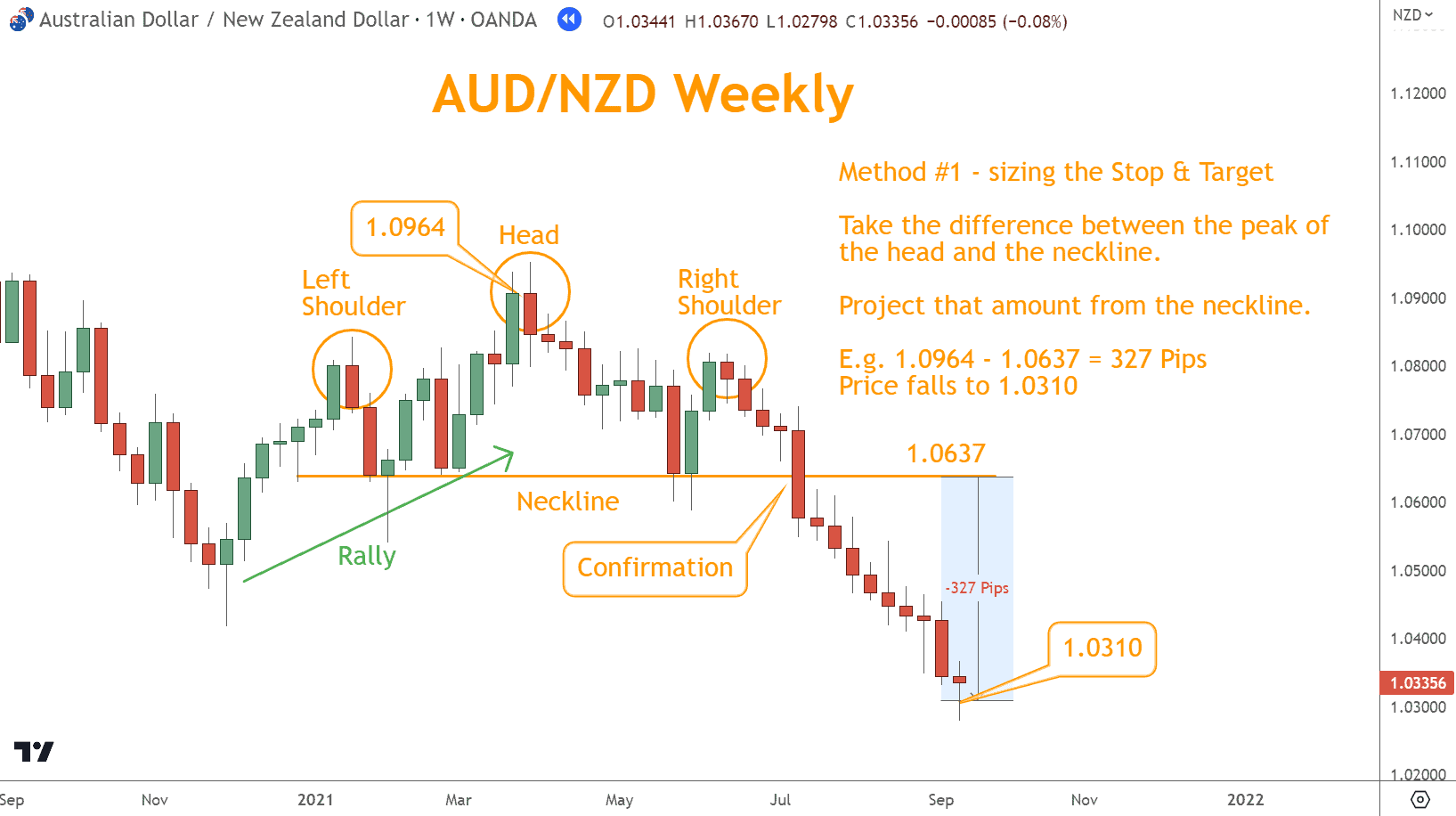

There are at Least Two Ways to Set a Stop and Target

When you trade with the Head and Shoulders pattern, multiple ways exist to select your stop-loss and target.

When choosing your stop placement, consider Support and Resistance levels; it should be above or below the right shoulder.

Calculate your profit target by measuring the distance between the head and neckline. Alternatively, other support and resistance levels can be used to determine a stop and target.

Before placing your trade, confirm that you accurately see a Head and Shoulders formation.

Use Your Complementary Indicators for Confirmation

The key to success with the Head and Shoulders pattern is confirmation.

After a neckline close, oscillators, Support and Resistance levels, and Japanese candlesticks are the best confirmation tools.

Oscillators like the Relative Strength Index (RSI) help identify overbought or oversold conditions to confirm a reversal.

Identifying critical Support and Resistance line levels confirms the formation of price charts’ Head and Shoulders.

The chart below shows that at 1.0850, the first shoulder nearly reached, the head pierced through and quickly reversed, and the second never reached.

The neckline and where the selloff ends are also near Support and Resistance levels.

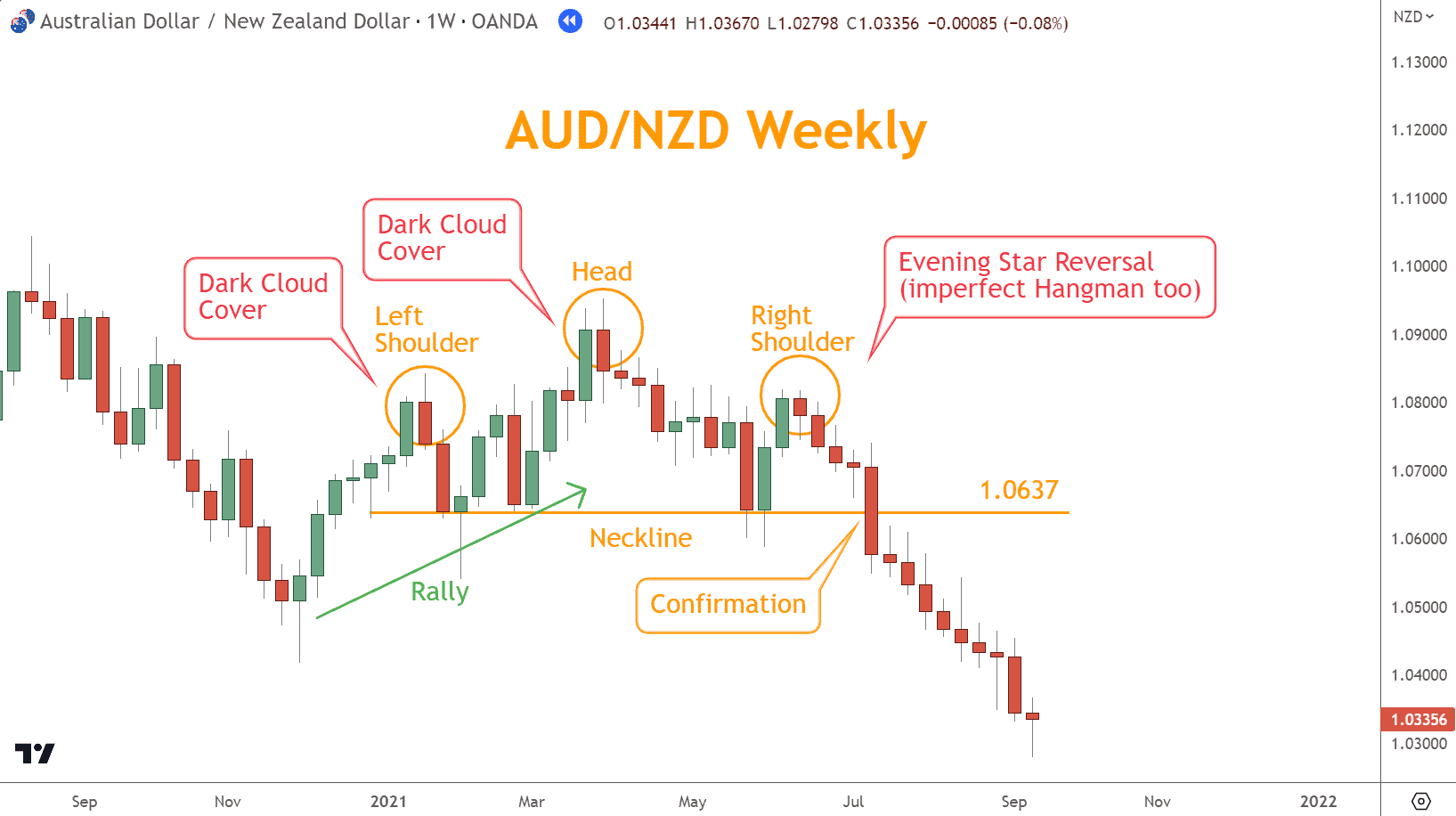

Different candlestick patterns, such as the Dark Cloud Cover or Evening Star, signify potential reversal opportunities for traders.

In the chart below, these reversal patterns appear on the head and both shoulders.

Combining a close through the neckline with other indicators and techniques can improve your likelihood of success.

Inverse Head and Shoulders: The Bullish Version

The Inverse Head and Shoulders Pattern is the Bullish version of the pattern discussed earlier and found at the end of a market bottom.

Similarly, the middle trough is the lower low, termed “head,” and the two other troughs on either side are called “shoulders.”

When the price closes above the neckline, open a long position on your forex pair, set a stop loss, and take profit target at prescribed levels.

Confirmation is critical before trading to avoid losses. Wait for a breakout above the neckline and use proper position sizing.

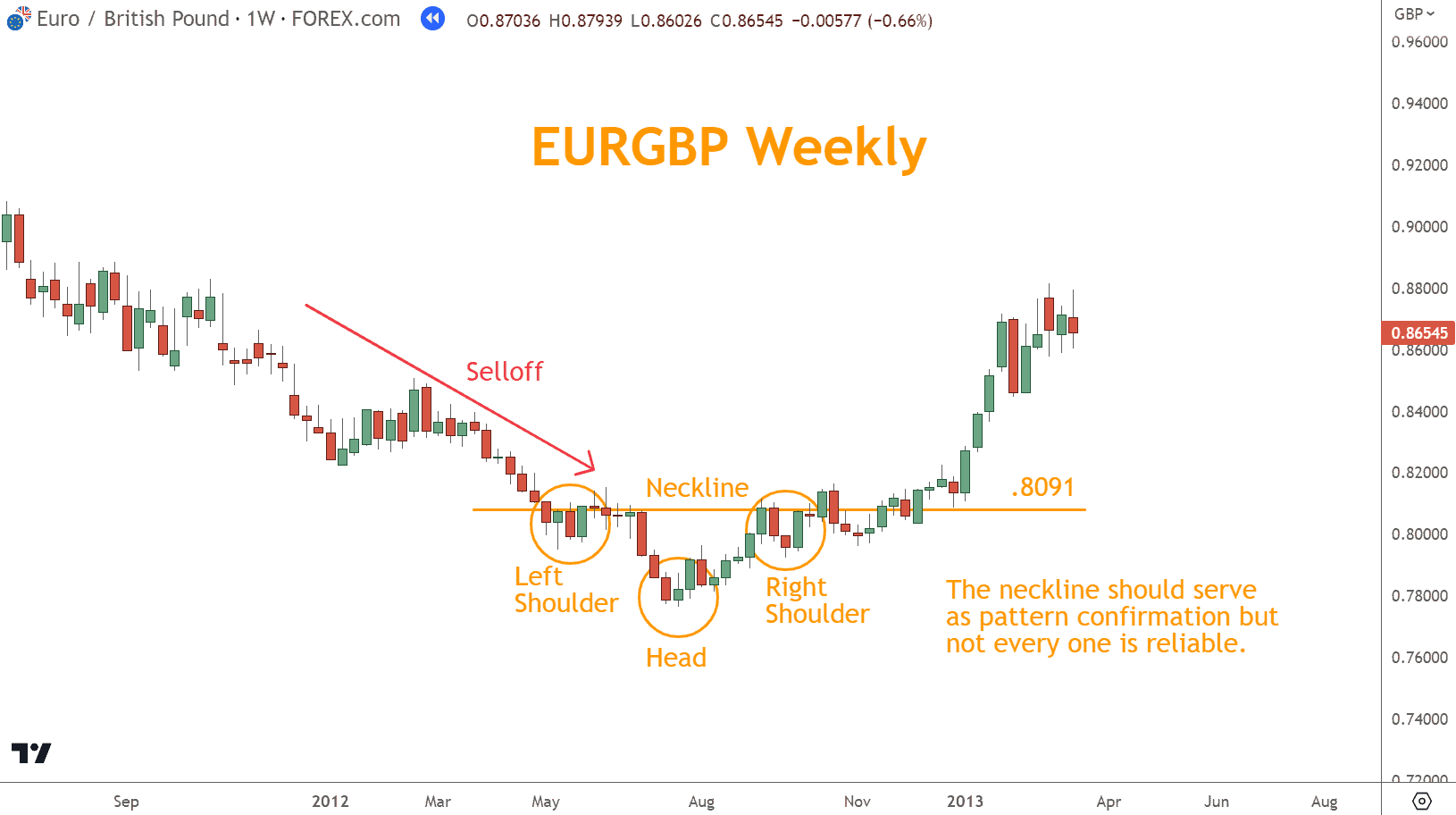

Look for a Selloff When Identifying Inverse Head and Shoulders Patterns

To identify an Inverse Head and Shoulder pattern (sometimes called an Inverted Head and Shoulders pattern) while trading in Forex, look for a Selloff followed by a price retracement forming the left Shoulder.

Once prices rise to form the first peak (left shoulders bottom), it then drops again, starting at a new low (the Head) before rising once more to start the second peak (right shoulders bottom).

The neckline is drawn by connecting the highs of each shoulder formation.

Traders must wait to confirm the pattern after seeing the breakout price close above this level.

Finding Bullish Reversal Opportunities With This Pattern

How do you confirm this pattern is complete, and a reversal higher is in motion?

After forming this pattern, a confirmed break above the neckline confirms a Bullish reversal.

Therefore, waiting for a confirmed break above the neckline before entering any trade is essential.

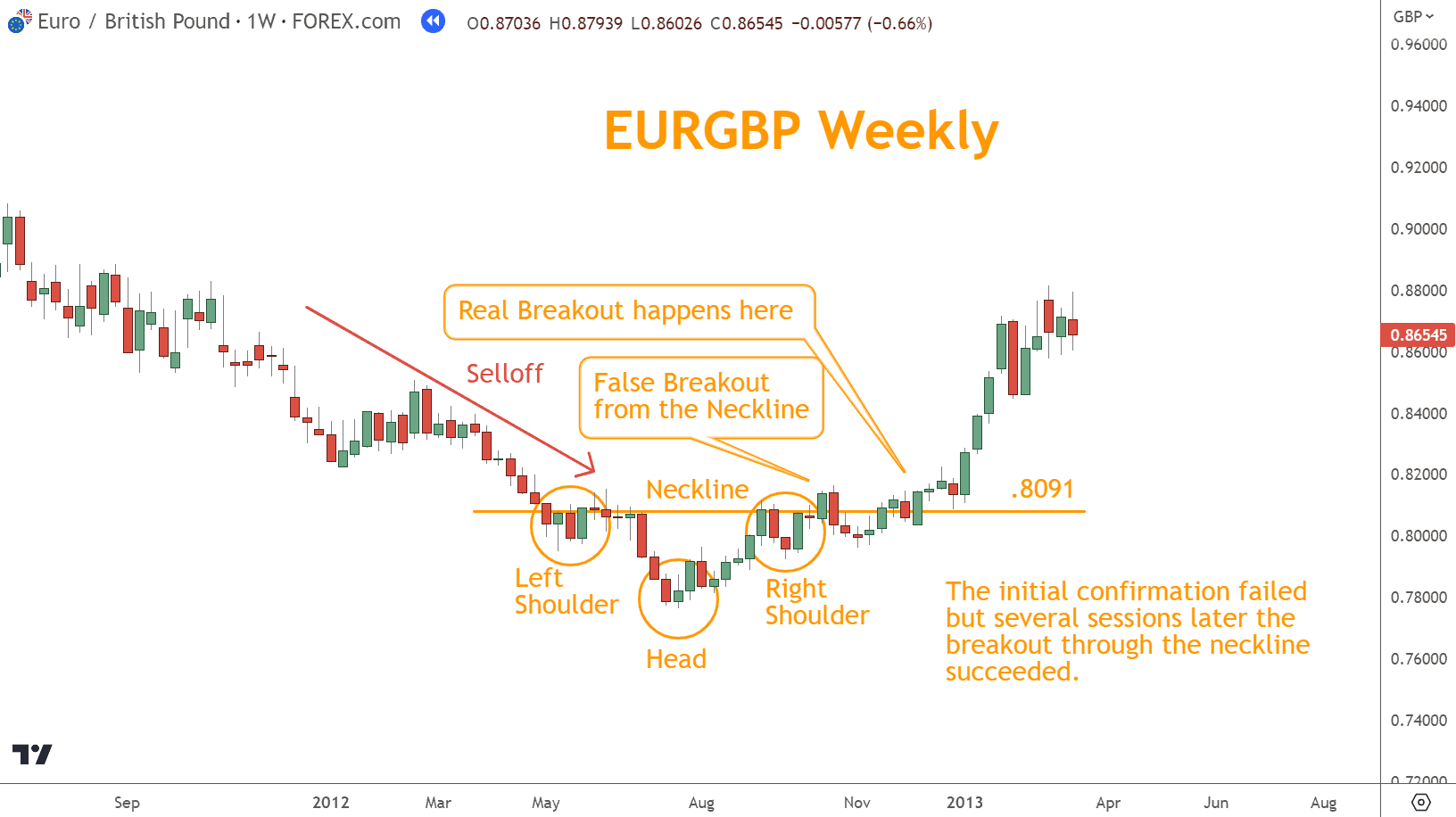

This is because false breakouts can occur, as you can see in this example, and traders must ensure the pattern’s validity before making trading decisions.

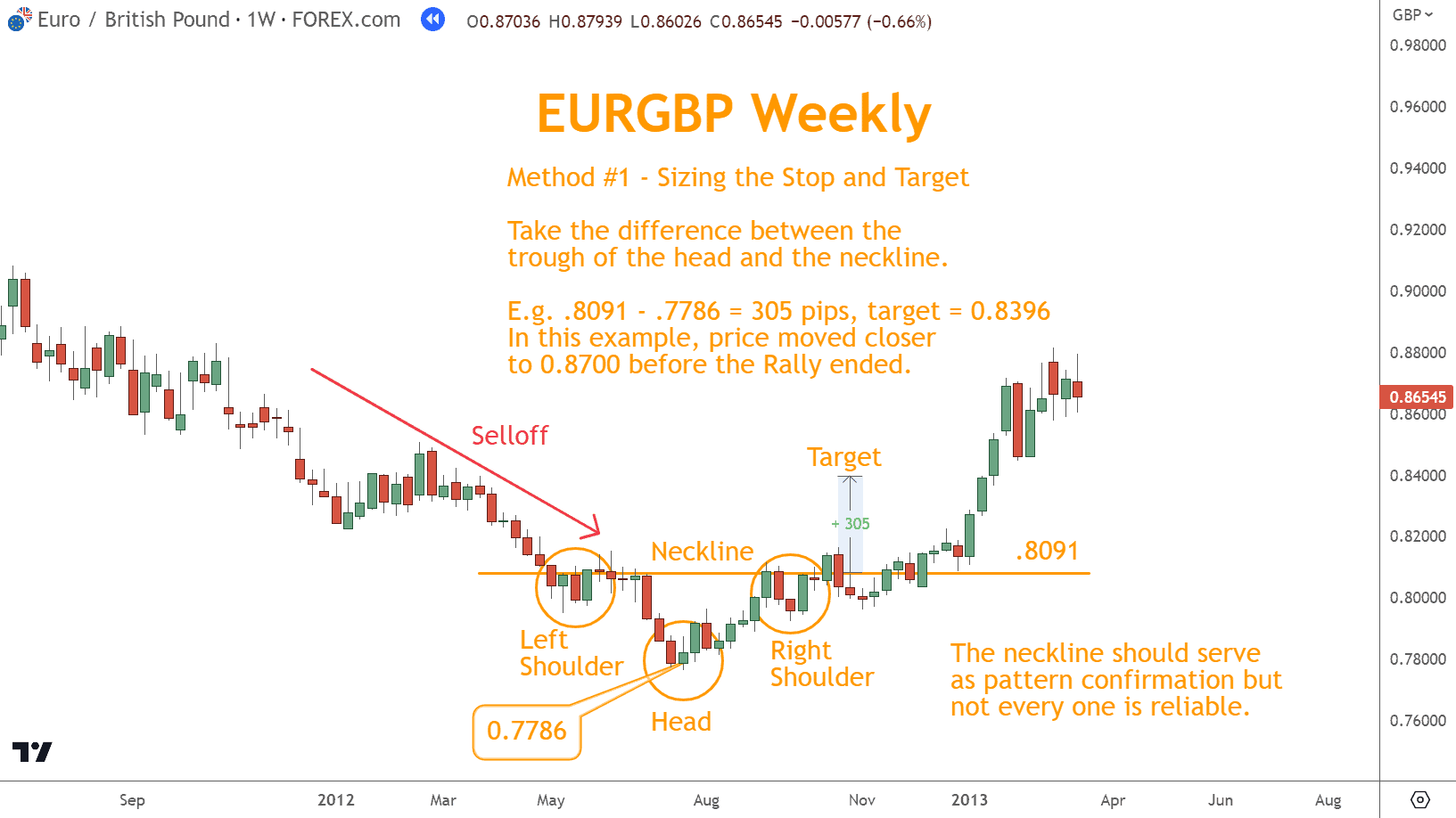

Two Techniques to Help Choose a Stop and Target

To choose a stop and target when trading with the Inverse Head and Shoulders pattern, traders can calculate using the distance between the Head and neckline.

In this example, the trade fails since using the Right Shoulder as a Stop fails. The breakout initially failed and would result in a losing trade.

You might consider re-entering when EURGBP closes above the neckline a second time.

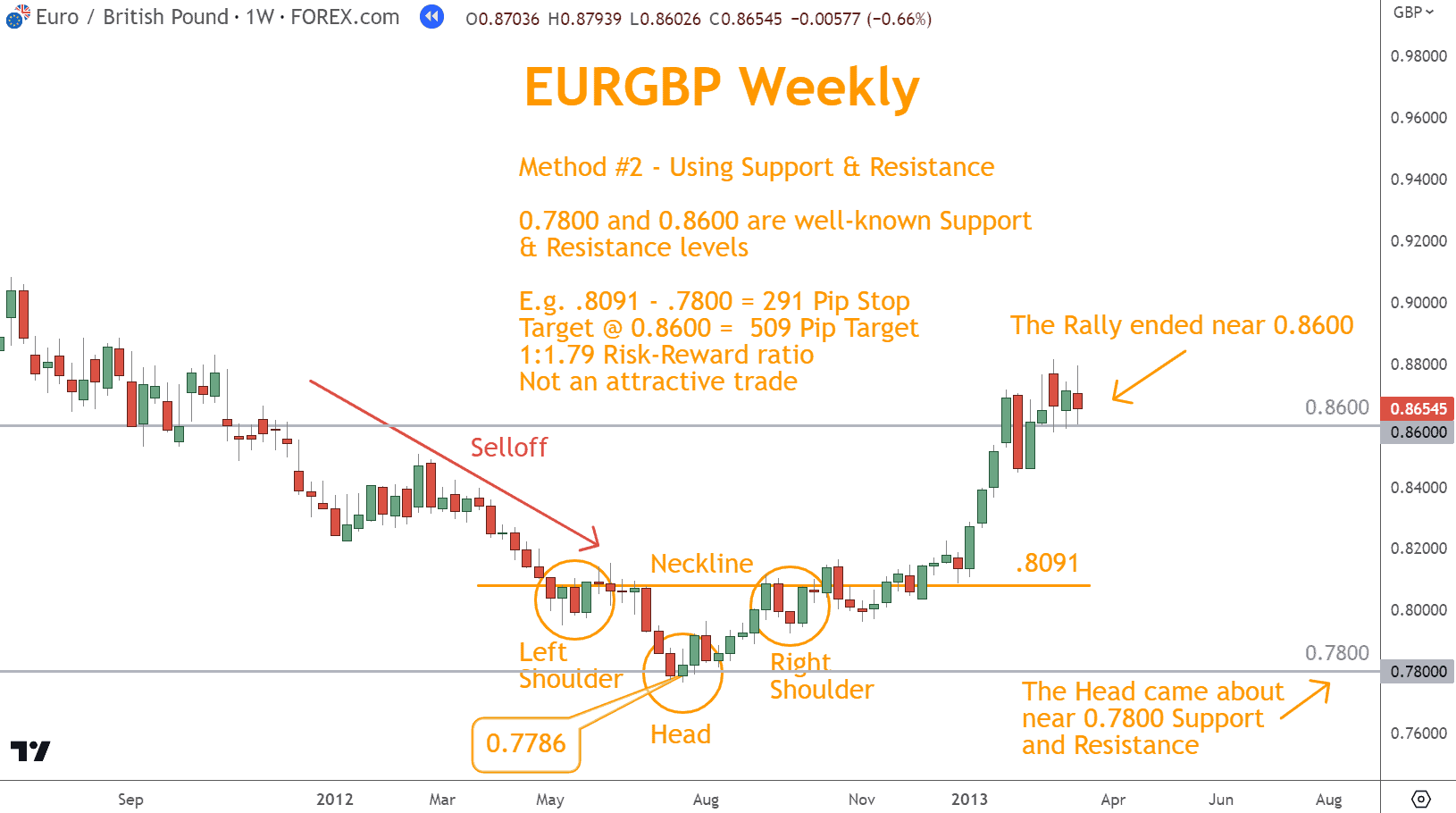

As a second method, look for a corresponding Support and Resistance level.

For a profit target, you can calculate the distance from the neckline to the Head or look for an appropriate Support and Resistance level. Sometimes, these two price levels coincide, giving the trade greater credence.

In this example, the risk-reward ratio is unattractive, and although, in retrospect, it is profitable, it’s not a trade I recommend taking.

Use proper position sizing to manage risk with your trades.

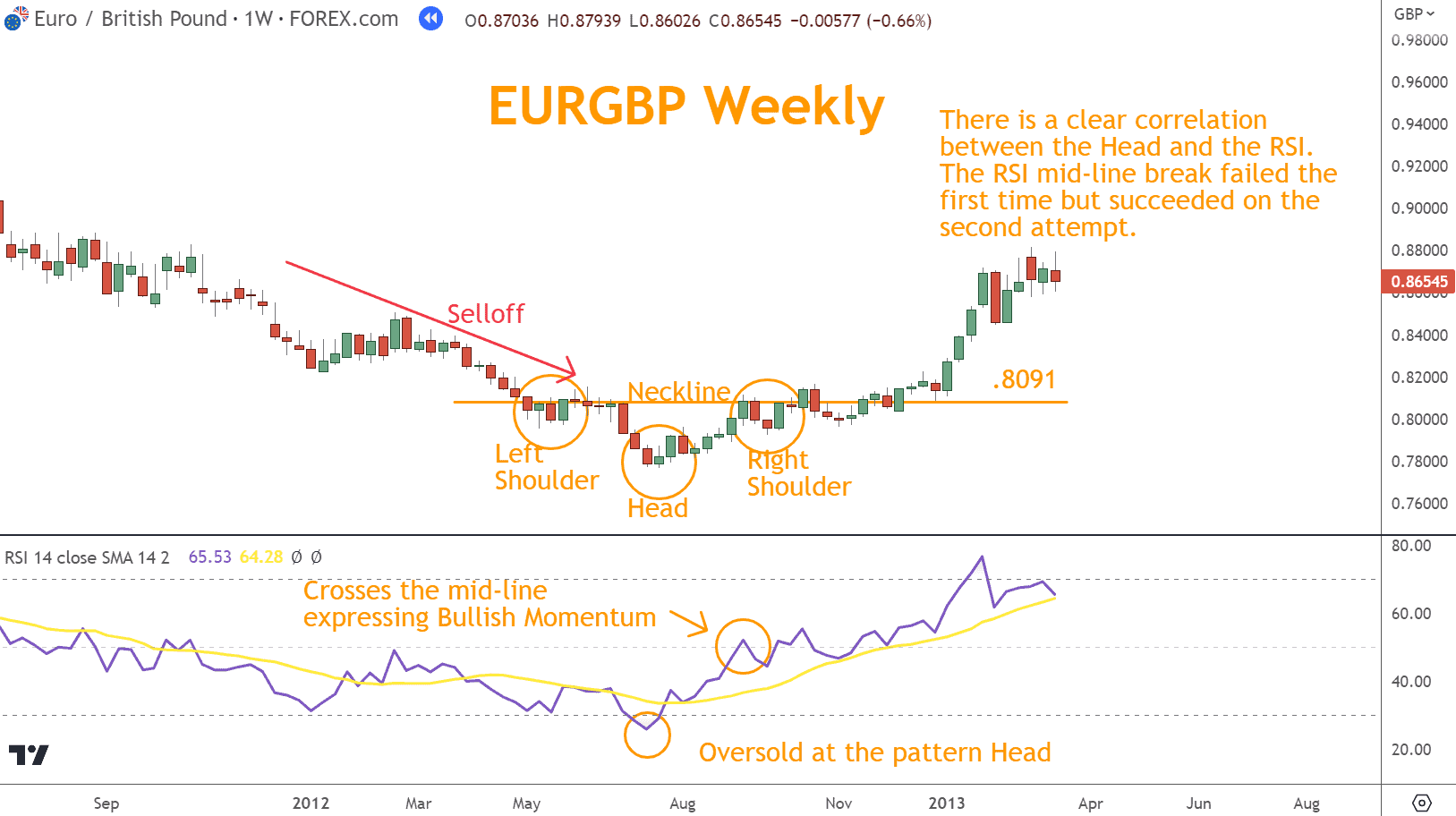

Use Up to Three Complementary Indicators for Confirmation

Confirming a Head and Shoulder pattern is crucial before entering into any trade.

Complementary technical analysis indicators play an essential role in confirming the validity of the pattern.

Oscillators like Stochastic and RSI can help identify Overbought or Oversold conditions, while Support and Resistance levels help determine price areas where buyers may enter the market.

The RSI Oversold status correlates perfectly with the Head trough in this example.

Unfortunately, the RSI rallies through the mid-line with the failed breakout of the Right Shoulder. You could reattempt this trade with the second mid-line break.

Unfortunately, the RSI rallies through the mid-line with the failed breakout of the Right Shoulder. You could reattempt this trade with the second mid-line break.

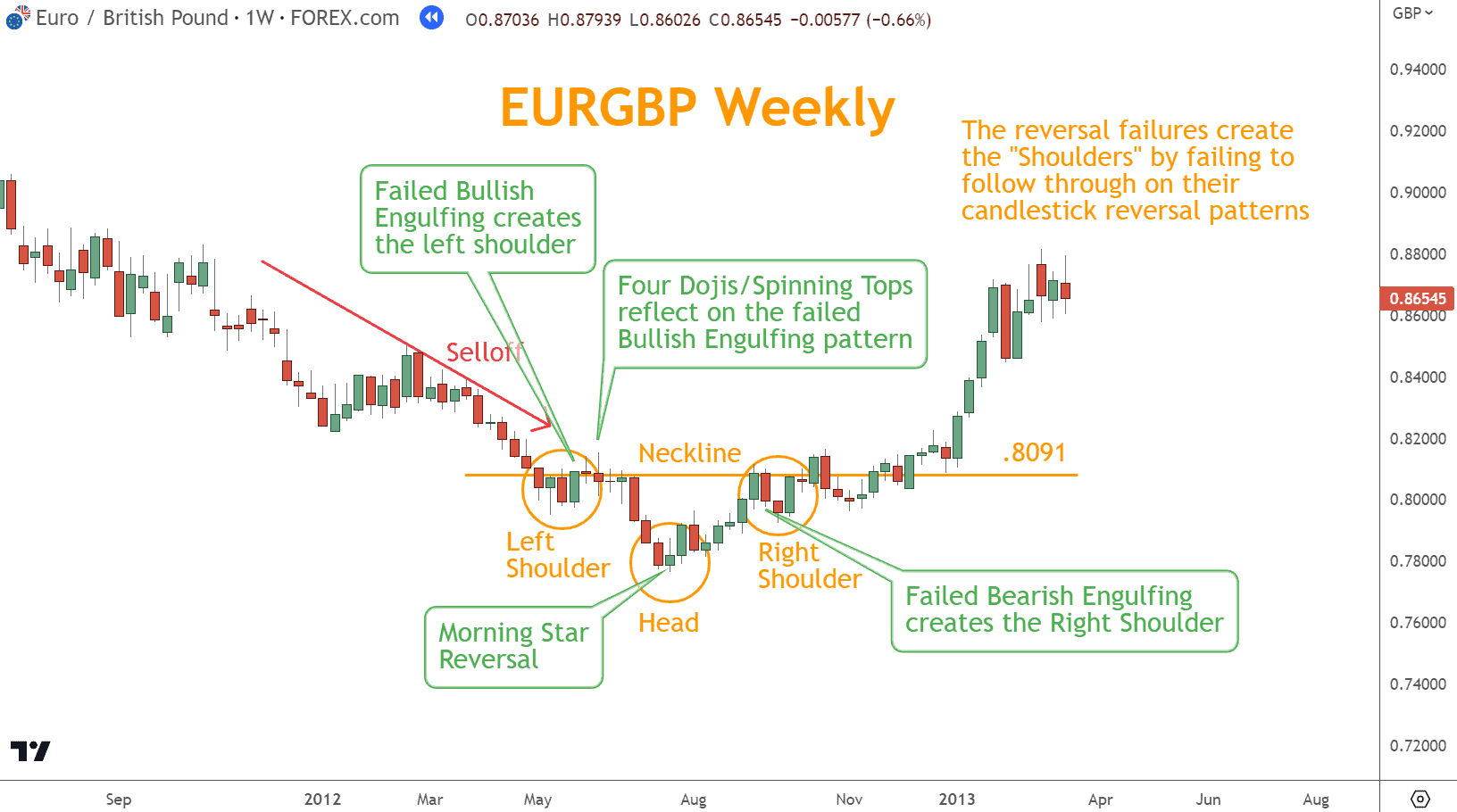

Traders should also focus on Japanese Candlestick patterns that give insight into potential market reversals.

In this example, there are advanced candlestick patterns that can help with the strategy but are beyond the scope of this article.

By incorporating these complementary indicators in their trading strategy, traders can effectively confirm their patterns for successful trades.

Head and Shoulders Patterns Have a Complex Version Too

When analyzing Head and Shoulders patterns, one must be aware of complex variations such as Multiple Head and Shoulders or Inverse Head and Shoulders.

What makes them complex patterns is they have multiple shoulders on each side of the peak head.

The psychology behind the pattern is the same; however, these complex patterns can be more challenging to identify and trade.

It’s also recommended that complementary technical analysis indicators be used to confirm these complex patterns.

What’s the Next Step?

Using what you’ve learned, select a price chart, find a Head and Shoulders pattern, and determine if there’s neckline confirmation.

In addition, look for opportunities to coincide confirmation with other technical analysis tools and techniques to see how they work together.

Combining Trend, Momentum, Japanese Candlesticks, and Support and Resistance can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate into what you’ve learned here.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies? I produce videos and guides to help you understand and build better trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Is a Head and Shoulders Pattern Bearish or Bullish?

The pattern of the head and shoulders signals a Bearish reversal. Conversely, an Inverse head-and-shoulders pattern is a Bullish reversal. Both patterns require confirmation.

Also, remember it’s crucial to consider other technical indicators before using this pattern to make trading decisions.

How Reliable Is a Head and Shoulders Pattern?

Although these patterns can help predict reversals in trading, they are unreliable indicators.

Considering other technical analysis tools is vital before basing a trading decision solely on this pattern.