Support and Resistance tactics are commonly discussed in the trading community, but what are the methods and rules leading to winning trades?

Can you earn profits from trading breakouts and reversals?

In this article, we will explore support and resistance tactics in Forex trading, from their definition and why they matter to the different types of lines you can use to identify them.

We’ll also discuss various strategies for drawing these lines and share some of the best indicators for determining them like a pro.

I’ve been trading Forex since 2007, and support and resistance have been important to my trading success.

This article will share my experience and perspective on this essential technical analysis component.

Table of Contents

- Are Support and Resistance Levels Important? How Important?

- Crafting Support and Resistance Lines is a Snap Using a Few Simple Techniques

- Can Using Higher Timeframe Analysis Help You Get Confirmation on Your Levels?

- What are Your Next Steps?

- Frequently Asked Questions

- Do Support and Resistance Tactics Work in Forex?

- How Often Should I Check for Changes in Support and Resistance Zones?

- Can Support Become Resistance and Vice Versa?

- Can you Solely Rely on Support and Resistance Levels in Your Trading Strategies?

- What is a Pivot Point, and is it Support and Resistance, too?

- Can Fibonacci Levels and Expansions Also Define Support and Resistance?

Are Support and Resistance Levels Important? How Important?

Support and Resistance levels serve as critical technical analysis indicators representing areas where a currency pair’s price movement is likely to encounter a barrier, either due to previous market activity or psychological factors.

Identifying these zones can help you develop a strategy for your trades’ potential entry and exit points. These entry and exit prices are part of calculating your risk-reward ratio in any trade.

The most common practical application of these zones is to identify them as stop-loss and target areas on a price chart.

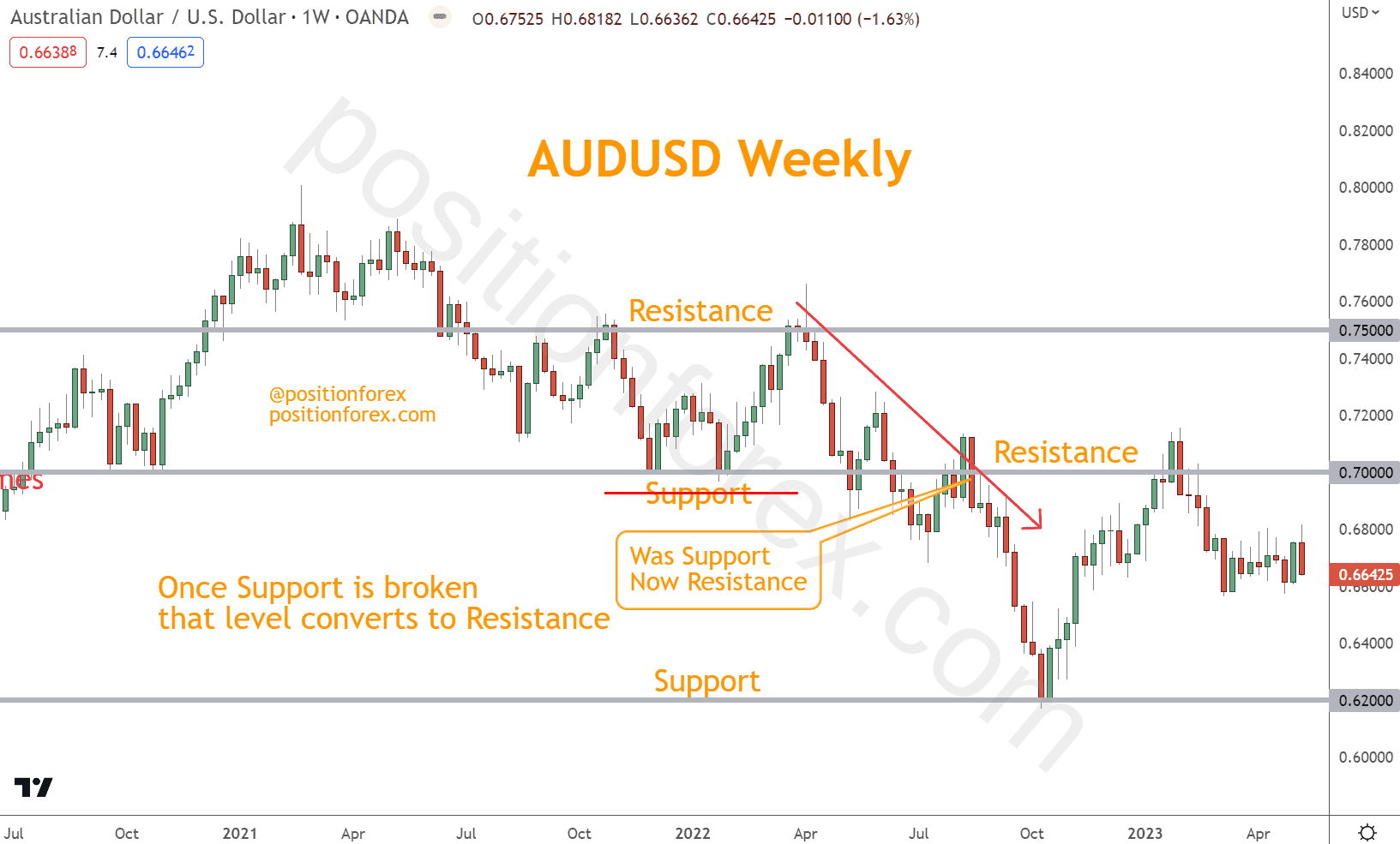

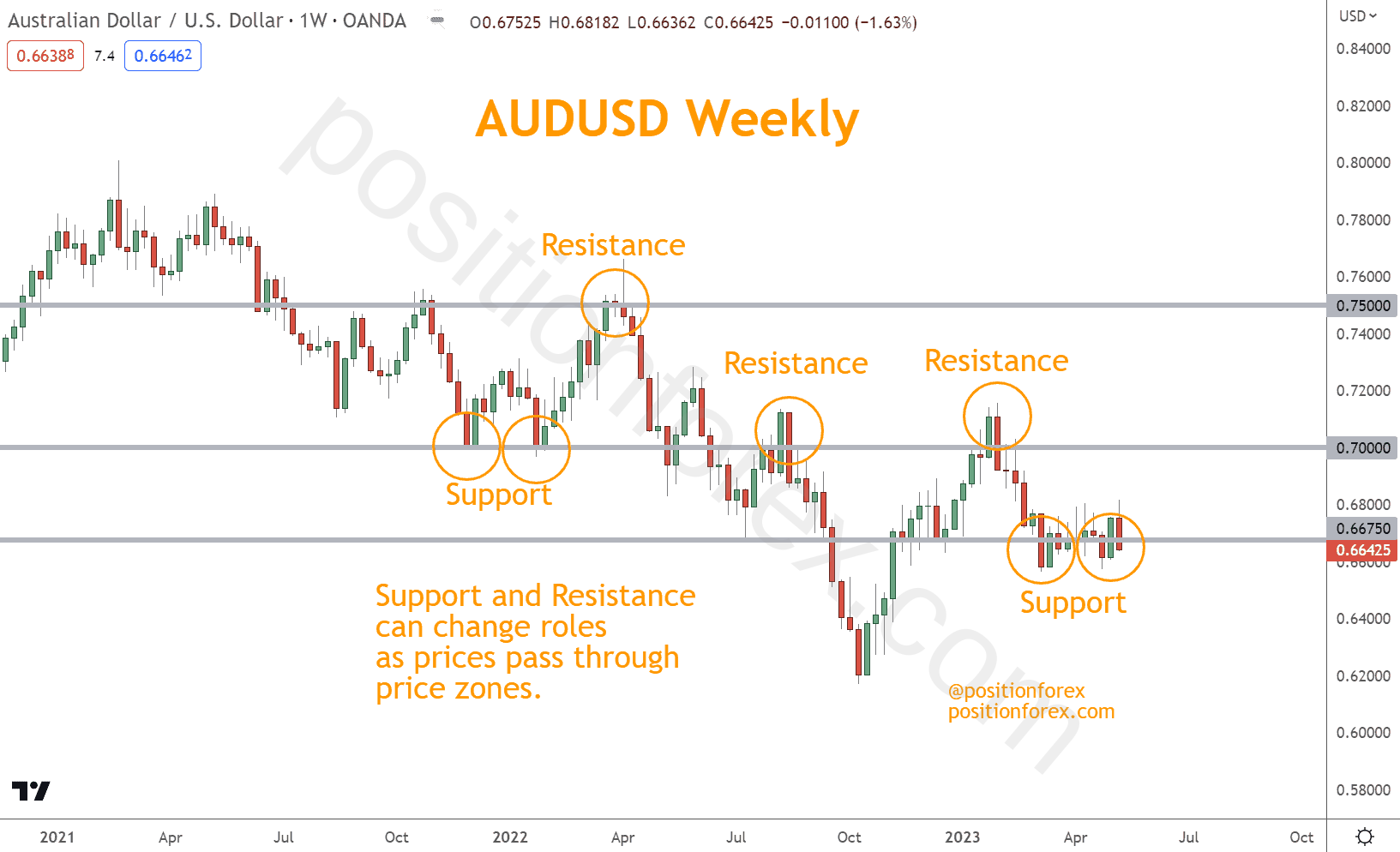

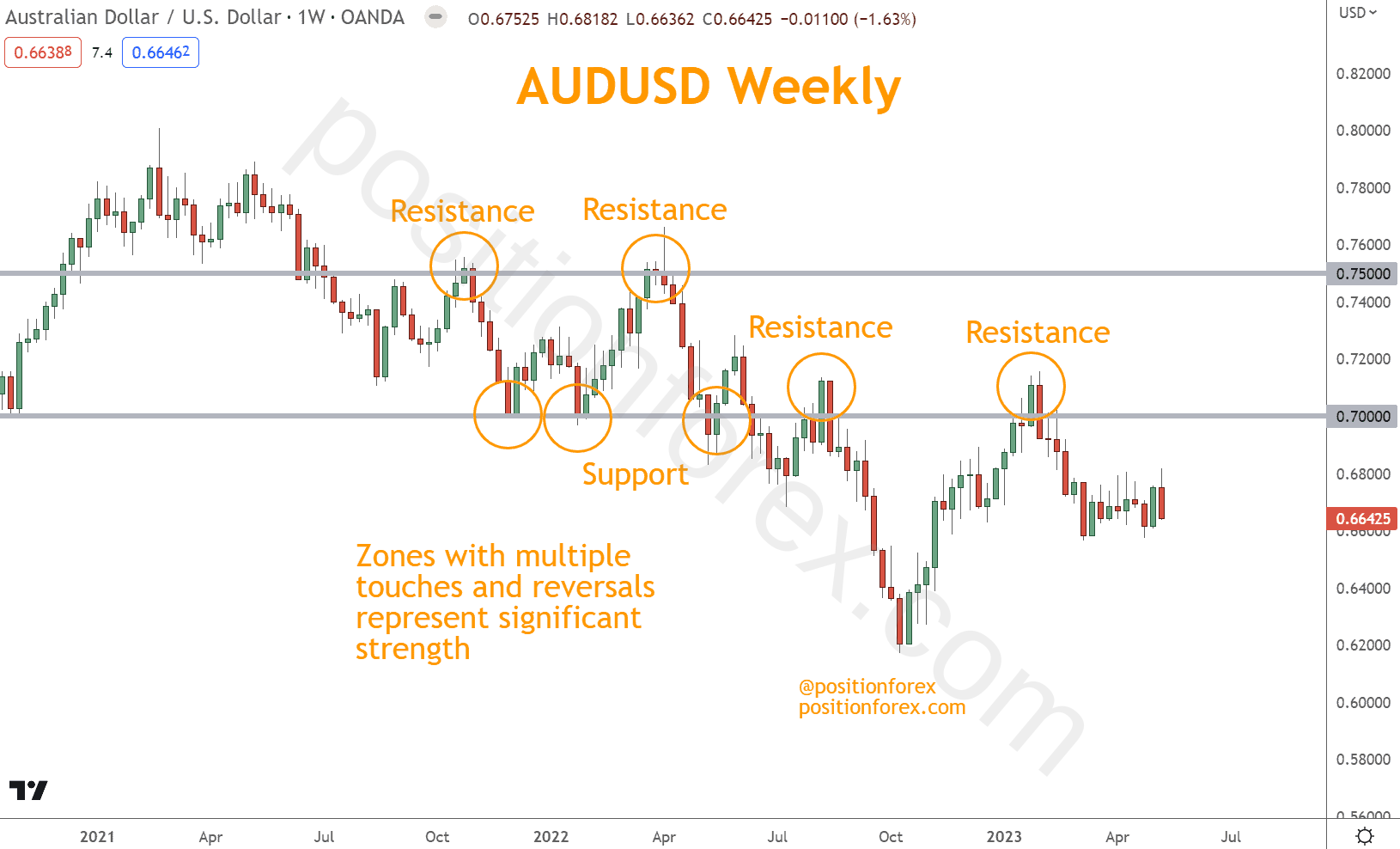

In the AUDUSD chart pictured below, 0.7500 is identified as resistance and 0.7000 as support.

These levels earned their designations based on prior price action. On multiple occasions, AUDUSD reached the 0.7500 and 0.7000 price zones and reversed.

The chart below shows that AUDUSD reached 0.7500 in October 2021 and again in April 2022, reversing away each time.

The same is true of 0.7000, which provided support in November 2021 and again in January 2022, with prices reversing direction each time.

Because these levels are tested multiple times, you can gain confidence in their significance and reliability.

A breakdown through significant support or a breakout of a major resistance area can also indicate a change in market psychology.

In the example below, trader psychology was focused on AUDUSD operating sideways or in a neutral range-bound state.

When 0.7000 support broke in June 2022, retested 0.7000, and reversed lower in September 2022, trader psychology on AUDUSD changed from neutral to bearish.

This changed 0.7000 from support to resistance since it was no longer holding AUDUSD up in a range but instead capping its upside in a selloff.

You can identify a support and resistance zone vital to profitable trading by aoccursnalyzing historical reversals.

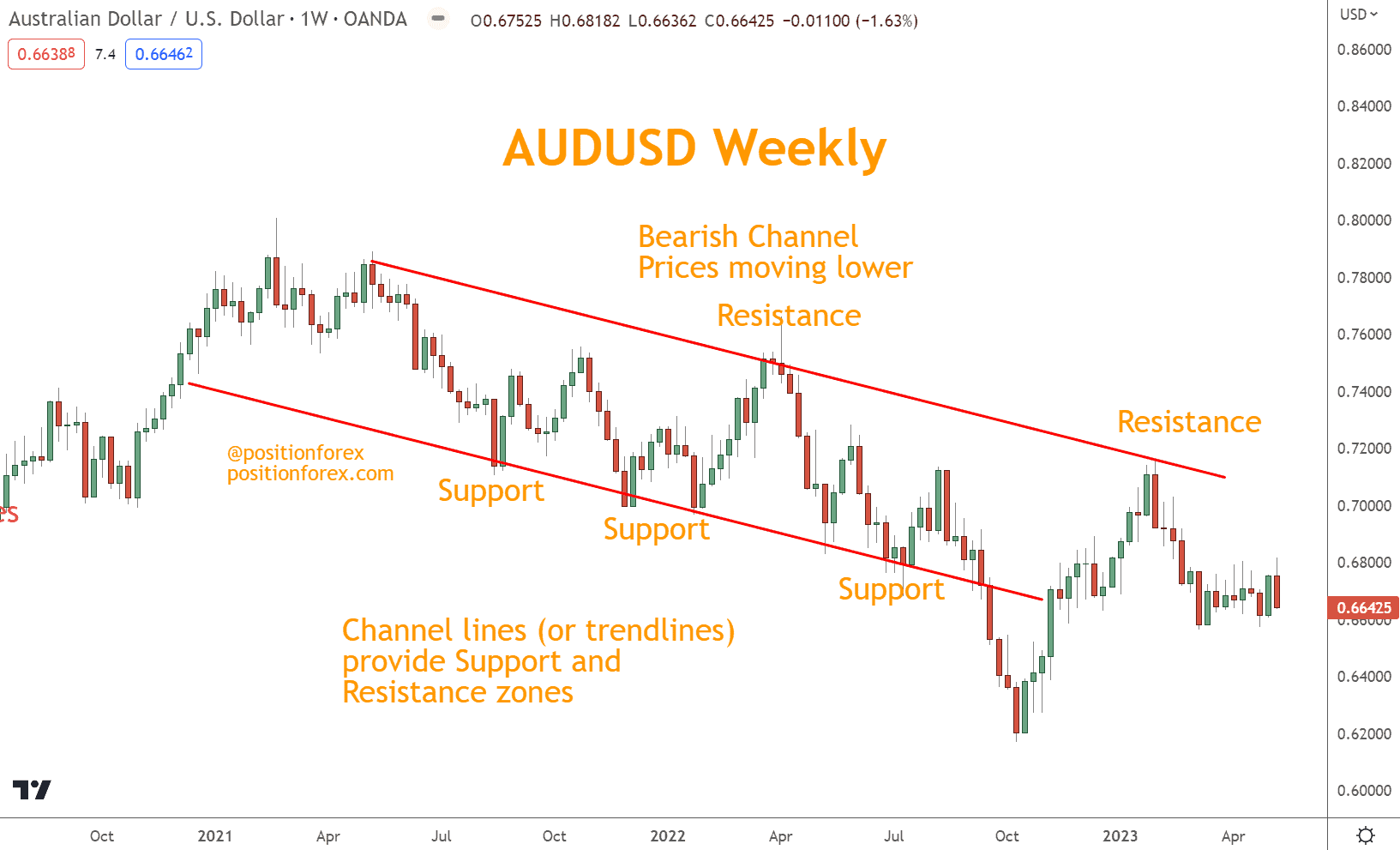

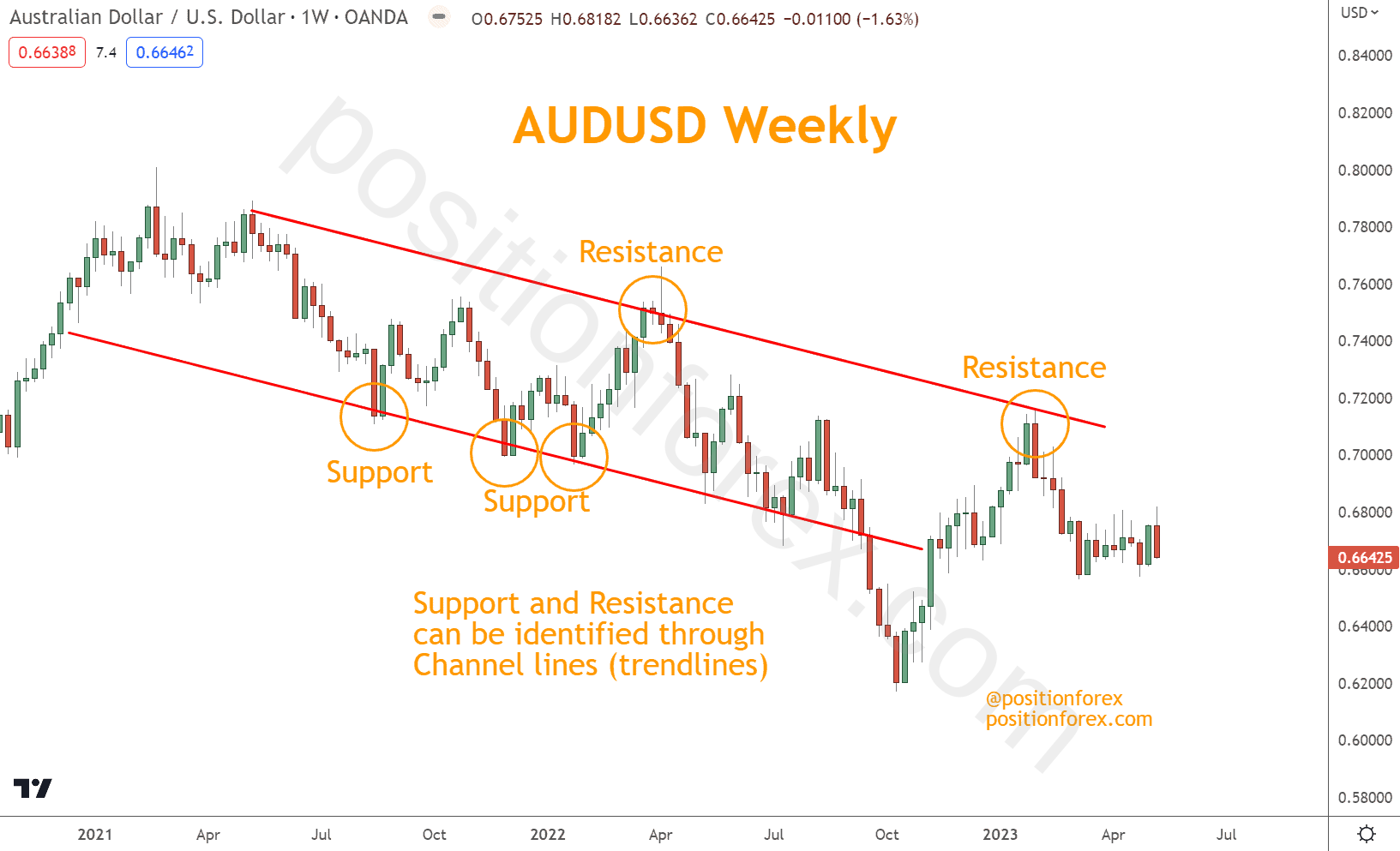

Additionally, channel lines (also known as trend lines) can be used to determine these areas.

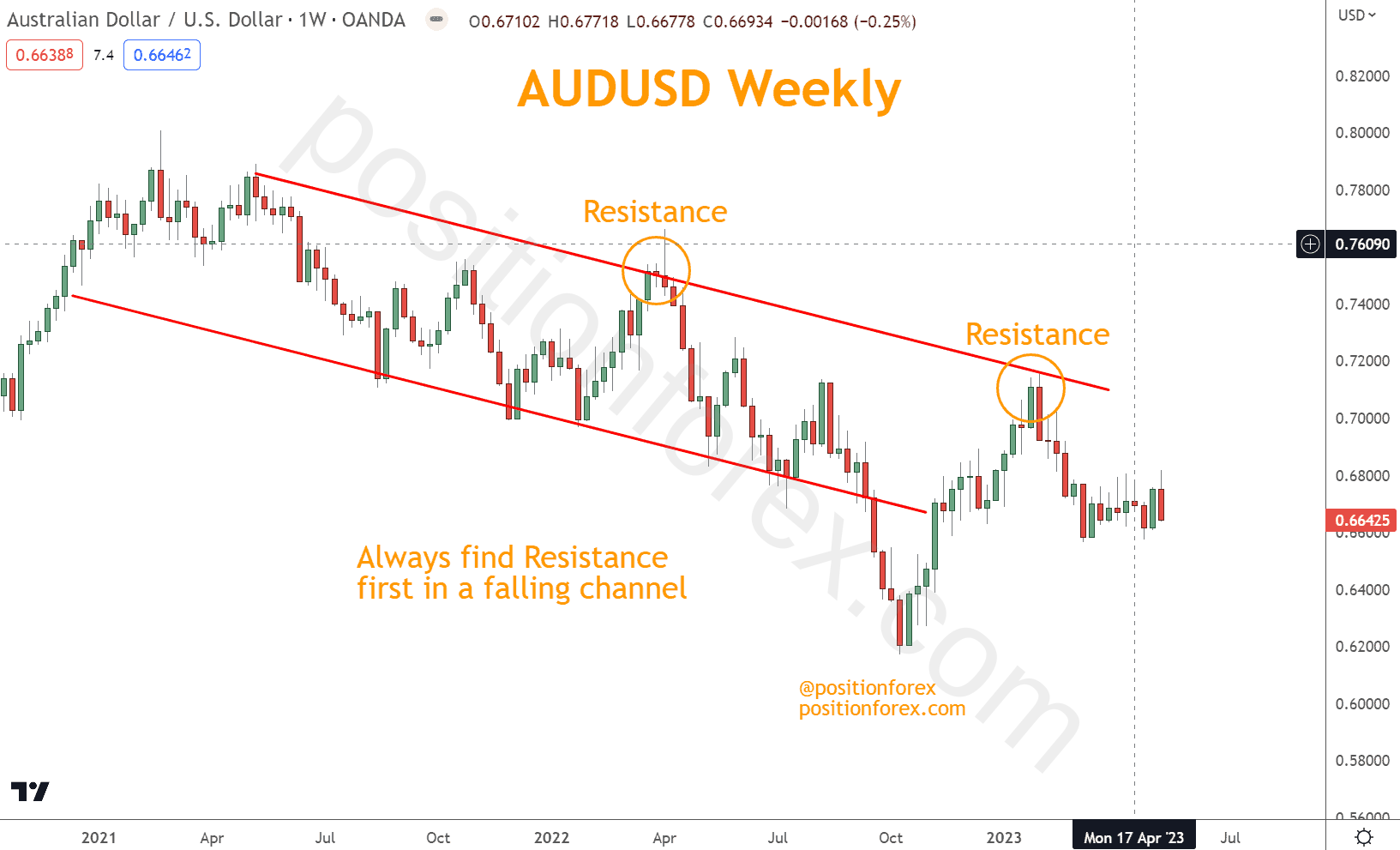

In the example below, AUDUSD moves lower in swing highs and lows. Connecting these swings creates a channel and, after a few connections on each side, creates trading opportunities.

When AUDUSD strikes the upper downsloping channel line and reverses, this line represents resistance and an opportunity for a short trade. This trade complements AUDUSD’s general direction.

The opposite circumstance is also available when AUD/USD strikes the lower, downsloping channel line and reverses higher.

Buying in this situation can be profitable but is a higher risk since a long trade opposes AUDUSD’s general direction.

Support areas are the price areas where buyers enter the market and prevent further price decreases, while Resistance levels are where sellers enter and prevent further price increases.

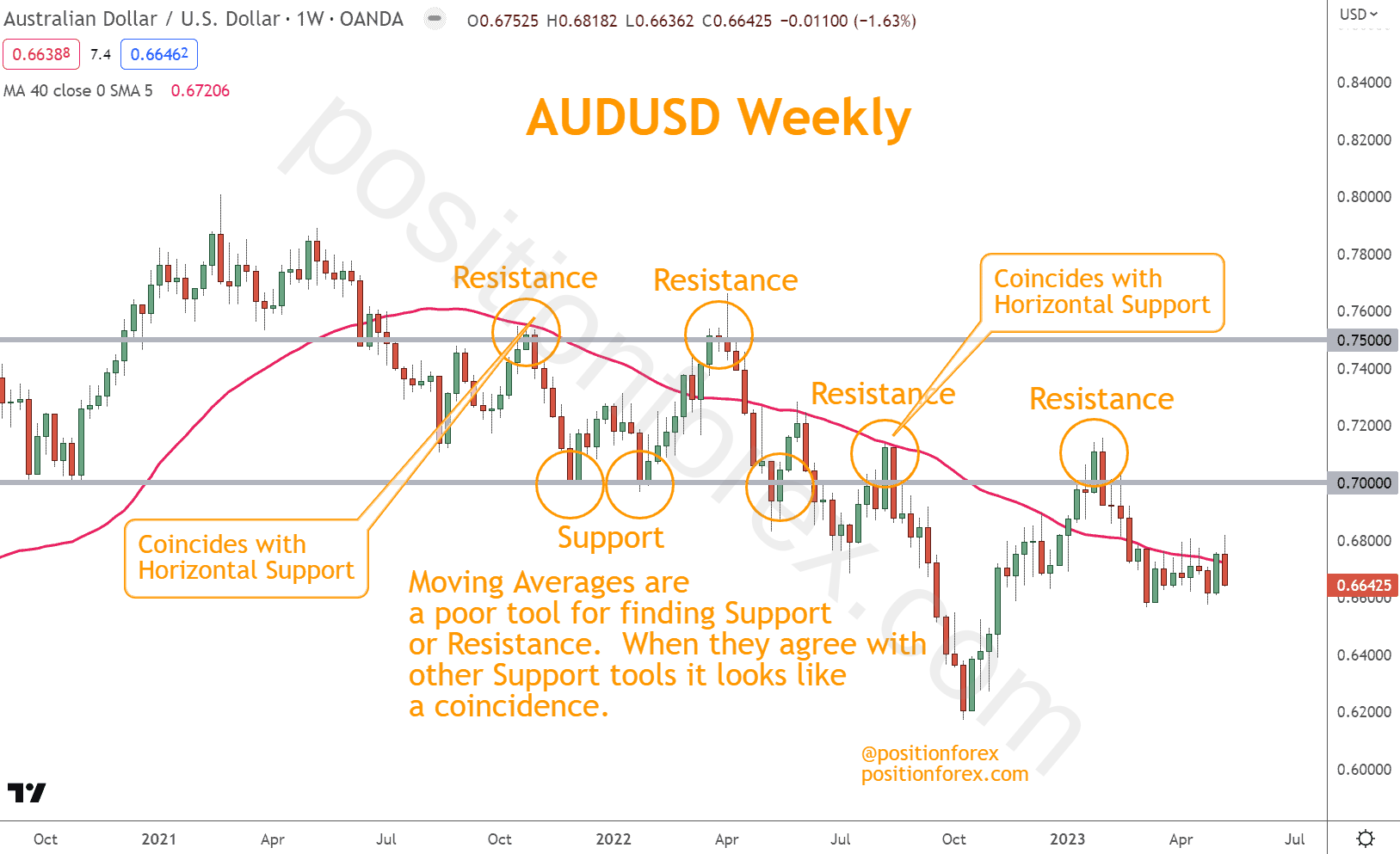

It’s important to note that moving averages are unreliable indicators for identifying these levels in Forex trading, which we’ll discuss here.

With these tools, you can develop a solid understanding of identifying zones and apply this knowledge to your decision-making process.

You can Identify Support and Resistance Tactics in Multiple Ways

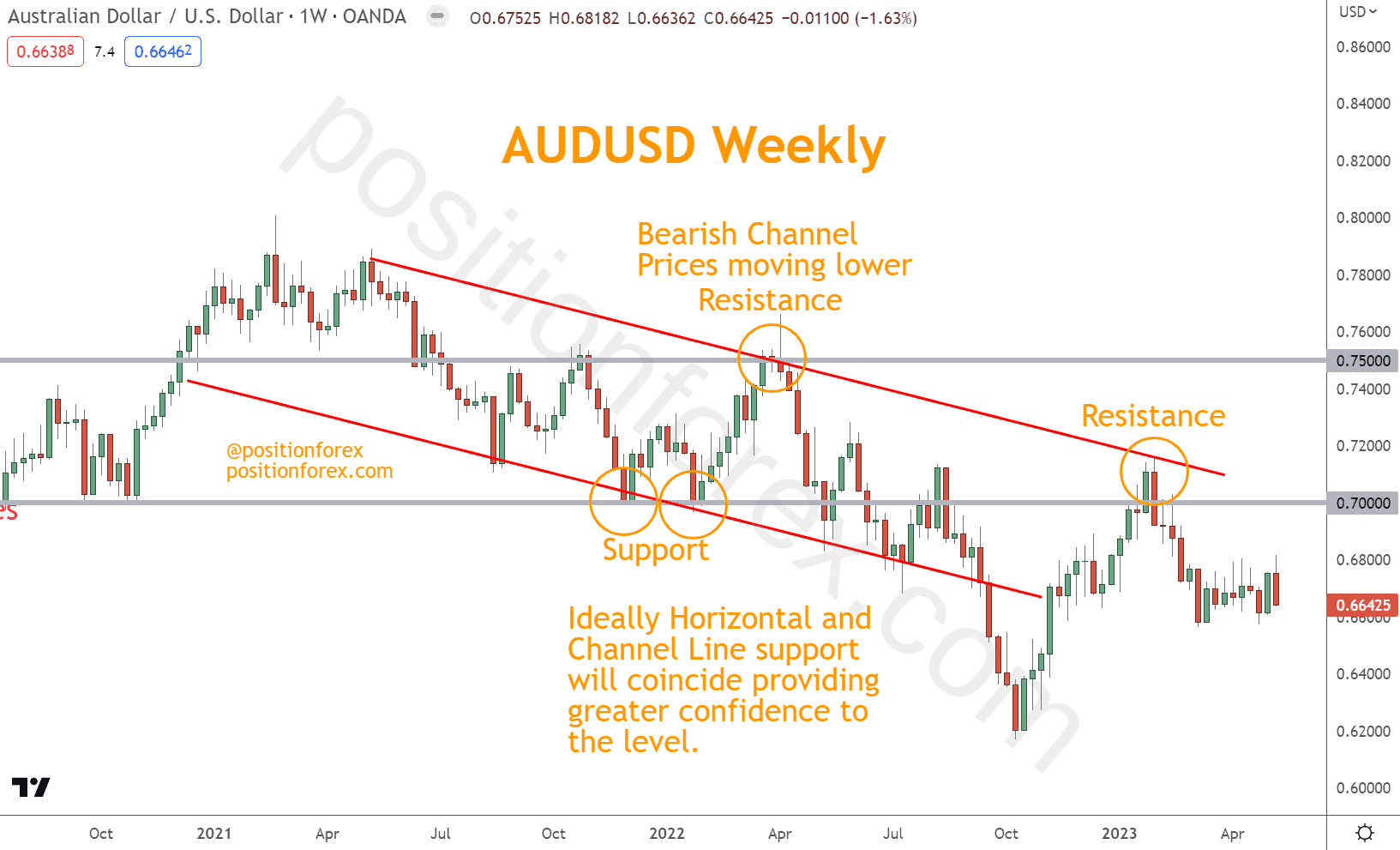

Horizontal zones are the most basic form of these areas, with a fixed price area where buyers or sellers enter the market. On the other hand, channel lines follow the direction of price movement.

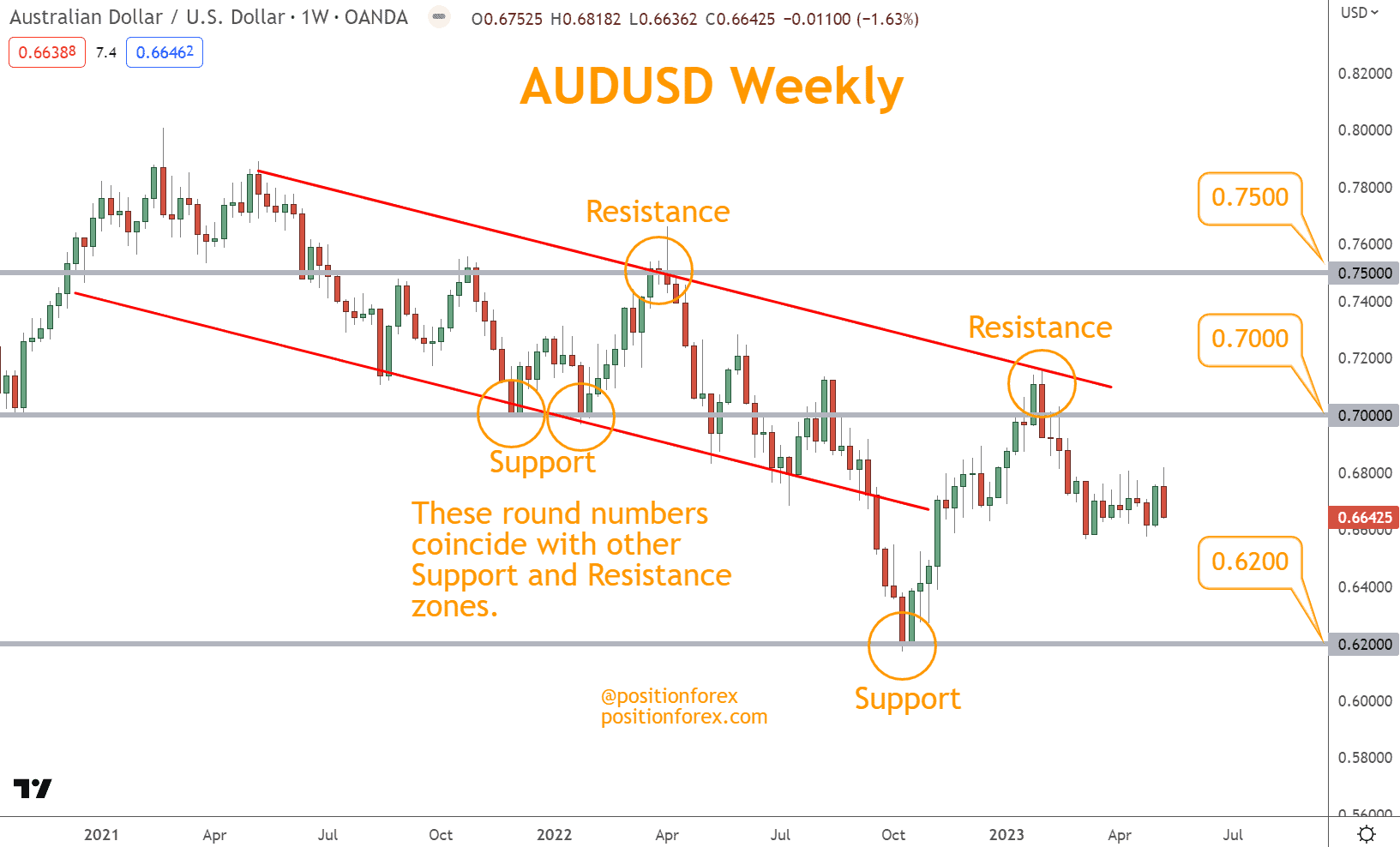

In the example below, AUDUSD established horizontal levels of 0.7000 and 0.7500 over long periods.

These are levels where prices have stopped and reversed many times over the years.

Channel lines connect the swing highs and lows in the AUDUSD channel below, which extends from early 2021 to early 2023.

The intersection of the horizontal zones and the channel lines in December 2021, January 2022, April 2022, and January 2023 is considered the most reliable since it leverages horizontal and channel line support together in one area.

These are excellent areas to consider entries and exits, leveraging risk management rules and additional confirmation with other tools and indicators.

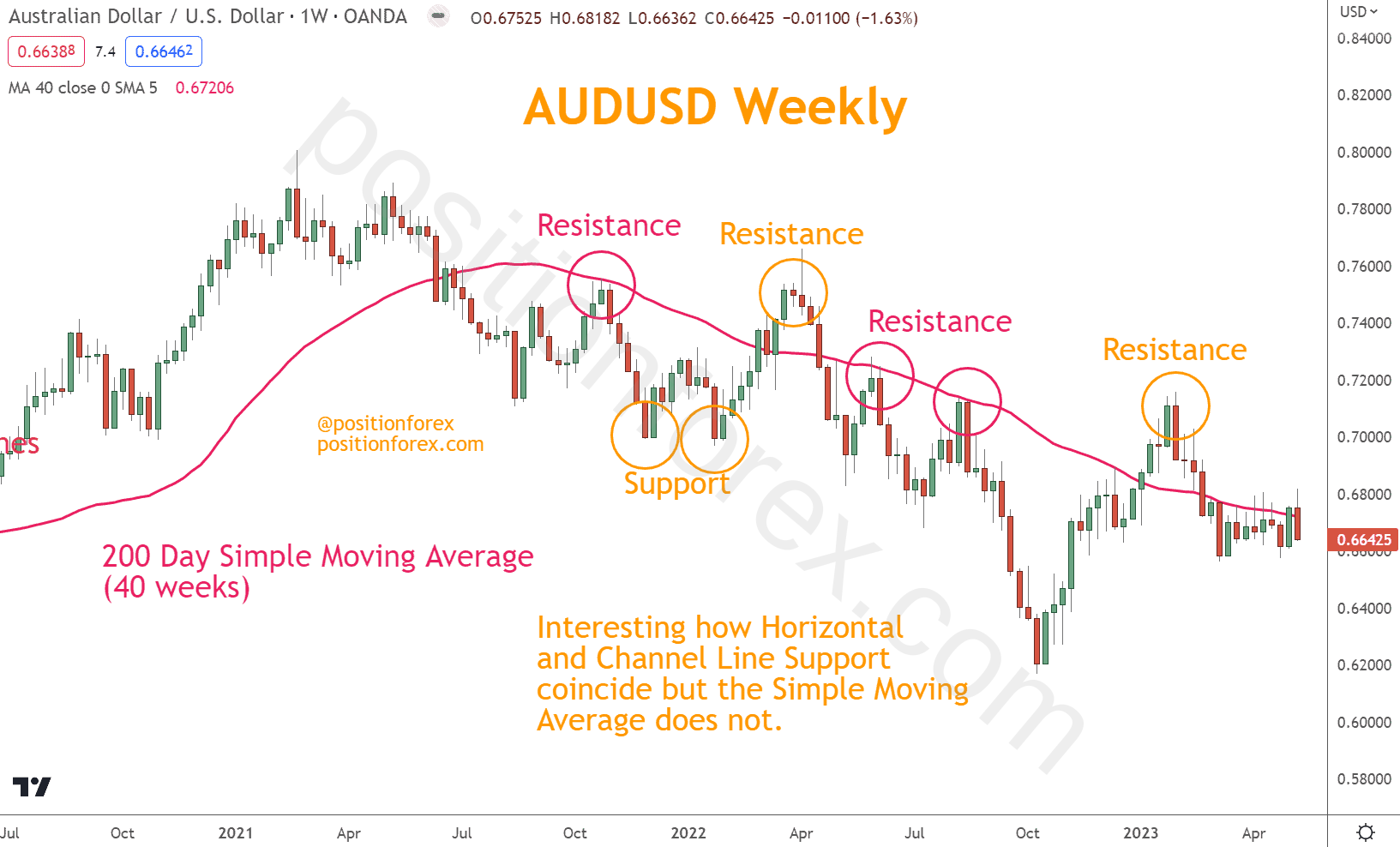

Moving averages such as the SMA (Simple Moving Average) and EMA (Exponential Moving Average) can also identify zones where prices may bounce off or remain under a moving average line.

In the example below, the same AUDUSD chart demonstrates how a 40-period moving average finds price in October 2021 and May and August 2022 and serves as resistance.

Prices reverse upon striking the moving average; however, it doesn’t help in other resistance areas or support areas with horizontal and channel lines.

Many traders leverage these and other moving average tactics as “dynamic support and resistance.” However, as you can see, they are not as reliable as the horizontal and channel line approaches.

I don’t recommend dynamic support and resistance as part of your support and resistance tactics.

Understanding the different support and resistance tactics types can help you make more informed decisions about their trading strategies.

Looking for a Strategy?

Download the Six Basics of Chart Analysis and sign up for Forex Forecast to learn a bottom-up approach to analyzing Forex markets and weekly market updates.

Crafting Support and Resistance Lines is a Snap Using a Few Simple Techniques

You can take a few essential steps when determining significant reversal areas in Forex trading.

First, look for areas where the price has previously reversed or stalled, indicating potential reversal zones. Then, once you’ve identified these areas, draw a horizontal line connecting them, describing the level.

See the example below, where 0.7000 served as support and resistance in November 2021, January 2022, August 2022, and January 2023.

These events are from a brief period and are leveraging similar price actions from the past.

Horizontal support and resistance is an excellent forecasting tool since history repeats.

Also, note how the role of the price level changes over time depending on the price action. What was support is now resistance, and vice versa.

You can also consider using channel lines to help identify reversal areas.

Channel lines are diagonal lines drawn to connect higher lows or lower highs, indicating potential areas of Support or Resistance.

In the example below, AUDUSD moves lower in a broad channel of swing highs and lows.

You can create a channel connecting multiple swing highs and multiple swing lows.

When the price reaches the channel’s top, this is an opportunity to sell AUDUSD, such as in April 2022 and January 2023.

In contrast, as shown in the chart below, you can consider a countertrend entry by buying AUDUSD at the support levels in August, November, or January 2022.

These are higher-risk trades since they are against the selloff’s broader direction.

Be mindful of psychological levels, such as round numbers, where reversals or breakouts are common.

The AUDUSD example below shows how 0.7500, 0.7000, and 0.6200 are all support and resistance levels where reversals and breakouts occur.

Monitoring economic and world news events can provide valuable context for understanding how these levels may be impacted.

Combining Support and Resistance tactics with other technical indicators, such as Trend, RSI, MACD, TSI, and other trading platform indicators, can help you quickly identify support levels and resistance lines.

These zones often appear near swing highs and lows, helping confirm your technical analysis.

By following these steps and monitoring these key indicators, you’ll be better equipped to make informed trading decisions in the Forex market.

Drawing Horizontal Lines is the Clear Cut A-List Tactic

Identifying Support and Resistance levels in Forex trading requires drawing horizontal lines. These lines help you determine key levels where the price will likely reverse, providing opportunities for entering or exiting trades.

Drawing horizontal lines involves looking for areas where the price has bounced or dropped multiple times, indicating strong Support or Resistance levels.

In the AUDUSD example below, multiple reversals demonstrate the strength of Support and Resistance.

0.7500 serves as resistance in October 2021 and April 2022.

0.7000 servers as support or resistance, depending on the date.

Before August of 2022, 0.7000 serves as support on three occasions. From August 2022 and beyond, AUDUSD fell below 0.7000, and this level became resistance.

The longer prices have touched and been rejected at a level, the more substantial the support and resistance.

In most cases, you will want to identify an area rather than a specific level.

Forex pair prices typically reverse around a price level rather than at an exact price. This is due to the “noisy nature” of markets.

Connect the chart’s multiple points with a straight line to draw these lines effectively.

It is also essential to regularly update your analysis as new levels may develop over time.

Channel Lines (trendlines) can Describe Future Support and Resistance Levels

Channel lines or trendlines can be outlined using candlestick charts, and it’s essential to look for multiple contact points to ensure their accuracy.

You can identify potential support and resistance levels by connecting the higher highs in an uptrend or lower lows in a downtrend.

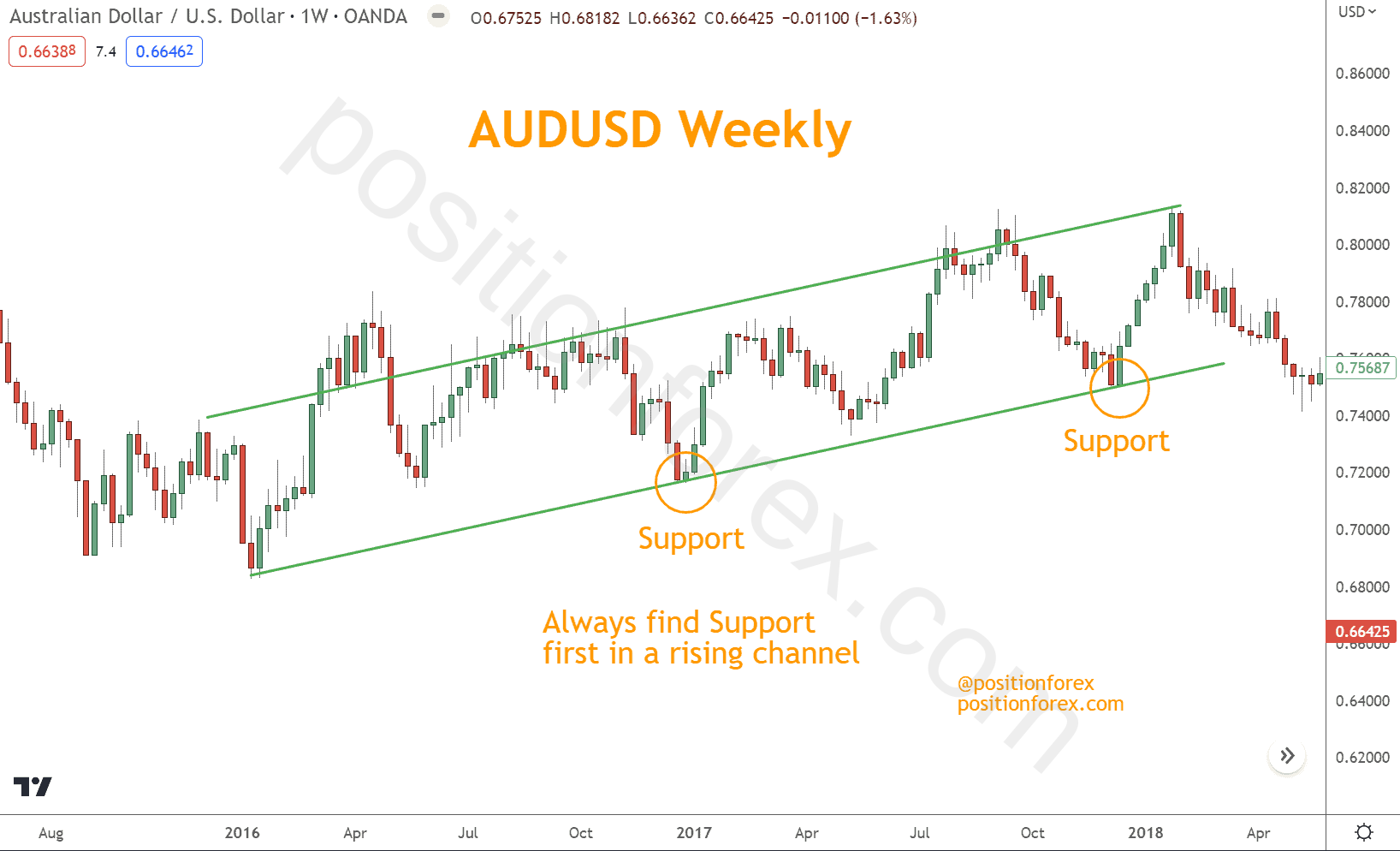

Always begin by finding support in a rising channel and resistance in a falling channel.

In the rising channel example below, you can see how AUDUSD touches the rising lower line of the channel.

These touches represent support and potential buying opportunities in November 2017 and December 2018.

The same is true in the opposite direction. In a falling channel, the downsloping upper channel represents resistance and a selling opportunity.

In the example below, AUDUSD’s selloff presented selling opportunities at resistance in April 2022 and January 2023.

Dynamic Support and Resistance Levels Will Get You in Trouble

Dynamic levels describe drawing Support and Resistance levels using moving averages. Unlike horizontal and trendline levels, dynamic levels continuously adjust to reflect changes in price action.

The problem with using “dynamic levels” is that they have no relation to market structure.

You will be more successful in identifying where prices have been and could be going rather than calculating a mathematical average of their movements.

An SMA or EMA always requires setting a period length, and since no one setting adequately describes a market, you are left guessing.

Adjusting the settings or using multiple moving averages isn’t helpful either. Changes in volatility will make choosing one SMA or EMA with one setting impossible.

If you choose moving average numbers that “fit” your chart, that only helps decipher the past and doesn’t help identify future prices, which is necessary for trading.

Here is an example using a 40-period simple moving average on a weekly chart.

The moving average finds resistance in June and September 2022 but otherwise provides little assistance.

Another shortcoming of this approach is that it only provides either support or resistance. As traders, we need both since we potentially want to use them as stop-losses and targets.

Can Using Higher Timeframe Analysis Help You Get Confirmation on Your Levels?

A higher timeframe analysis can be valuable when determining reversal zones in Forex trading.

By examining past price action on longer time frames, you can identify critical levels that may continue to hold.

This approach allows you to take a step back from short-term fluctuations and focus on the bigger picture, which can help you make more informed trading decisions.

To implement this strategy effectively, looking for areas where price has previously shown significant buying or selling pressure is essential.

This could include levels where the price has bounced off in the past or areas where the market has struggled to break through.

The weekly chart dominates position trading, and higher time frame analysis is less applicable than swing or day trading.

What are Your Next Steps?

Using what you’ve learned, select a chart and look for Support and Resistance zones.

In addition, look for opportunities to coincide them with other technical analysis tools and techniques to see how they work together.

Combining these zones with trends, momentum, Japanese candlesticks, and chart patterns can give you a comprehensive view and understanding to make trading easier.

If you need help developing an analysis process, you can use our Six Basics of Chart Analysis. If you’re unfamiliar with the Six Basics, you can learn them here for free.

The “Six Basics” will give you a strong foundation in chart analysis, which you can incorporate into your knowledge of support and resistance tactics.

In addition, when you get the “Six Basics,” you’ll also get Forex Forecast delivered to your inbox every Sunday.

Forex Forecast includes:

- Trade Ideas and Analysis

- I will show you the trade opportunities I’m watching using the Six Basics of Chart Analysis and Advanced Strategies.

- Case Studies from Around the Web

- Watch how applying the Six Basics worked on some of the best, most profitable trades.

- Trading Education Guides and Videos

- Want to learn most Six Basics techniques and advanced strategies?

- I produce videos and guides to help you learn and improve trading practices.

- Links to New Articles

- I publish new articles on topics traders will want to know about every week, and you can find out when they post.

- Positionforex.com News

- Did something change at positionforex.com? Learn about it here first!

- Links to upcoming webinars

- Attend free webinars to improve your trading.

- And Much More

- Tools, Membership-only Videos, and more will be released in the Forex Forecast.

The best part – it’s completely free.

Frequently Asked Questions

Do Support and Resistance Tactics Work in Forex?

Support and Resistance levels can be effective in Forex trading, providing key levels to watch for potential price reversals.

However, it’s important to note that these levels are not always exact and should be combined with other analysis tools.

How Often Should I Check for Changes in Support and Resistance Zones?

These zones can change, so reviewing and updating your analysis weekly is essential.

Can Support Become Resistance and Vice Versa?

These zones can reverse roles depending on market conditions and price action. Therefore, monitoring them closely and adjusting your trading strategy accordingly is essential.

Can you Solely Rely on Support and Resistance Levels in Your Trading Strategies?

No, building a strategy with other analysis tools is vital for a well-rounded approach to trading.

Relying solely on support and resistance levels can lead to oversights and missed opportunities in the market.

What is a Pivot Point, and is it Support and Resistance, too?

A Pivot Point is a technical analysis indicator to determine potential reversal zones.

They use a mathematical formula based on a period’s high, low, open, and closing prices. Unfortunately, they don’t reflect a broader market understanding and aren’t recommended.

Can Fibonacci Levels and Expansions Also Define Support and Resistance?

Yes, Fibonacci levels and expansions can also determine potential reversal zones in Forex trading.

They are based on mathematical calculations of the market’s price movements and can provide additional insights when combined with other analysis tools.

Using Fibonacci Retracement levels to determine these areas is beyond the scope of this article because it involves a complex plan for combining multiple measurements to find clusters across periods.

While some traders succeed with Fibonacci tactics, there are better and more accessible trading approaches, in my opinion.